El Segundo, Calif., Sept. 6, 2007 — Lenovo Group Ltd. regained the number-three position in the global PC market in the second quarter, but with competitor Acer Inc. engaging in an aggressive acquisition strategy, how long can Lenovo maintain this rank?

Chinese PC OEM Lenovo shipped 4.9 million PCs worldwide in the second quarter, up 22.9 percent from 3.96 million in the first quarter, according to a preliminary ranking by iSuppli Corp. This marked the largest increase among the world’s Top-5 and Top-10 PC suppliers—although it was only marginally ahead of the 17 percent sequential growth achieved by Apple Inc. On a unit basis, Lenovo’s shipments rose by 908,000 in the second quarter compared to the first.

This was a remarkable accomplishment, considering that overall shipments declined sequentially during the period, decreasing by 1.7 percent, or by 1.03 million units.

“Lenovo’s sales were propelled by strong demand in the domestic Chinese market,” said Matthew Wilkins, principal analyst for compute platforms at iSuppli. “The company previously stated that it would deliver a stronger performance in the second quarter than it did in the first, and it duly delivered.”

The company’s industry-leading growth caused its market share to rise to 7.9 percent in the second quarter, up from 6.4 percent in the first quarter. This rise allowed Lenovo to take the third position in the global PC market, reclaiming the rank from Taiwan’s Acer, which took the No. 3 place from Lenovo in the first quarter.

Meanwhile, Acer’s PC shipments declined by 0.2 percent during the second quarter.

“Acer’s performance was better than the seasonal results of the overall PC market during the second quarter,” Wilkins said. “However, the Top-5 PC OEMs enjoyed such strong results that even a very small sequential decline is against the trend we saw during the quarter.”

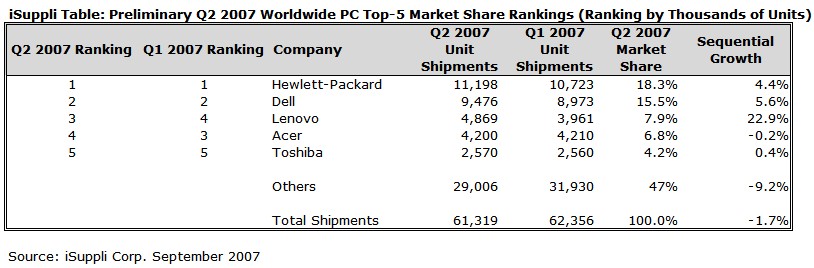

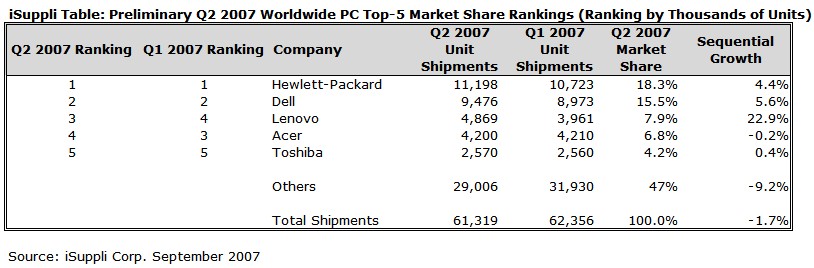

The following table presents iSuppli’s preliminary estimate of Top-5 global PC market share in the second quarter.

Lenovo should enjoy its time at No. 3—because it may not last for long.

Acer’s planned acquisitions of Europe’s Packard Bell and North America’s Gateway, the company will cause the company to gain approximately 2.5 percentage points of market share. If those acquisitions were figured into the second-quarter rankings, Acer would have retained its third-place ranking in the second quarter, Wilkins noted.

As a result of the planned acquisitions, Acer is expected to take a firm grip of the third-place position in the coming quarters.

Hewlett-Packard stays on top

Hewlett-Packard Co. cemented its position as the worldwide leader in PC shipments in the second quarter.

The U.S. PC OEM increased its shipments to 11.2 million units, up 4.4 percent from 10.7 million units in the first quarter—and up by a whopping 35 percent from the second quarter of 2006. Hewlett-Packard’s market share rose to 18.3 percent, up from 17.2 percent in the first quarter. The company’s growth in PC shipments outpaced the expansion of the overall PC industry by nearly a factor of three.

Meanwhile, second-ranked Dell Inc. of the United States posted a 5.6 percent sequential increase in PC shipments, the second-best performance among the Top-5 PC OEMs. However, Dell’s shipments were down by 5 percent compared to the second quarter of 2006, reflecting the company’s continued struggles.

Despite this, the shipment gap between Dell and Hewlett-Packard remained constant between the second and first quarters of 2007, at 1.7 million units.

The big get bigger

Most of the Top-5 PC OEMs had a strong quarter, with four of them posting a sequential increase in sales. Furthermore, four of the Top-5 experienced double-digit growth in the second quarter compared to the same period in 2006.

As a result of the huge growth enjoyed by the Top-5, the proportion of quarterly shipments supplied by smaller OEMs in the “Others” category declined on both a year-over-year and a sequential basis in the second quarter.

Asia rising

The Top-3 Asian PC vendors—Lenovo, Acer, and Toshiba Corp.—in the second quarter generated 56.3 percent of the combined shipments of the Top-2 North American PC vendors, Hewlett-Packard and Dell. This is up from 54 percent in the first quarter.

This serves as a reminder of the strength of the North American vendors, but it also illustrates that the Asian PC OEMs can increase their penetration of the market—even without major acquisitions.

The notebook segment continued to drive growth in the overall PC market, with second-quarter growth of 27 percent on a year-over-year basis.

U.S.-based Apple reported the highest sequential growth in notebook shipments out of the Top-10 ranked PC OEMs in the second quarter, at 27 percent. Apple’s Notebook shipment growth even outstripped that of Lenovo, which reported the second highest sequential growth in notebook PC shipments.

iSuppli’s latest PC forecast calls for unit growth of 11.7 percent in 2007 compared to 2006.

Chinese PC OEM Lenovo shipped 4.9 million PCs worldwide in the second quarter, up 22.9 percent from 3.96 million in the first quarter, according to a preliminary ranking by iSuppli Corp. This marked the largest increase among the world’s Top-5 and Top-10 PC suppliers—although it was only marginally ahead of the 17 percent sequential growth achieved by Apple Inc. On a unit basis, Lenovo’s shipments rose by 908,000 in the second quarter compared to the first.

This was a remarkable accomplishment, considering that overall shipments declined sequentially during the period, decreasing by 1.7 percent, or by 1.03 million units.

“Lenovo’s sales were propelled by strong demand in the domestic Chinese market,” said Matthew Wilkins, principal analyst for compute platforms at iSuppli. “The company previously stated that it would deliver a stronger performance in the second quarter than it did in the first, and it duly delivered.”

The company’s industry-leading growth caused its market share to rise to 7.9 percent in the second quarter, up from 6.4 percent in the first quarter. This rise allowed Lenovo to take the third position in the global PC market, reclaiming the rank from Taiwan’s Acer, which took the No. 3 place from Lenovo in the first quarter.

Meanwhile, Acer’s PC shipments declined by 0.2 percent during the second quarter.

“Acer’s performance was better than the seasonal results of the overall PC market during the second quarter,” Wilkins said. “However, the Top-5 PC OEMs enjoyed such strong results that even a very small sequential decline is against the trend we saw during the quarter.”

The following table presents iSuppli’s preliminary estimate of Top-5 global PC market share in the second quarter.

Lenovo should enjoy its time at No. 3—because it may not last for long.

Acer’s planned acquisitions of Europe’s Packard Bell and North America’s Gateway, the company will cause the company to gain approximately 2.5 percentage points of market share. If those acquisitions were figured into the second-quarter rankings, Acer would have retained its third-place ranking in the second quarter, Wilkins noted.

As a result of the planned acquisitions, Acer is expected to take a firm grip of the third-place position in the coming quarters.

Hewlett-Packard stays on top

Hewlett-Packard Co. cemented its position as the worldwide leader in PC shipments in the second quarter.

The U.S. PC OEM increased its shipments to 11.2 million units, up 4.4 percent from 10.7 million units in the first quarter—and up by a whopping 35 percent from the second quarter of 2006. Hewlett-Packard’s market share rose to 18.3 percent, up from 17.2 percent in the first quarter. The company’s growth in PC shipments outpaced the expansion of the overall PC industry by nearly a factor of three.

Meanwhile, second-ranked Dell Inc. of the United States posted a 5.6 percent sequential increase in PC shipments, the second-best performance among the Top-5 PC OEMs. However, Dell’s shipments were down by 5 percent compared to the second quarter of 2006, reflecting the company’s continued struggles.

Despite this, the shipment gap between Dell and Hewlett-Packard remained constant between the second and first quarters of 2007, at 1.7 million units.

The big get bigger

Most of the Top-5 PC OEMs had a strong quarter, with four of them posting a sequential increase in sales. Furthermore, four of the Top-5 experienced double-digit growth in the second quarter compared to the same period in 2006.

As a result of the huge growth enjoyed by the Top-5, the proportion of quarterly shipments supplied by smaller OEMs in the “Others” category declined on both a year-over-year and a sequential basis in the second quarter.

Asia rising

The Top-3 Asian PC vendors—Lenovo, Acer, and Toshiba Corp.—in the second quarter generated 56.3 percent of the combined shipments of the Top-2 North American PC vendors, Hewlett-Packard and Dell. This is up from 54 percent in the first quarter.

This serves as a reminder of the strength of the North American vendors, but it also illustrates that the Asian PC OEMs can increase their penetration of the market—even without major acquisitions.

The notebook segment continued to drive growth in the overall PC market, with second-quarter growth of 27 percent on a year-over-year basis.

U.S.-based Apple reported the highest sequential growth in notebook shipments out of the Top-10 ranked PC OEMs in the second quarter, at 27 percent. Apple’s Notebook shipment growth even outstripped that of Lenovo, which reported the second highest sequential growth in notebook PC shipments.

iSuppli’s latest PC forecast calls for unit growth of 11.7 percent in 2007 compared to 2006.