Editor's take: As shown off during AMD's industry analyst day last week, the company has a solid product portfolio, but investors hoped to see more progress on AI. AMD makes the case that customers want an alternative to Nvidia, but Nvidia has 11 billion counter-arguments to that. AMD came in force with updates to its laptop CPUs, its server CPUs and a formidable new GPU tailored for AI, and yet its stock fell 5% on the news.

Most likely, this decline in stock value can be attributed to the phenomenon of "Buy the rumor, sell the news," as many of their product announcements had already been foreshadowed elsewhere. No one we spoke to seemed to have any issues with the performance of the new products, which all appear to be well-positioned against the competition. Some financial analysts expressed disappointment that the newest product, especially the AI accelerator, did not come with customer announcements. However, we believe that expecting large volume customer announcements for a product that has not begun major sampling is a bit premature. Besides, executives from Microsoft, AWS, and Facebook gave glowing reviews of other AMD products on stage – isn't that hint enough?

Editor's Note:

Guest author Jonathan Goldberg is the founder of D2D Advisory, a multi-functional consulting firm. Jonathan has developed growth strategies and alliances for companies in the mobile, networking, gaming, and software industries.

AMD's prospects are squeezed between its two major competitors – Intel and Nvidia. They have great products, but even those are bound by the laws of physics, meaning there's no silver bullet to drastically change the market position. Their products currently have some competitive advantages, but competitors will eventually launch new products, keeping the industry's wheel turning.

On one hand, Intel retains a strong incumbent position in both the server and client CPU markets. AMD's products have clear performance advantages here, which are enough to further erode Intel's market share but not completely oust them. Intel still exerts considerable channel control in the PC market, that plus a healthy dose of price cuts allow them to tread water in the segment for now. On the data center side, Intel's share loss is more noticeable and painful. But data center customers make purchase decisions based on Total Cost of Ownership models, so even if the performance side slips, the cost-effectiveness can work in their favor. Many investors we speak with remain skeptical about AMD's potential market share in the data center industry. While there's room for growth, it's not infinite.

Also read: The Rise, Fall and Renaissance of AMD

And naturally, the primary focus of attention is on AI and Nvidia. AMD claims that customers are irritated by Nvidia's increasing stronghold in this market niche. This is a plausible argument, but Nvidia has 11 billion reasons to disagree this quarter, leaving it unclear when or if customers will voice their frustration with actual orders.

That being said, we think there is a real opportunity for AMD in data center AI. The training market is lost to them for the foreseeable future, they barely mentioned the topic during their presentation, a sensible omission. On the other hand, the market for data center inference is going to be much larger. All those generative AI models are currently hampered by the cost of user queries, a bottleneck for which AMD now has a solid solution.

The question remains will customers take advantage of their offering, and the answer is unclear. There is no doubt that customers would like to explore alternatives to Nvidia, given its limited supply and rising costs. Set against this are two factors. Countering this are two factors. First, customer inertia - the hyperscalers prefer a limited number of vendors, and sticking with Nvidia is often the path of least organizational resistance. (As the saying goes, no one gets fired for buying Nvidia, though CFOs may have different thoughts on the matter.)

The second factor is Nvidia's CUDA software, which simplifies the optimization of Nvidia GPUs, an essential feature at AI scale. We got into a fairly deep debate with AMD executives on this subject. They convincingly argued that CUDA is not the ultimate authority in AI software, pointing to their partnerships with both PyTorch and Hugging Face, two pivotal AI software projects. Despite this, CUDA still has its merits. In a market where software requirements are rapidly evolving, a known solution is an easy default fallback. While CUDA may not be a permanent competitive moat for Nvidia, there are few practical signs of that on the ground.

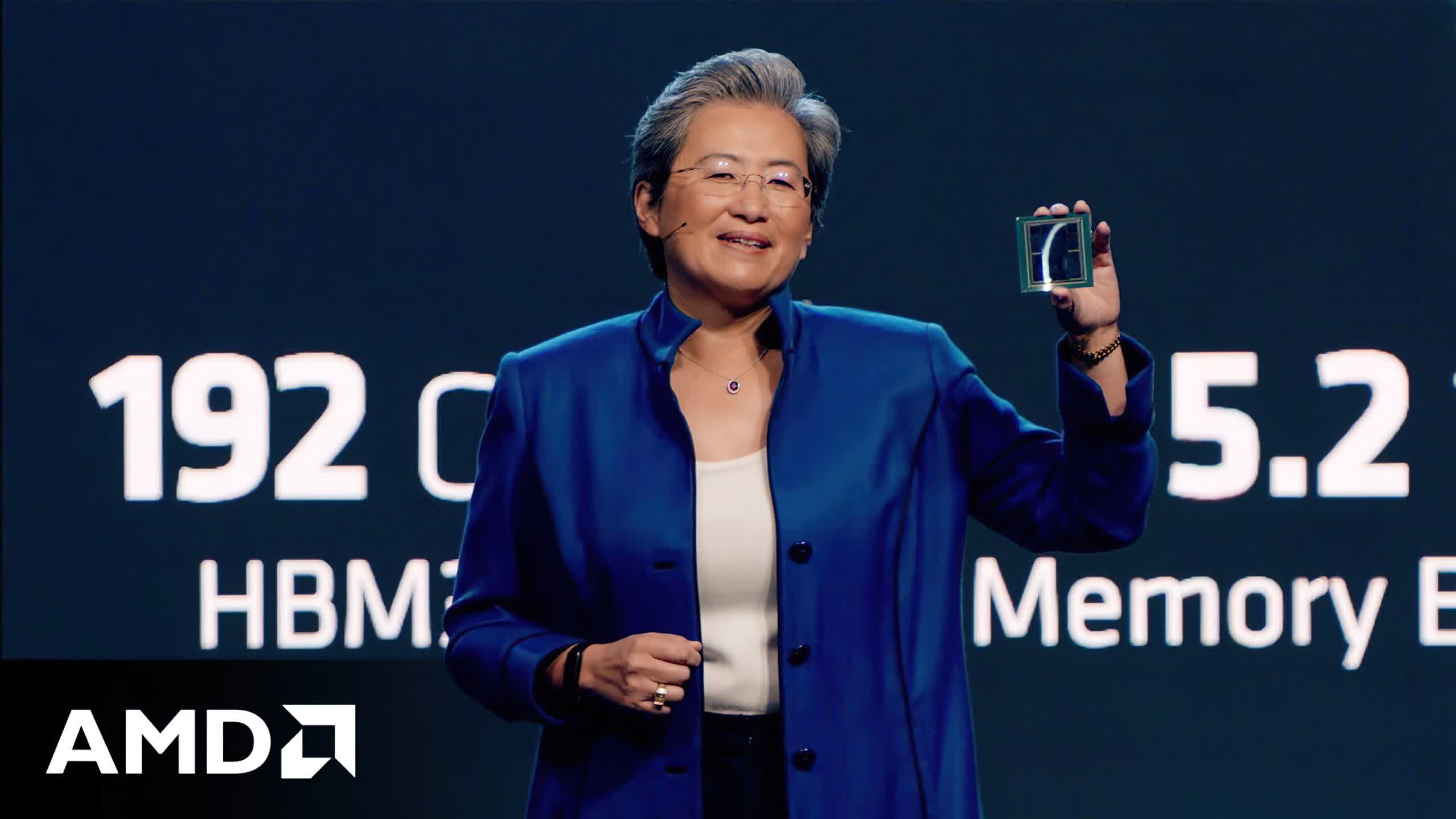

Despite all this, AMD looks well positioned. We can debate the right share price, but strictly from a business perspective, they continue to execute incredibly well. Their CEO, Lisa Su, is one of the best in the industry, and their product line-up reflects this. Thus, the ongoing debate about AMD's stock revolves around how much more market share they can acquire and how much of this emergent AI market they can capture. Overall, they are in a strong position, and the deciding factor will be how much further they can progress.