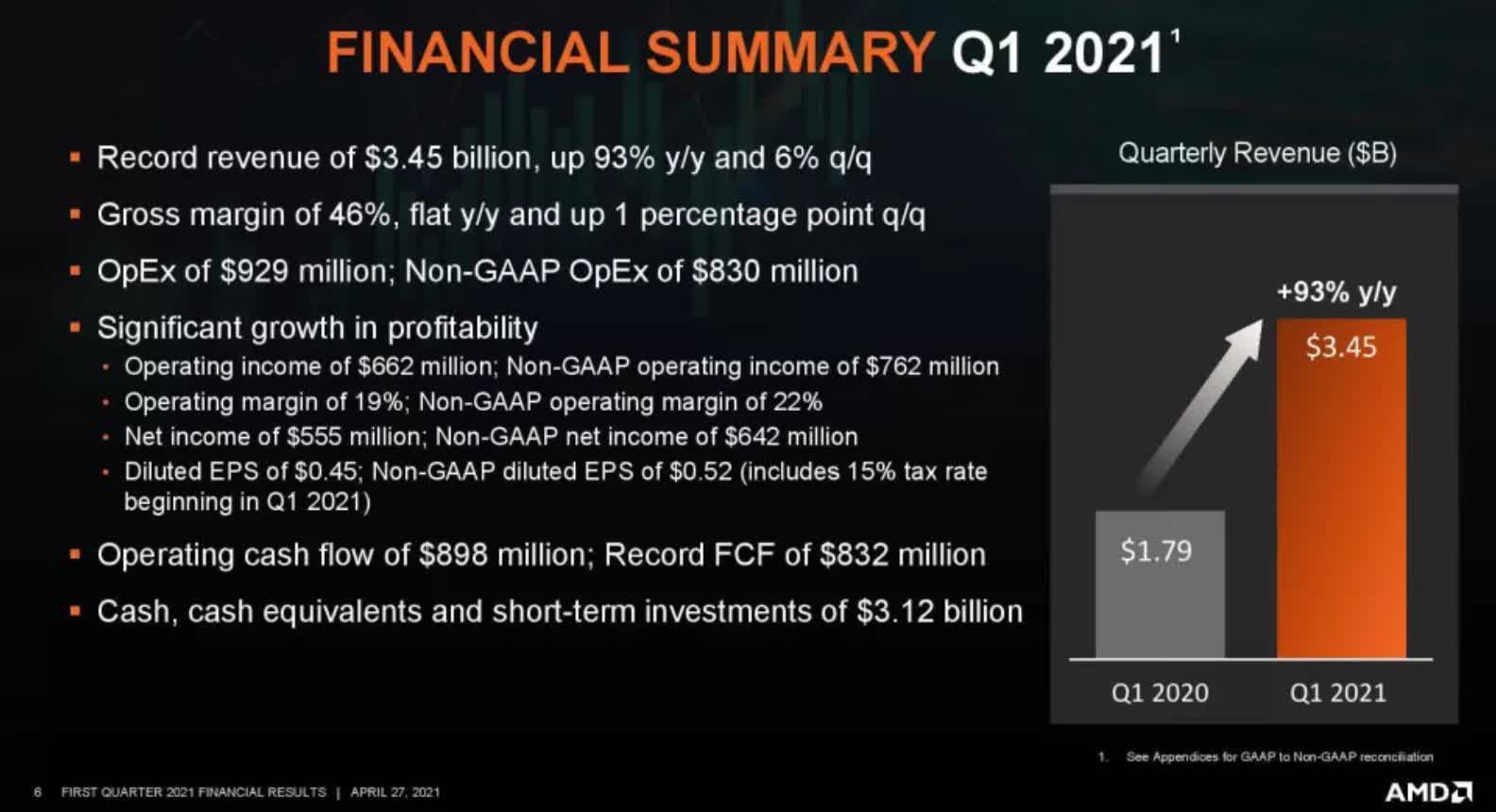

In brief: Consumers are doubtlessly sick of hearing the words "chip shortage," but for AMD, the unprecedented demand contributed to a record-breaking quarter. During the first three months of 2021, team red saw its revenue increase 93% year over year (YoY) to $3.45 billion.

We know the difficulty in buying graphics cards and, to a lesser extent, CPUs right now, especially at something close to their MSRP, but AMD is pumping out huge numbers of chips—just not enough to meet demand—and that's boosting the company's bottom line.

AMD's net income was up 243% YoY to $555 million. That would have been another record were it not for a one-off tax benefit in the previous quarter that increased Q4 2020 net income to $1.7 billion.

The Computing and Graphics segment, comprising consumer GPUs and CPUs, generated $2.1 billion in revenue, up 46% YoY. We recently saw how the firm's Ryzen processors are dominating Amazon's top-selling CPUs chart, despite Intel discounting many of its chips.

AMD said it was also a record-breaking quarter for its Ryzen CPUs in terms of revenue and average selling prices. The company keeps eroding Intel's share of the processor market; AMD CPUs are now found in close to 30% of Steam survey participants' PCs.

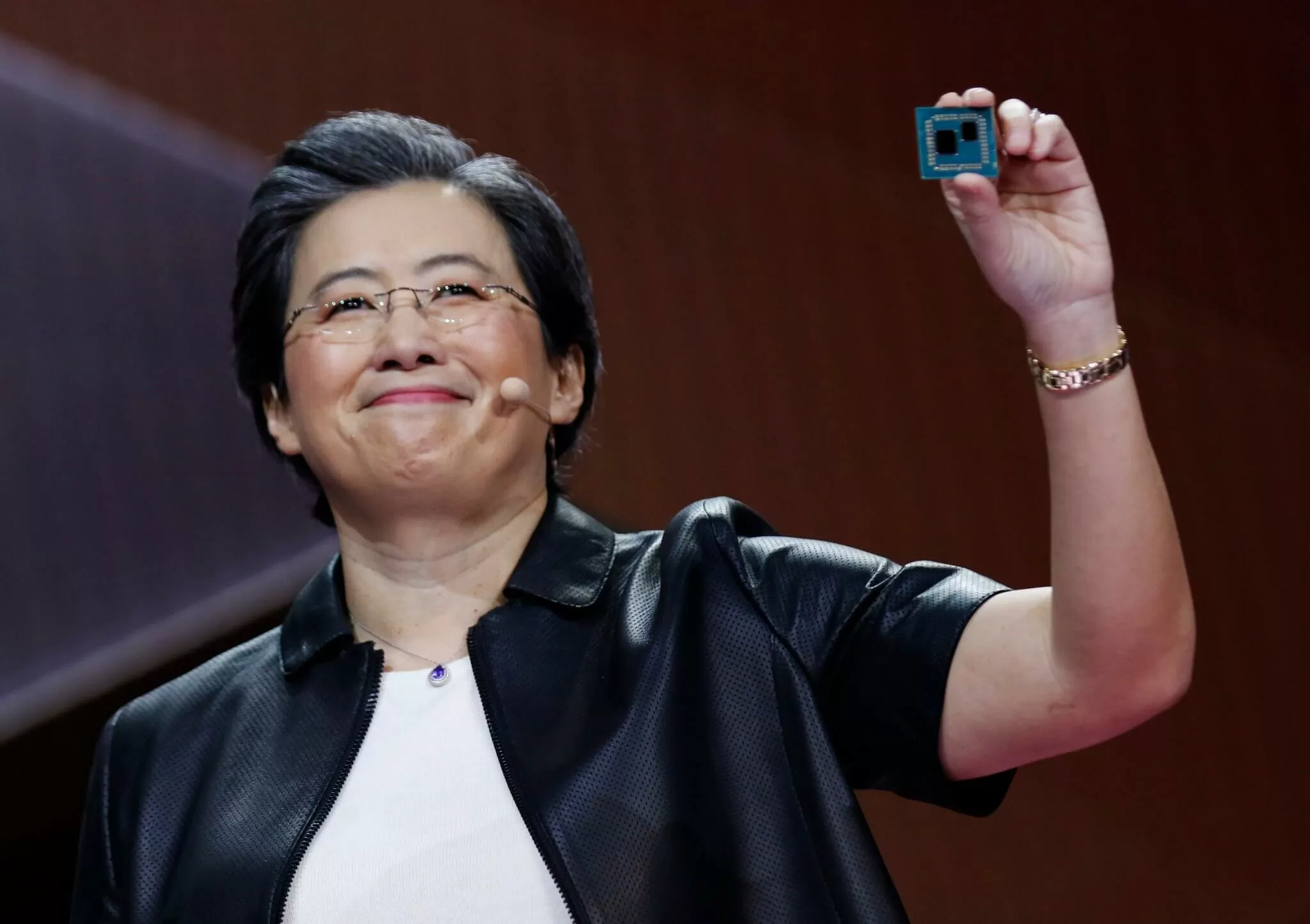

CEO Lisa Su spoke about the mobile division: "We delivered our sixth straight quarter of record mobile processor revenue based on sustained demand for Ryzen 4000 series processors and the launch of our new Ryzen 5000 series processors."

Su said that Radeon 6000 GPU sales had doubled compared to the previous quarter, and, in what sounds like good news for gamers, claimed GPU supply would improve in the next quarter. She was also asked what effect, if any, crypto mining had on AMD's profit surge:

"You asked about crypto. We do not—we have negligible crypto in here. So this is really the foundational business, really, the new products and just seeing the customers adopt and ramp quickly."

It was a massive quarter for the Enterprise, Embedded, and Semi-Custom (EESC) group, a result of the Xbox Series X/S and PS5 launches, as well EPYC Milan's arrival. It made $1.35 billion in revenue, up 286% YoY. Operating income was at $277 million, whereas the segment lost money in Q1 2020.

AMD expects this success to continue throughout the rest of the year. It predicts $3.6 billion in revenue for Q2, up 86% YoY, and has increased its previous projection of 37% annual growth to 50%.

https://www.techspot.com/news/89473-amd-reports-another-record-quarter-revenue-jumps-93.html