In a nutshell: Binance, the world’s largest cryptocurrency exchange, is under investigation by Internal Revenue Service and the Department of Justice agents who deal with money laundering and tax offenses.

Binance, incorporated in the Cayman Islands and with an office in Singapore, has become the largest and best-known crypto exchange since its founding in 2017. Bloomberg writes that the IRS and DoJ are now taking an interest in potentially illegal transactions moving through the service, though they haven't accused Binance of doing anything wrong.

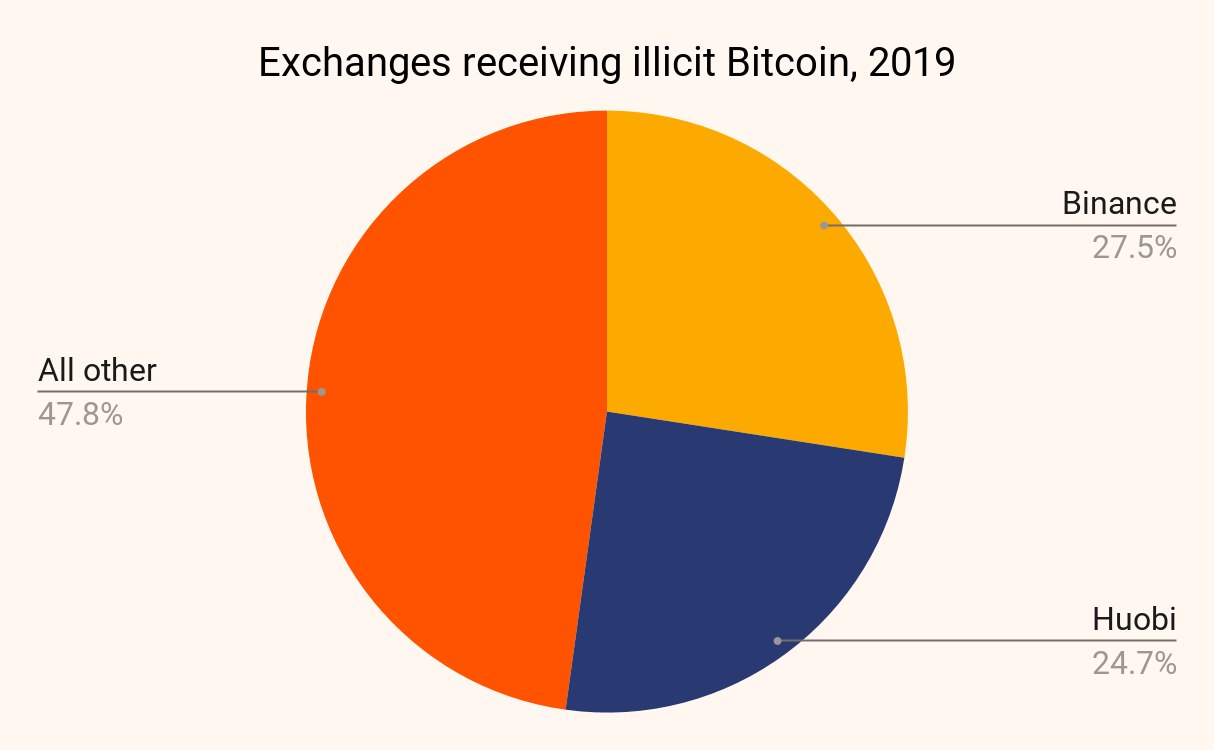

The investigation isn't too surprising, given that forensics firm Chainalysis Inc. found that more funds linked to criminal activity went through Binance in 2019 than any other crypto exchange— $756 million out of a $2.8 billion total.

Crypto’s mostly anonymous nature has seen it become the currency of choice for illegal activities such as drug deals and blackmail. The skyrocketing price of Bitcoin, Ethereum, and many others has brought another problem for authorities: traders not paying taxes on the millions they make.

It was reported back in March that the US Commodity Futures Trading Commission (CFTC) was investigating whether Binance was allowing Americans to make illegal trades on the platform, by letting them buy derivatives linked to digital tokens. US residents are barred from purchasing such products from firms not registered with the CFTC.

“We have worked hard to build a robust compliance program that incorporates anti-money laundering principles and tools used by financial institutions to detect and address suspicious activity,” a Binance spokesperson said. “We have a strong track record of assisting law enforcement agencies around the world, including in the United States.”

Bitcoin lost around 17% of its value earlier this week after Elon Musk said Tesla would suspend customers’ ability to pay for its products using the crypto. It has rallied slightly to $50,000 since then, but that’s still $10,000 lower than its price on Monday.

https://www.techspot.com/news/89681-doj-irs-reportedly-investigating-crypto-exchange-binance.html