IBM recently announced plans to invest $3 billion into semiconductor research over the next five years as part of an effort to keep hardware innovation moving in the right direction.

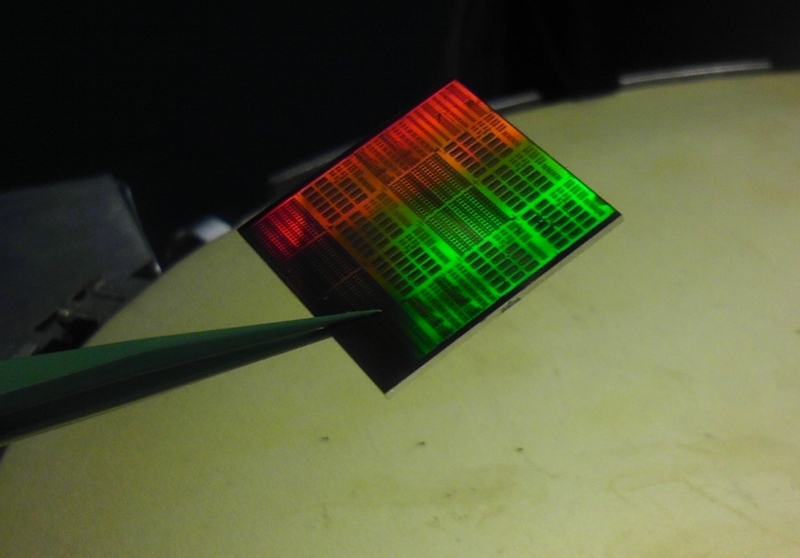

Specifically, Big Blue has two plans for the cash. First, the company aims to push transistor technology down to 7nm (7 billionths of a meter). That's far smaller than Intel's current crop of processors, for example, at 22nm. To put it into perspective, it is more than 1,400 times thinner than a human hair or about the width of 16 potassium atoms laid side by side.

Even with smaller manufacturing processes, however, traditional silicon will one day reach end of life status. This may happen sooner rather than later as silicon is already running into physical limitations.

IBM wants to be prepared ahead of time which is why they're also researching silicon alternatives. Surprisingly enough, there's no shortage of silicon replacement candidates. Possible successors include carbon nanotubes, graphene and silicon photonics.

But that's only part of the equation as IBM is also interested in new memory technologies and new architectures that could support cognitive and quantum computing.

While $3 billion may sound like a healthy investment, it's far less than the $6.2 billion IBM spent on R&D last year. The new influx of money will simply allow IBM to maintain its current levels of spending over the coming years.