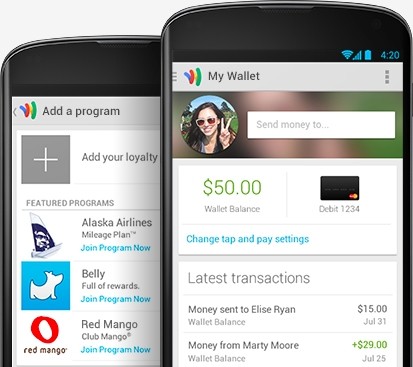

Google Wallet and other mobile payment platforms like PayPal and Venmo make it incredibly easy to send or receive money from one person or entity to another. While most of us don't use these services to actually store funds, the fact of the matter is that there's a ton of money tied up in these platforms at any given moment.

Because these money transfer services aren't considered banking institutions, they aren't required to be federally insured. What that means is that in the unlikely event of them shutting down or filing for bankruptcy, your money goes down with the ship and you become a creditor.

Fortunately, that's no longer the case with Google Wallet as the search giant is now holding Wallet balances in multiple banking institutions that are insured by the Federal Deposit Insurance Corporation (FDIC) which provides up to $250,000 of insurance per account.

That's great news for Google Wallet users, but what about PayPal and Venmo users? Spokespeople for the two companies told Yahoo Finance that they don't reveal how unused funds are stored. We do know, however, that neither are FDIC insured.

Furthermore, if the money you are sending or receiving is tied to a bank or credit card account, you should be good. PayPal also offers protection against fraudulent account activity, another plus.

With any luck, Google's move will spur others in the industry to step their game up and offer FDIC insurance.