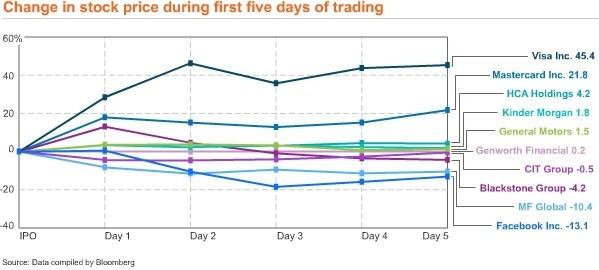

Facebook’s introduction on the Nasdaq certainly hasn’t lived up to the hype leading up to last Friday and the current forecast isn’t looking much better. The stock is down 16 percent from its IPO price, prompting Bloomberg to declare it the worst large IPO in the past decade based on the first five days of trading.

In an interview on Bloomberg TV, markets reporter Sheila Dharmarajan compared Facebook to four other poorly performing IPOs: Blackstone Group, General Motors, Mastercard and MF Global, the latter of which filed the eighth largest bankruptcy in US history last year. This comparison, she says, really shows the magnitude of the flop for Facebook’s IPO.

Some would argue that the decline started even before shares were made available as lead underwriter Morgan Stanley urged Facebook to increase the number of shares being offered by 25 percent. The introductory price was also raised ahead of the big day.

But the trouble didn’t stop there as Morgan Stanley allegedly cut their estimates for the stock mid-road show. News of this extremely rare move supposedly only tricked down to high-level investors, leaving Joe Trader in the dark.

On opening day, issues with the Nasdaq software delayed the IPO for nearly 30 minutes and additionally meant that many brokers were unable to get confirmation on whether their clients’ orders were actually processed.

It’s anybody’s guess as to what the future holds for Facebook on the stock exchange. Do you think Facebook will recover over the coming weeks / months or are they ultimately headed for more doom and gloom?