In brief: Research firms Gartner and IDC have released figures showing the state of PC sales last year---and it's not good news. Due to processor shortages and the trade war with China, shipments declined during the last quarter and across the whole of 2018.

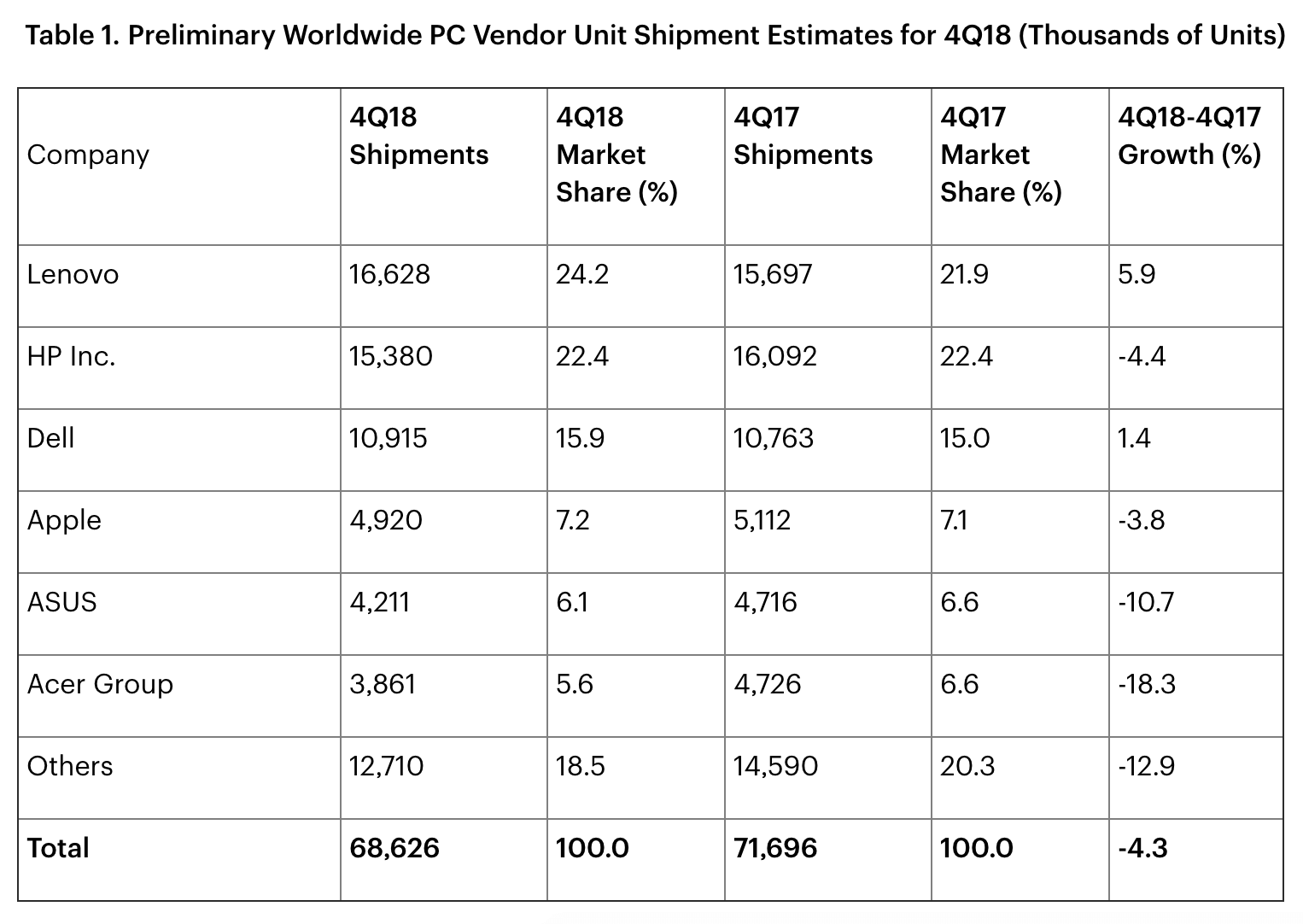

For the holiday period, Gartner has worldwide PC shipments at 68.6 million units, down 4.3 percent YoY. Only Lenovo, which moved ahead of HP to become the quarter's top vendor, and third place Dell showed growth compared to Q4 2017. The rest of the top six was made up of Apple, Asus, and Acer.

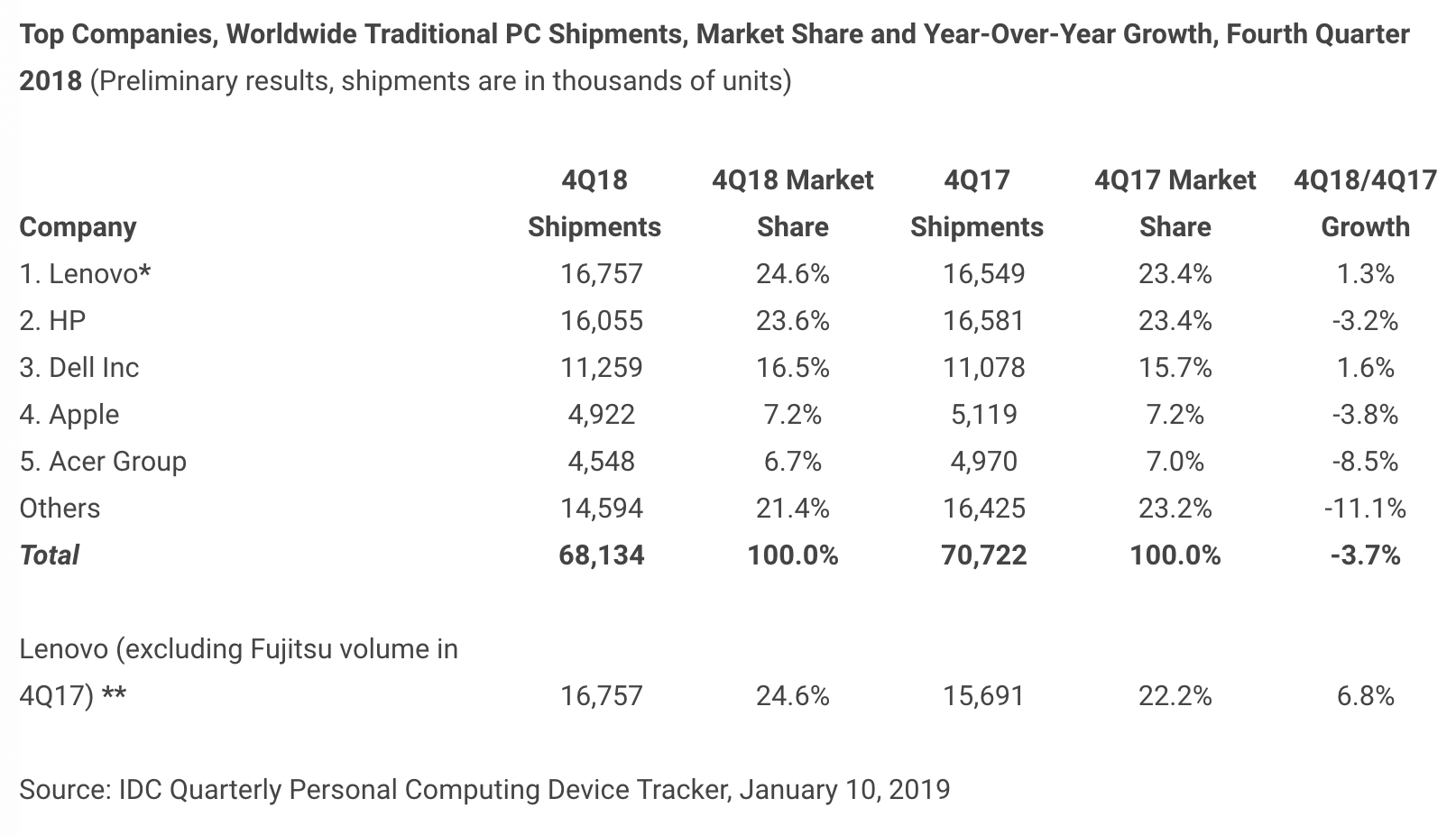

IDC's figures were only slightly better. It has YoY growth for the quarter down 3.7 percent, with 68.1 million units shipped. The top four firms are the same as Gartner, and Acer replaces Asus in fifth spot.

IDC writes that vendors aggressively built up their inventories heading into Q3 as concerns over processor shortages and the trade war increased. But a volatile stock market and a post-Black Friday/Cyber Monday downturn saw "the lowest sequential growth for a holiday quarter since the fourth quarter of 2012."

Gartner placed the blame on Intel's manufacturing problems and the subsequent CPU shortage, but it's optimistic about the year ahead.

"Just when demand in the PC market started seeing positive results, a shortage of CPUs (central processing units) created supply chain issues," said Mikako Kitagawa, senior principal analyst at Gartner. "The impact from the CPU shortage affected vendors' ability to fulfill demand created by business PC upgrades. We expect this demand will be pushed forward into 2019 if CPU availability improves."

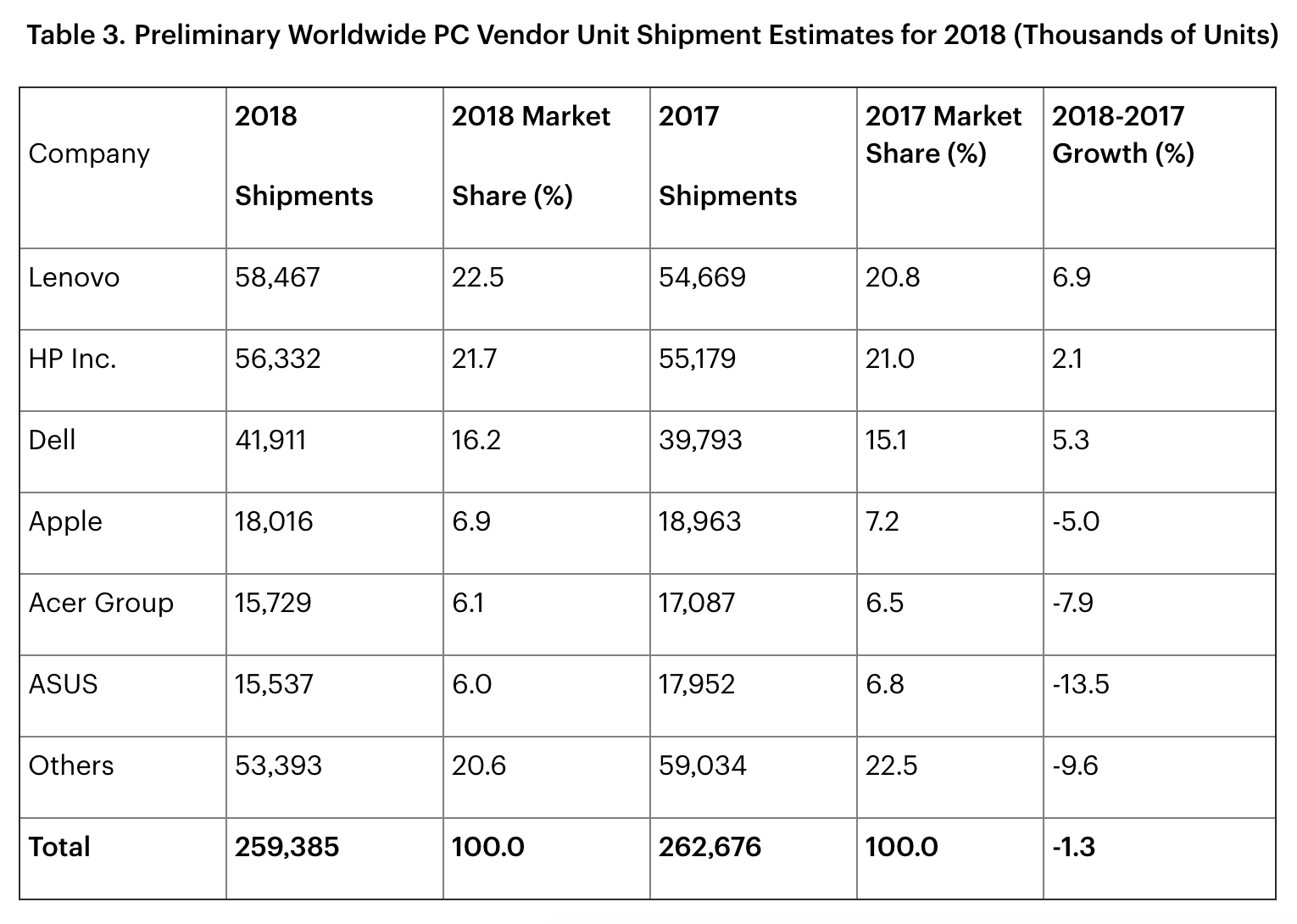

Despite showing growth in the second and third quarters, Gartner said 2018 was the seventh year PC shipments experienced annual declines, though the 1.3 percent fall to 259 million units wasn't as bad as the previous three years. Additionally, the top three companies showed growth.

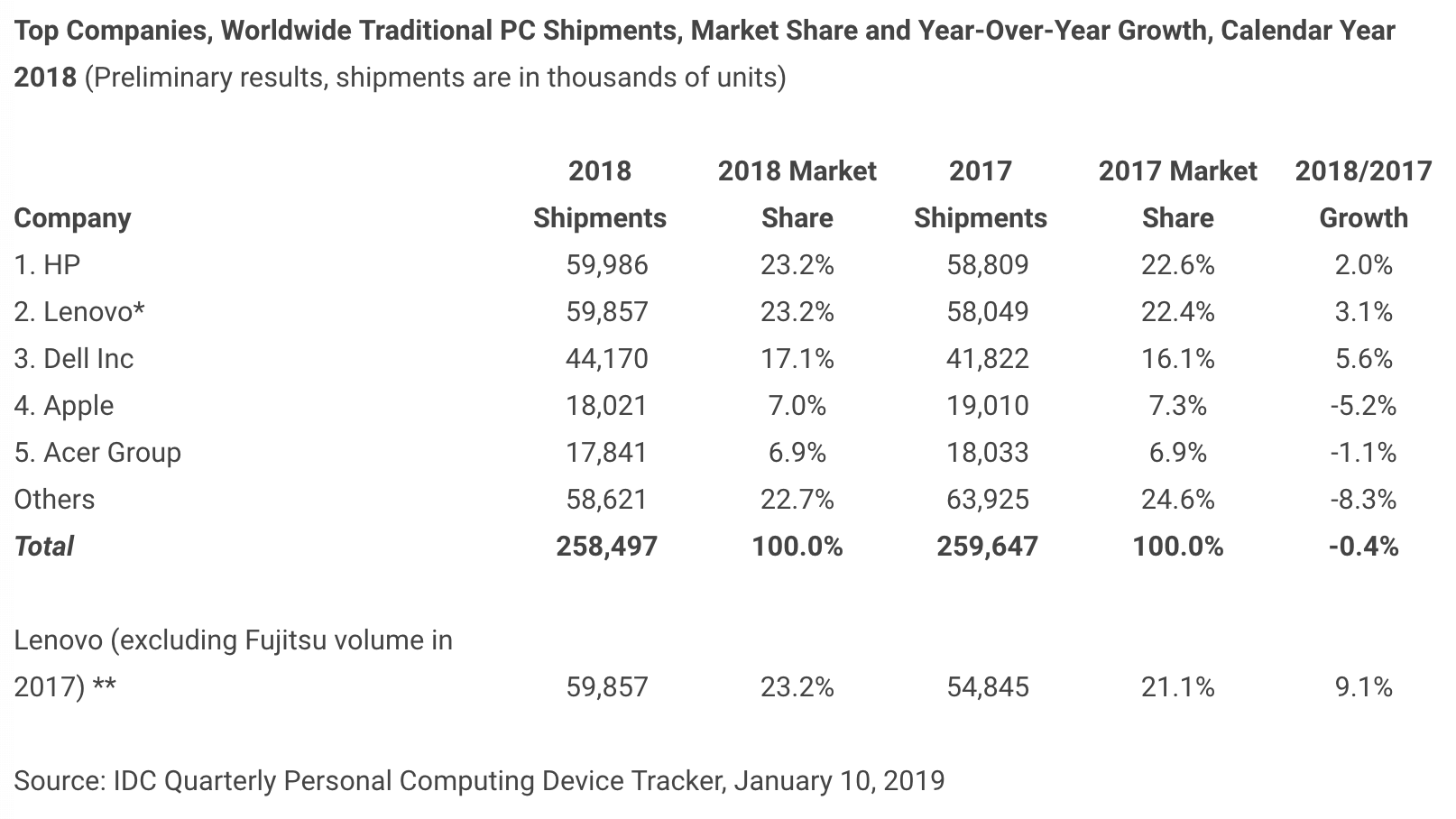

IDC had shipments for the year flat (258 million) at -0.4 percent and places HP ahead of Lenovo at the top, but it did say US-China tensions could cause more problems.

"The majority of the PC shipment decline in 2018 was due to weak consumer PC shipments. Consumer shipments accounted for approximately 40 percent of PC shipments in 2018 compared with representing 49 percent of shipments in 2014," Gartner senior principal analyst Mikako Kitagawa said. "The market stabilization in 2018 was attributed to consistent business PC growth, driven by Windows 10 upgrade."