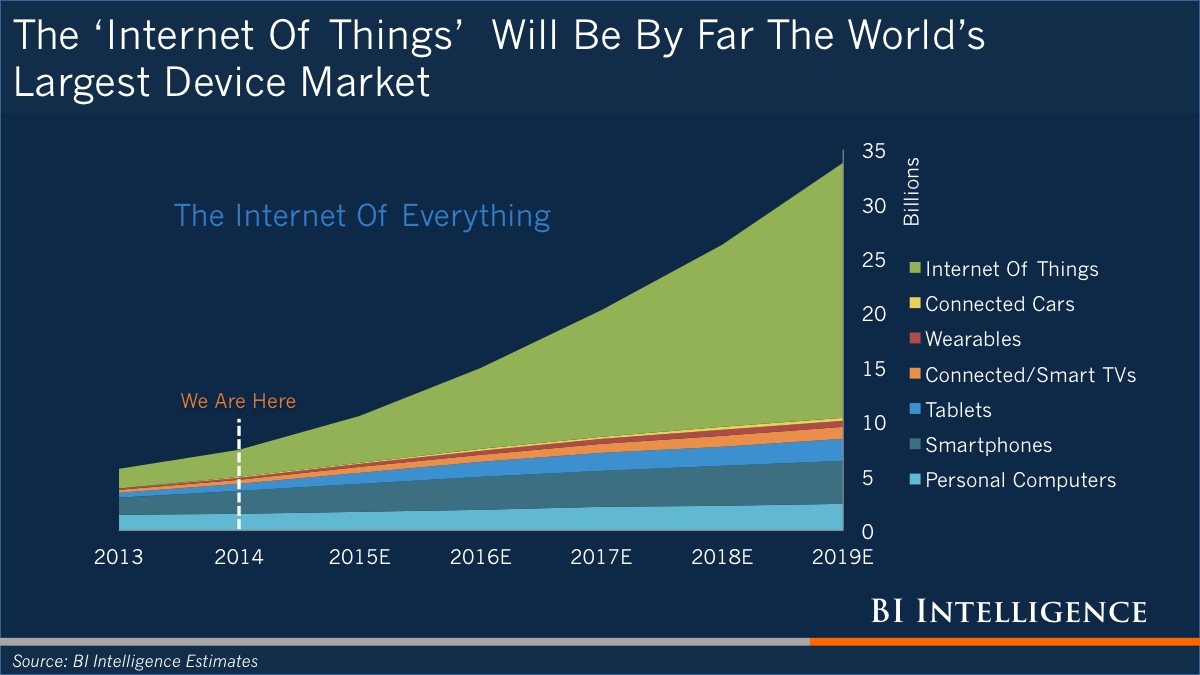

While there are never-ending debates about the potential size of the market opportunity for the Internet of Things (IOT), most everyone will agree that it's going to be a relatively large number, both in terms of units and revenues.

However, there's another aspect of the IOT market that isn't discussed as much, but in my mind, is equally as certain: at every level imaginable, the IOT market is wide open. From semiconductor architectures to semiconductor makers, operating systems, sensor makers, device makers, application providers, data analysis tools, and on and on, there are few, if any, dominant players in IOT. Instead, there's opportunity for a lot of different companies---both large and small--- to try and stake a claim in these new markets and to find traction in a variety of IOT sub-segments. In fact, this is one of the reasons so many companies are now talking about IOT---they clearly see that they have a chance to carve out some solid business for themselves.

In the case of CPUs, not only will we see big players like Intel continue to build on their strength in the embedded space, but several different ARM licensees, such as Broadcom, Marvell, STMicro and Atmel (among many others) will likely capture many types of design wins. At the same time, the IOT market is also very well-suited for MIPS architectures. With the infusion of money and support from parent company Imagination Technologies, MIPS licensees such as Freescale and NXP (both of whom also support ARM) are also likely to find success as well. At the end of the day, much of the success for CPU, modem and other semiconductor providers will be determined by the suite of tools they can offer (or partner with others to offer) in order to enable fast, efficient and, most importantly, secure IOT product development.

In the case of operating systems, Google's rumored version of Android for IOT (code-named Brillo) is likely to have some impact, but so will Windows 10 given Microsoft has announced a version of their new OS specifically for IOT applications. At the same time, there will probably be even bigger numbers for basic real-time operating systems (RTOS) from companies like Blackberry (their QNX platform), as well as Intel's WindRiver division, and loads of other smaller companies that we've likely never heard of. Similar to the chipmakers, the most powerful tools won't necessarily win in IOT, because the compute and software requirements for IOT applications are generally very modest. Instead, success will be determined by the quality of tools that the platform makers can offer.

The most powerful tools won't necessarily win in IOT, because the compute and software requirements for IOT applications are generally very modest.

Part of the reason for this wide open opportunity in IOT is because the market for it is still very young. As it begins to mature, we'll likely see a few larger players start to take a bigger role. Another reason for this Wild West-type mentality is because the IOT opportunity is so diverse. As I've written previously, the IOT market is really a loose federation of different opportunities. From embedded industrial applications that have existed for years (but only recently have been renamed IOT), to transportation and logistics businesses, to smart meters and utility applications, through farming, connected cars, smart home devices and, depending on your definition, even smart wearables, there's an enormous range of IOT segments.

This represents a very large pie for companies to battle over---at least in theory. The problem is that it's likely to end up being played out as hundreds of small skirmishes across an equally large number of different vertical applications, very few of which turn out to be particularly impressive from a revenue perspective. So, I think companies need to be realistic in setting their expectations about how much revenue they can generate from these IOT opportunities, particularly in the near term.

Over time, I believe the IOT market will prove to be extremely important, and given that we are in its early days, it certainly makes sense for a lot of companies to pursue it---especially in an effort to lay claim to their share of this clearly unclaimed territory. As we start to hear more vendors' grandiose claims about striking gold in these undiscovered new lands, however, it's best to take these potential prospects' claims with a grain of salt.

Bob O'Donnell is the founder and chief analyst of TECHnalysis Research, LLC a technology consulting and market research firm. You can follow him on Twitter @bobodtech. This article was originally published on Tech.pinions.

Header image via Shutterstock