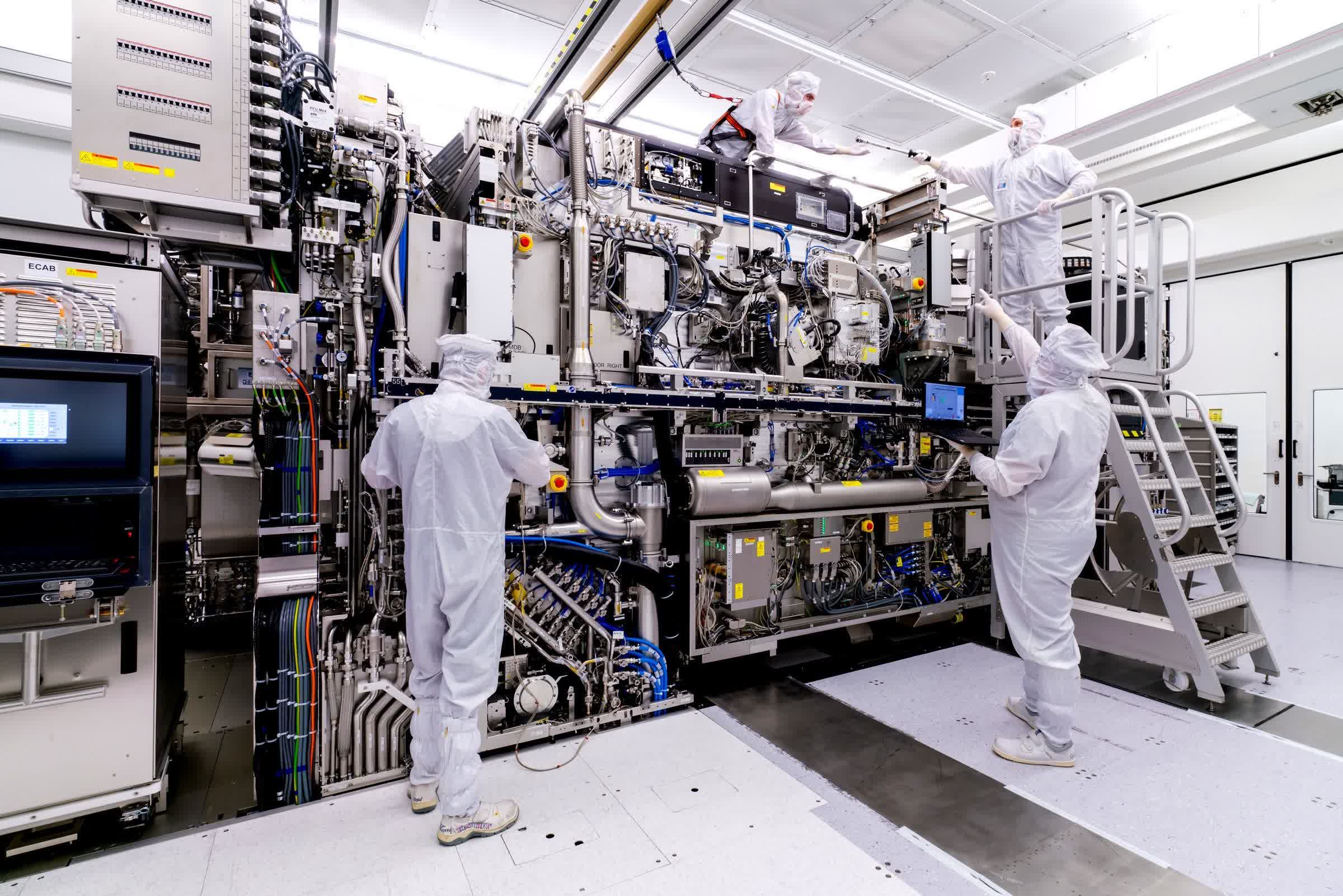

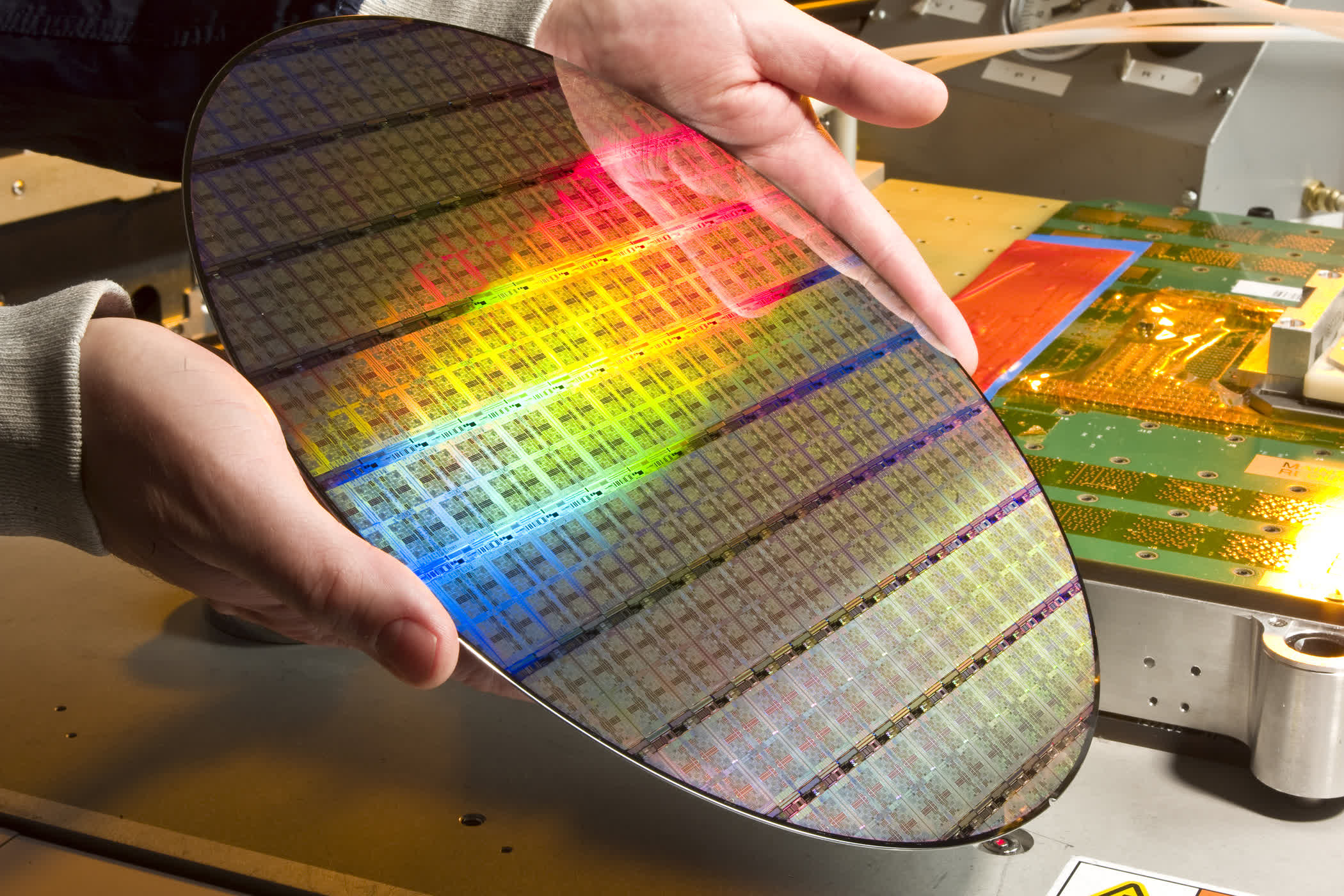

In context: Holding company ASML specializes in manufacturing and supplying advanced chipmaking tools to the world's biggest foundries. The Dutch company is Europe's highest-valued tech venture and the world's only supplier of extreme ultraviolet lithography (EUV) machines.

The fourth quarter and full-year 2023 financial results for ASML show remarkable growth for its photolithography machine venture despite the fickle semiconductor industry. The company forecasts that customers are still recovering, but utilization of litho tools is beginning to show improvement.

The company's net sales in Q4 2023 were €7.2 billion, with a gross margin of 51.4 percent and a net income of €2.0 billion. Quarterly net bookings were €9.2 billion, with €5.6 billion in sales for EUV chipmaking machines. For the entire year, ASML achieved 30 percent growth with total net sales of €27.6 billion, a gross margin of 51.3 percent, and an order backlog of €39 billion.

Chief Executive Peter Wennink stated that the semiconductor industry continues to struggle as it works through the "bottom of the cycle." Its customers are still uncertain regarding market recovery in 2024. Positive signs include deflating inventory levels and a "strong order intake" in the fourth quarter, clearly showing solid future demand.

The supplier is betting on the growing interest in its most advanced EUV machines. The first recently shipped to an Intel fab. Extreme ultraviolet lithography tools are more expensive and will likely help ASML achieve stellar growth in 2025. This year, CFO Roger Dassen said, ASML might be impacted by the new export restrictions to China imposed by the US and Dutch authorities.

Dassen noted that ASML does not expect to get new export licenses for 2024, meaning China will not have access to "advanced immersion" tools such as NXT:2000i. Dassen estimates the financial impact will be 10 to 15 percent on the overall sales to China.

Wennink expects 2024 revenues to be similar to 2023. It will be a transitional year in preparation for future growth, with more robust results in 2025 as many fab ventures are opening and becoming operational away from Beijing's direct influence.