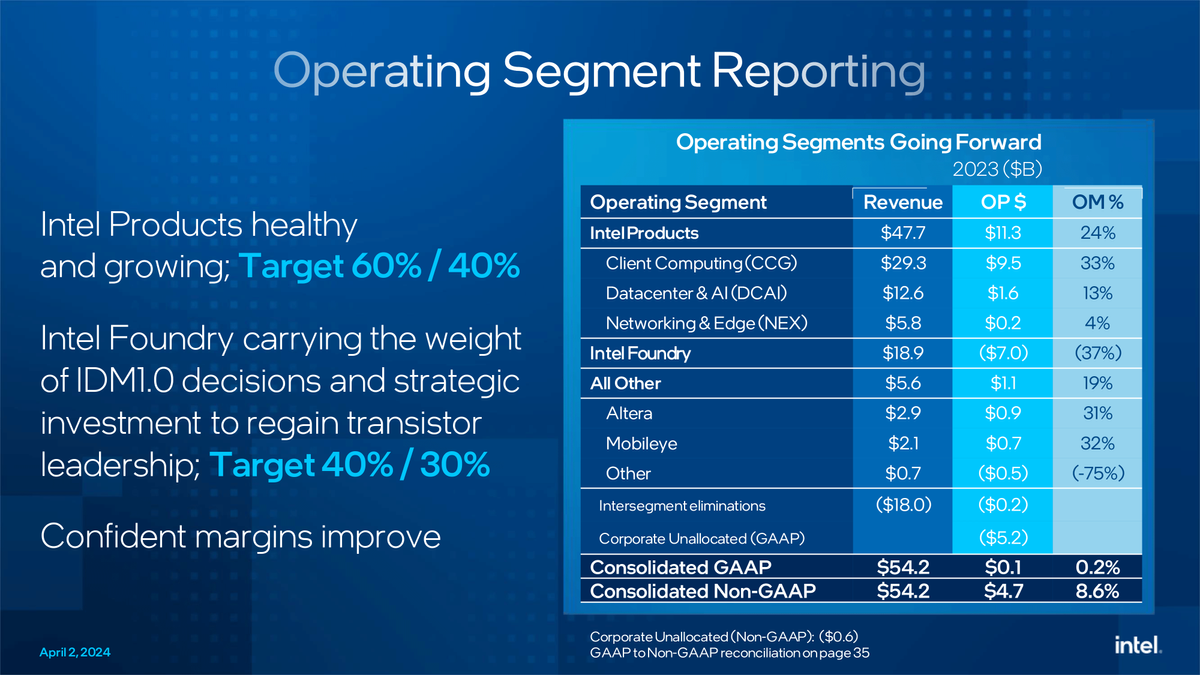

In brief: Intel's share price has fallen over 4% in the last few hours following news that its foundry business recorded an operating loss of $7 billion in 2023, almost $2 billion more than the $5.2 billion loss it experienced a year earlier. Revenue was also down year-on-year in 2023, falling 31% from $27.49 billion to $18.9 billion.

Intel CEO Pat Gelsinger warned investors that the worst is yet to come. He expects Intel's chipmaking business to have its worst year of losses in 2024, adding that it won't break even on an operating basis until about 2027.

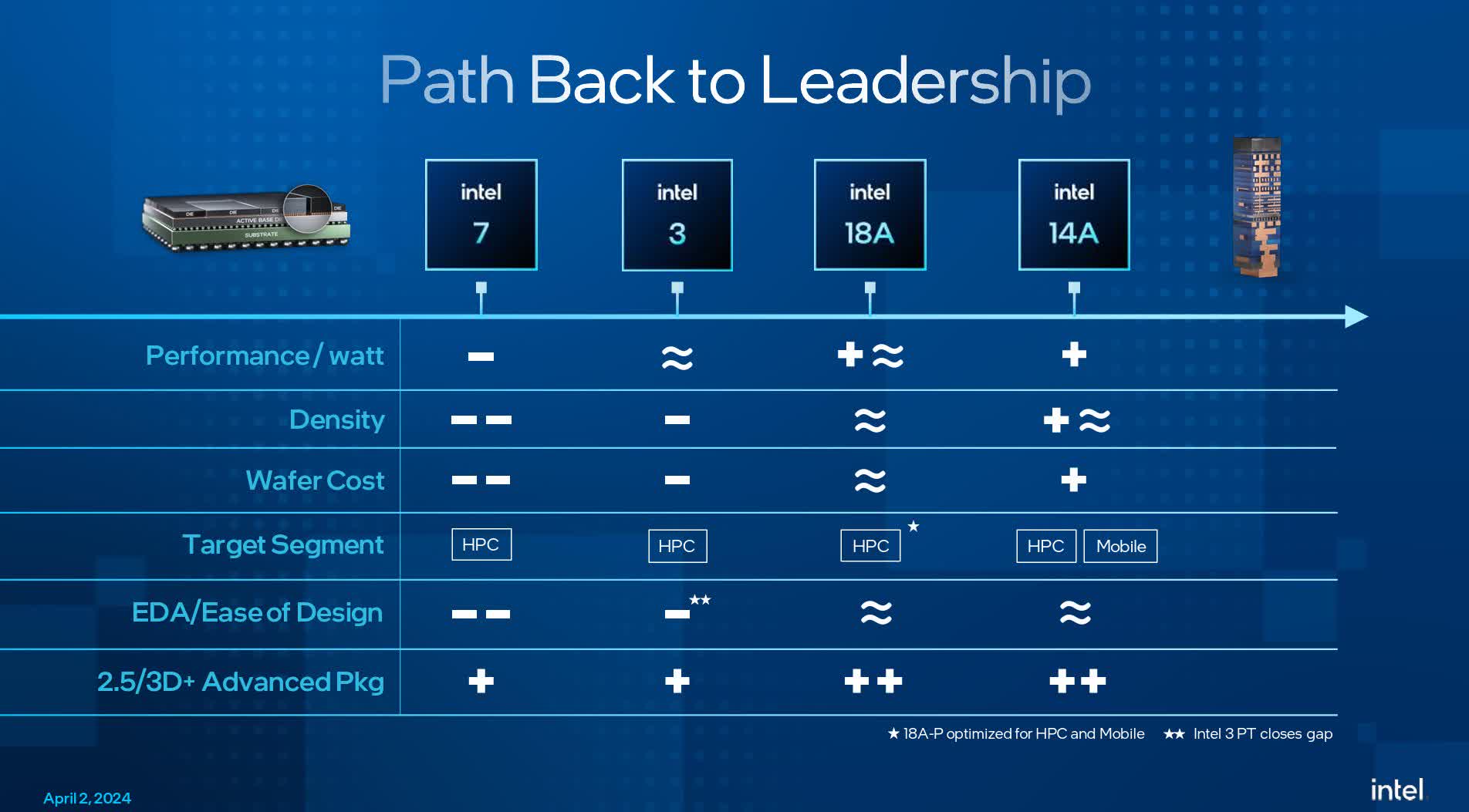

Gelsinger partly blamed the losses on Intel's past mistakes in this area. One of these was the decision made one year ago to not use ASML's extreme ultraviolet (EUV) machines. While they can cost over $150 million, they are more cost-effective than previous chipmaking equipment. Intel later went back on its decision and invested in the EUV machines, which should help the foundry business' goal to break even in about three years.

"In the post-EUV era, we see that we're very competitive now on price, performance (and) back to leadership," Gelsinger said. "And in the pre-EUV era, we carried a lot of costs and (were) uncompetitive."

Gelsinger added that these mistakes forced Intel to outsource 30% of all its wafer production to other foundries, including current chipmaking rival TSMC. Team Blue's boss said Intel aims to bring that share down to 20%.

The key to making money is for Intel to attract more customers to its foundry business. Microsoft recently struck a $15 billion deal with Intel for IFS to produce custom chips, so it's on the right track. The have shown optimism for the mid to longer term, too...

It was announced last month that Intel would become the biggest beneficiary of the CHIPS Act to date. The White House said Team Blue would be provided with $8.5 billion in direct funding along with $11 billion in low-interest loans and 25% investment tax credit on up to $100 billion of capital investments, which is how much IFS plans to spend on building new chip manufacturing plants in the US and improving its current facilities over the next few years.

This $INTC Foundry slide from yesterday is informative for many reasons.

– Patrick Moorhead (@PatrickMoorhead) April 3, 2024

1/ Honest about the past- @Intel rarely (historically) will show a "-" even when the entire world knows. I take this as a positive cultural shift.

2/ Aspirational about the future- Intel is in it to win it.... https://t.co/sTYXv7Djcr pic.twitter.com/Gv6bA5VJ48

Intel says past mistakes contributed to its foundry business losing $7 billion last year