Despite a decline in computer shipments, the second quarter of 2012 proved to be "good" if not "great" for the graphics hardware industry according to Jon Peddie Research (JPR). GPU shipments totaled 126 million units, up 2.7% from the same time last year, ahead of the average growth of 2.5% for the period and more welcomed than the 1.5% drop in overall PC shipments during the recently ended quarter.

Much of that growth is attributed to the graphics solutions built into Intel's Sandy Bridge and Ivy Bridge chips, as total discrete GPU shipments only increased 0.5% from the first quarter of 2012 and were down 7% on-year. JPR says this is "due to the same problems plaguing the overall PC [industry], continued HDD shortage, macroeconomics, softness in western European market, and the impact of tablets."

Graphics cores inside Intel's processors made it into 6.3% more desktops and 13.9% more notebooks on-quarter, while those figures are 13.6% and 3.8% year-over-year. AMD's integrated GPUs shipped in 13.8% less desktops and 6.7% notebooks from the first quarter (we couldn't find on-year figures and it's worth noting that JPR doesn't include handsets or tablets, so Nvidia's Tegra chips aren't covered).

The outfit's highlights also jump back and forth between quarterly and yearly changes when discussing the discrete market, making it tough to draw direct comparisons, so we won't (for example, AMD's discrete desktop GPU results are displayed on-year and Nvidia's are on-quarter). Anyhow, both outfits seem to be doing okay and JPR says the overall trend for discrete GPUs is up with a CAGR to 2015 of 5%.

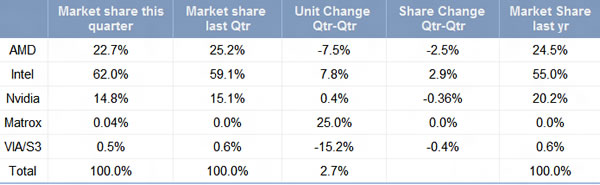

Unsurprisingly, Intel maintained the largest market share of overall graphics shipments at 62.0%, up from 59.1% in the first quarter and 55% in the second quarter last year. AMD's share worked out to 22.7%, down from 25.2% and 24.5% in the aforementioned periods, while Nvidia held a 14.8% slice, down from 15.1% and 20.2%. The remaining sliver of shipments was split between VIA/S3 and Matrox.