The recent discovery of a new type of ATM card skimmer reportedly has the Secret Service on high alert.

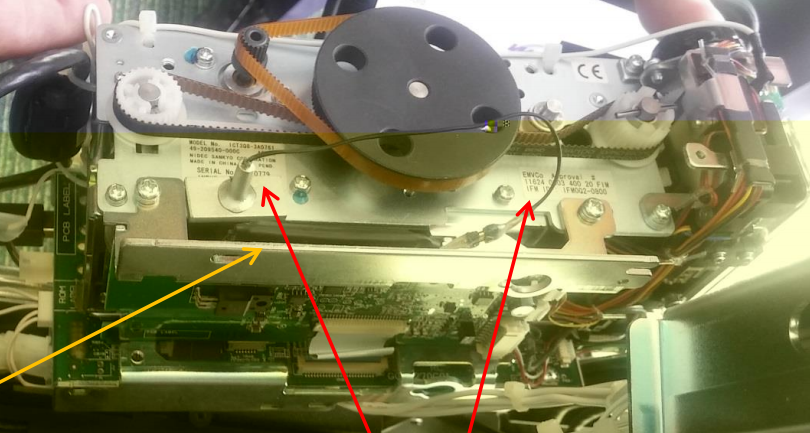

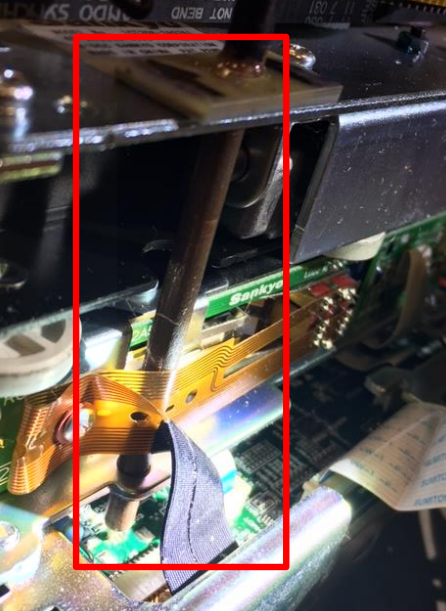

According to Krebs on Security, the agency is alerting banks and ATM owners about an advanced skimming technique known as periscope skimming. The device, which consists of two components, is installed inside of an ATM through a top hatch accessible with a key, thus making it impossible to detect from the outside.

A financial crimes task force in Connecticut believes this is the first time periscope skimmers have been found in the US. Their report references two periscope skimmers uncovered thus far in the US, one last month in Greenwich, Connecticut, and another earlier this month in Pennsylvania.

Krebs notes that the Connecticut task force didn’t find any hidden cameras or other method of capturing PINs which suggests these are early prototypes designed to help improve future versions. At some point, however, those installing periscope skimmers will want to somehow capture PINs so they can later drain bank accounts.

The devices that have been found could remain inside an ATM for up to 14 days before running out of power from their battery. In that amount of time and given the skimmer’s storage capacity, it could record as many as 32,000 card numbers.

Krebs recommends ATM users shield the keypad when they enter their PIN as to prevent a visual device like a camera from seeing the numbers entered. They also recommend sticking to ATMs that are installed in the wall at a bank and to never use a machine that’s in a secluded spot, especially at night.

https://www.techspot.com/news/66329-periscope-atm-skimmers-undetectable-outside.html