Over 13 million Americans had their identities stolen in 2015. By taking these steps, you can avoid becoming one of this year's statistics.

The signs might not raise any red flags at first. An unfamiliar-looking debit from your checking account here, an innocuous charge to your credit card there. Suddenly, a surge of unauthorized purchases slams you with multiple overdraft fees and taps out your credit limit. Soon, it becomes evident that this is more than some financial fluke.

Depending on the scenario and time of year, your bank, your creditor, the IRS, and even your medical provider may come after you for this pattern of errant behavior that was never yours to begin with. Unfortunately, it's still up to you to fix this debt that's now your responsibility.

The Problem is Real, Lasting, and Costly

Identity theft is no laughing matter if you're on the receiving end. It can ruin your credit and worsen your financial well-being, even when you've been super diligent with your money matters. According to a recent study by Javelin Strategy & Research, 13.1 million Americans had their identities stolen last year, the second-highest number in six years. It amounted to a loss of $15 billion for consumers, banks, and others.

It's estimated that it takes about 600 hours to restore your reputation after an identity theft.

It's also estimated that it takes about 600 hours to restore your reputation after an identity theft. Though those numbers are a few years old, it was just last month that comedian John Oliver highlighted the high rates of error and customer dissatisfaction facing credit reporting bureaus.

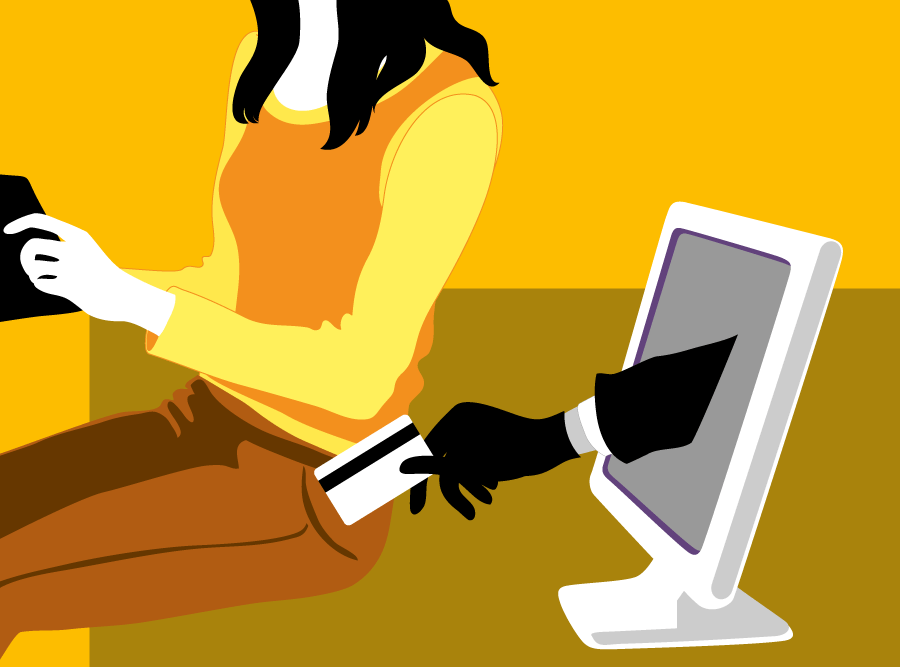

Identity thieves have no qualms about stealing someone else's information for their own financial gain, and it's becoming harder to fully safeguard oneself. But you can take simple actions to prevent yourself from becoming a victim.

5 Ways to Protect Yourself From Identity Theft

Guard Important Personal Documents

If you must guard one piece of physical documentation with your life, make it your Social Security card. Never carry it in your wallet, and only reveal your SSN when it's safe to do so (I.e., for banking or employment purposes). Those nine personalized digits can mean a bad case of identity theft if they fall into the wrong hands.

For paper bank statements, ensure that there aren't any unauthorized or unfamiliar transactions. Keep these and other relevant documents in a locked safe or safety deposit box. When you no longer need papers containing personal information, such as receipts, mail, or other personal documents, consider investing in a shredder to destroy them. Dumpster divers do exist and will troll through people's trash looking for any piece of information.

Beware of "Shoulder Surfers"

Keep watch over your debit or credit cards whenever making a transaction. Even at the most seemingly secure location, you never know who might be looking over your shoulder; thieves have even been known to install tiny cameras, credit card skimmers, and even use binoculars from afar to catch a glimpse of your card.

At the ATM, always use one hand the shield the keypad and prevent anyone from seeing you punch in your PIN. When traveling, use your card only in familiar, well-lit areas, since some ATMs are set up by thieves to fool unwitting tourists. Carry only the plastic that's absolutely necessary in your wallet or purse. If it's stolen or lost, immediately close out your cards with your provider or bank so no unauthorized purchases are made.

Protect Your Digital Presence

With the rise in clever hacking techniques, your home computer or laptop might just be the most vulnerable to identity thieves. Install firewalls, anti-virus software, and/or an anti-spyware program to protect it while you're online.

Even if your computer has never been compromised, it's also good to frequently change your passwords, whether they're for your bank account, social media, or another site; experts suggest using a combination of letters, numbers, and symbols. Avoid easy-to-guess debit card PINs as well, and remember to never, ever store any of this information on your computer.

Be Wary of Fishy Phishing Scams

Open your emails and text messages carefully. Many that look harmless and legitimate are scams in disguise, out to fool people into giving up their personal information. Colloquially, it's known as "phishing" because the prospective thieves go fishing for ways to steal your identity. And it's not always as obvious as someone claiming to be a Nigerian prince in need of your help; several phishing scams look real, posing as scholarship offers, discount deals, correspondence from fictitious organizations, or even communications from your own bank.

Several phishing scams look real, posing as scholarship offers, discount deals, or even communications from your own bank.

Always do a close inspection if you receive an email that leaves you in doubt. First, check online to see if the organization is legitimate. Keep in mind that your bank will never solicit you for passwords or PIN numbers in an email. Neither will the IRS. Check for misspellings or poor grammar, which are surefire signs you're looking at a scam. Again, use that anti-virus software, since phishing emails can often damage your computer when you click on them.

Check Your Credit Report

If you don't already, start checking your credit report at least once a year to see where you stand financially — especially if you're thinking about taking out a loan, buying a car, or opening a new credit card. Look for any fraudulent activity in your accounts, or for open accounts you may not recognize. If people have been racking up debt on your dime, you need to know.

For your own financial sake, and to prevent scammers' access to your accounts, put a fraud alert on your credit report. This 90-day hold only requires you to contact one of three reporting credit bureaus (TransUnion, Equifax, or Experian), according to Credit Sesame. If you suspect a breach in your finances, you can also place a security freeze on your credit reports, which will prevent the approval of any new applications until you've sorted out the potential problem.

If you believe you've been the victim of identity theft or fraud, don't hesitate to contact the relevant authorities. This includes your credit and banking providers, your local police, and/or the Federal Trade Commission.

Paul Sisolak is a contributing writer at dealnews. Republished with permission.

Image credit: Finger print masthead by nulinukas, bank card in internet by Lolabek

https://www.techspot.com/news/64747-identity-theft-rise-five-simple-ways-protect-yourself.html