In a nutshell: Nvidia has revealed that around $100-$300 million of its revenue in Q4 was from sales to cryptocurrency miners, and it expects the new crypto mining processor (CMP) line will generate around $50 million during the first quarter of FY 2022.

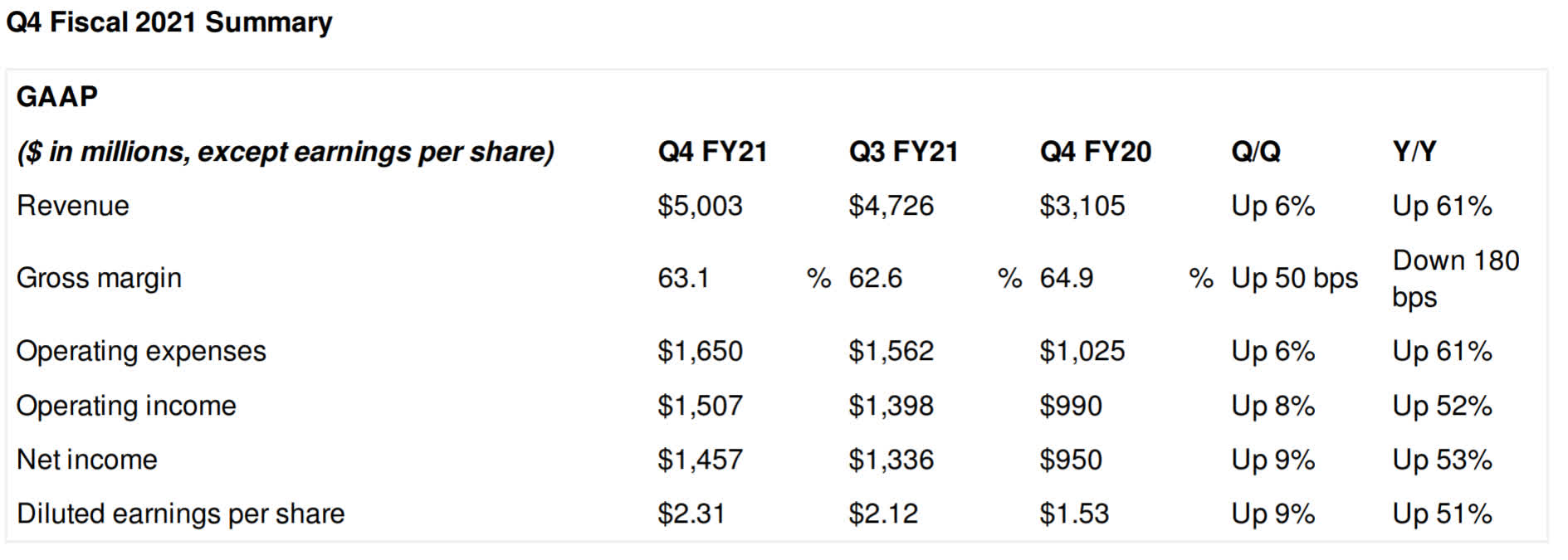

In its Q4 and fiscal 2021 earnings report, Nvidia posted a record $5 billion in quarterly revenue, up 61 percent year-over-year and reaching net earnings of $1.475 billion. The company's gaming segment accounted for $2.5 billion of that revenue.

Nvidia estimates that crypto mining sales brought in between $100 million and $300 million. CFO Colette Kress says that's the best estimate as it can't accurately track the end-use of GPUs that are sold to card manufacturers, so the actual figure is likely to be higher.

"We suspect that the significant increase in the Ethereum hash rate observed over the past few months was driven by a combination of previously-installed mining capacity that was reactivated, as well as news sales of GPUs and ASICs," said Kress.

Nvidia has curtailed the Ethereum mining abilities of its upcoming RTX 3060 to make the card less appealing to miners. It's also hoping the new CMP line will help ease Ampere's current availability issues. It expects CMP card sales to bring in $50 million during the first quarter of the year. The global chip shortage is still going to be problem, of course, one that's predicted to last into next year.

The company suggested it doesn't expect to see any cryptocurrency crash as we saw in January 2018, when Bitcoin fell by 65 percent in four weeks.

"Cryptocurrencies have recently started to be accepted by companies and financial institutions and show increased signs of staying power," Kress added. "CMP products will let us gain some visibility into the contribution of cryptomining to our overall revenue."

CEO Jensen Huang says if there is a crypto crash, we won't see second-hand graphics cards flood the market like we did last time as most miners will hang on to their cards until prices improve again—at least that's what Nvidia hopes. If you do buy an ex-mining card, expect its gaming performance to have been impacted. But it might just need a little maintenance to get those fps back.

https://www.techspot.com/news/88740-nvidia-believes-if-made-100-300-million-crypto.html