Global PC shipments may be down for the eighth consecutive quarter, but Microsoft's revenues are still moving in the right direction, thanks to the popularity of its cloud, Office, and Surface businesses. The company posted earnings for its first fiscal quarter of 2017 yesterday, showing results that beat many analysts' expectations.

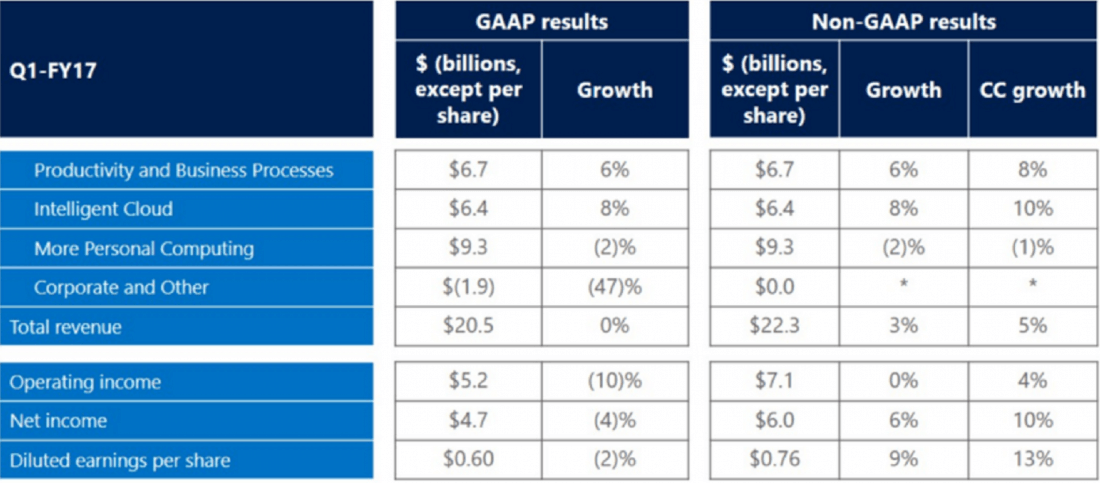

Microsoft reported revenue of $20.5 billion and net income of $4.75 billion, or 60 cents a share. Non-GAAP results were 76 cents a share on revenue of $22.3 billion for the first quarter, exceeding Wall Street estimates of 68 cents a share on adjusted revenue of $21.71 billion.

Revenue from Surface products reached $926 million during the last quarter, up from $672 million a year ago, with the Surface Pro 4 and Surface Book selling particularly well. Microsoft will no doubt be pleased with the line's 38 percent YoY increase, but the Surface sector still has some way to go before it matches Apple's iPad business, which brought in $4.9 billion in revenue last quarter. So expect the Windows maker to continue its series of iPad-mocking ads.

Again, the intelligent cloud area was a big earner for Microsoft. The section, which includes Windows Server and Azure, grew 8.3 percent overall to $6.4 billion, with Azure revenue increasing 116 percent from the same time last year.

Strong Office and Office 365 sales helped the company's productivity and business process segment grow 6 percent to $6.7 billion.

It wasn't all good news from Microsoft; unsurprisingly, revenue from its phone business declined 72 percent, while price cuts and declining Xbox sales saw its revenue drop 5 percent. Windows OEM Pro and non-Pro revenue remained flat.

However, the overall personal computing section, which covers all Windows licensing and devices, was down just 2 percent to $9.3 billion - better than expected, considering the continuing decline in commercial PC sales.

We'll find out in the next quarter what effect the LinkedIn acquisition and rumored all-in-one surface device has on Microsoft's finances.

The positive report saw the company's share price jump 6.1 percent to $60.73, adding more than $27 billion to its market value. It's the first time the shares have passed the $60 mark since December 1999.