Ouch! The bank that financed many Silicon Valley startups just ran out of money in the second-biggest bank collapse in US history. The failure will seriously damage the venture capital economy and is already hurting the banking sector at least in the short term. However, the risk of a 2008-style collapse is low.

Update (Mar 13): The US Department of the Treasury, Federal Reserve, and FDIC made a joint statement on Monday announcing that all Silicon Valley Bank (SVB) depositors will be "fully" protected and their money will be available on March 13. The statement reads that after taking action by the aforementioned regulation bodies, the FDIC will complete "its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects all depositors. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer."

This is the largest rescue package from the US government since the 2008 financial crisis. The White House insists this is not a bailout, and according to Axios, "this is nothing radical or new," as uninsured depositors have been paid out in full in every bank failure except for IndyMac in 2008.

The original story follows below:

Silicon Valley Bank failed on Friday after a massive run on deposits, putting almost $175 billion, including money from some of the biggest tech companies, under the control of the FDIC (Federal Deposit Insurance Corporation). The bank had been a significant venture capital funding source for technology companies, the New York Times reports.

The institution is exploring a potential sale as it halts all share trading. The FDIC will hold the Silicon Valley Bank's deposits and assets at the recently built National Bank of Santa Clara, which should be operational by Monday. Silicon Valley Bank-issued checks will still clear.

However, the bank's insurance policy only covers deposits under $250,000. Accounts over that amount will eventually receive certificates to be partially paid back for their uninsured money. Less than three percent of Silicon Valley Bank's deposits were insured since it dealt with many Big Tech firms.

Silicon Valley Bank had used its bountiful capital from venture funds to invest in bonds, which produced reliable returns due to low-interest rates. Between 2018 and 2021, the bank's deposits grew from $49 billion to $189.2 billion. However, last year's federal interest rate hikes upended the strategy.

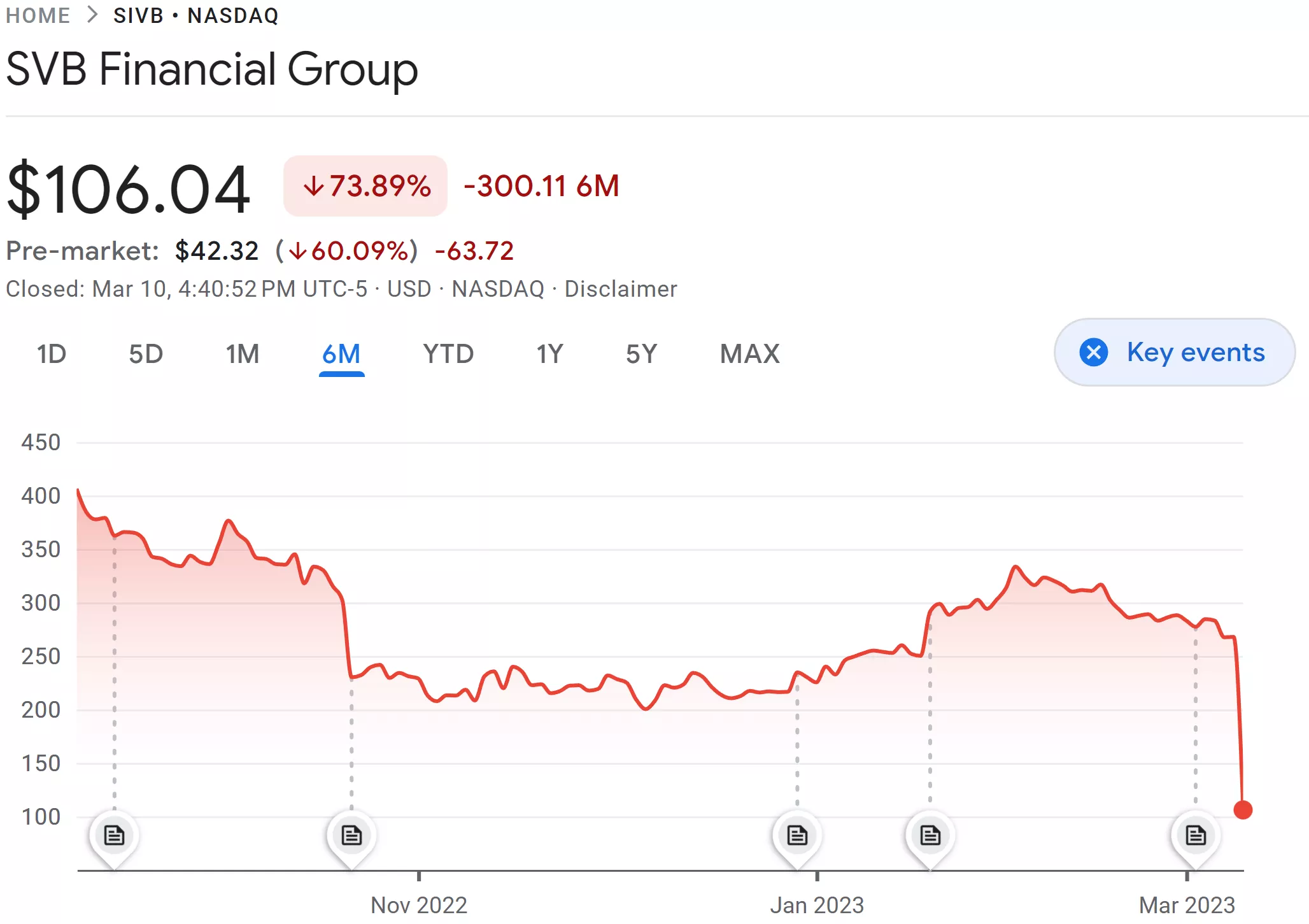

The bank responded with some cautionary measures this week, but the announcements of those moves started a panic. Silicon Valley Bank sold some securities at a loss, selling $21 billion in investments, borrowing $15 billion, and raising cash through an emergency stock sale. The poor reception to these decisions triggered a bank run as its stock price plummeted.

The fallout caused Signature Bank and Western Alliance to end Friday more than 20 percent down. PacWest Bancorp dropped by over 35 percent. Other large banks, however, like JPMorgan and Wells Fargo, are fine, ending slightly up on Friday. Bank of America and Morgan Stanley suffered minor declines.

The fall of Silicon Valley Bank is the biggest US bank failure since the collapse of Washington Mutual in 2008 – the largest in American history – which affected $300 billion in customer deposits.

https://www.techspot.com/news/97897-silicon-valley-bank-collapses-biggest-american-bank-failure.html