In context: This past year saw a notable decline in the PC market due to sinking demand, which dragged many tech giants' financials downward. AMD was no exception, reporting falling revenue for the year despite a buoyant final quarter. Gaming was a sore spot, but the company's year-end report omits a crucial detail regarding Radeon sales.

AMD posted its 2023 financial results this week. Although the company did notably better in the last quarter of the year compared to 2022, it couldn't escape the overall market decline throughout 2023. Team Red's revenue and gross profit were down 4 and 7 percent, respectively. Gaming was a significant factor. It was the only segment where AMD reported a quarterly and annual decline. Fourth quarter revenue fell 17 percent year-over-year and 9 percent compared to Q4 2022. Revenue in that segment for 2023 also decreased by 9 percent.

The primary reason is a decline in semi-custom sales, primarily referring to the custom AMD chips used in Xbox and PlayStation consoles. Sony hasn't released year-end sales numbers for the PlayStation 5 yet. However, the company increased its forecast last August. It also surpassed 50 million in lifetime sales just before the end of the year, putting it on track to catch up with the PlayStation 4.

Meanwhile, Microsoft has only sold around one-third as many Xbox Series consoles.

AMD CEO Lisa Su pinned the gaming revenue decline on a maturing console cycle entering its fifth year, where supply is catching up with demand. Notably, the company said quarterly and annual growth in Radeon PC graphics card sales mostly offset the semi-custom dip without revealing how much.

Su noted robust demand for Radeon RX 6000 and 7000 GPUs in 2023 but didn't say how strong. The growth in dedicated PC graphics shipments last year might have been minor.

The PC market slump also dragged the company's client-sector revenue for 2023 down 25 percent. However, an uplift in Ryzen 7000 CPU sales pushed Q4 revenue up 62 percent year-over-year.

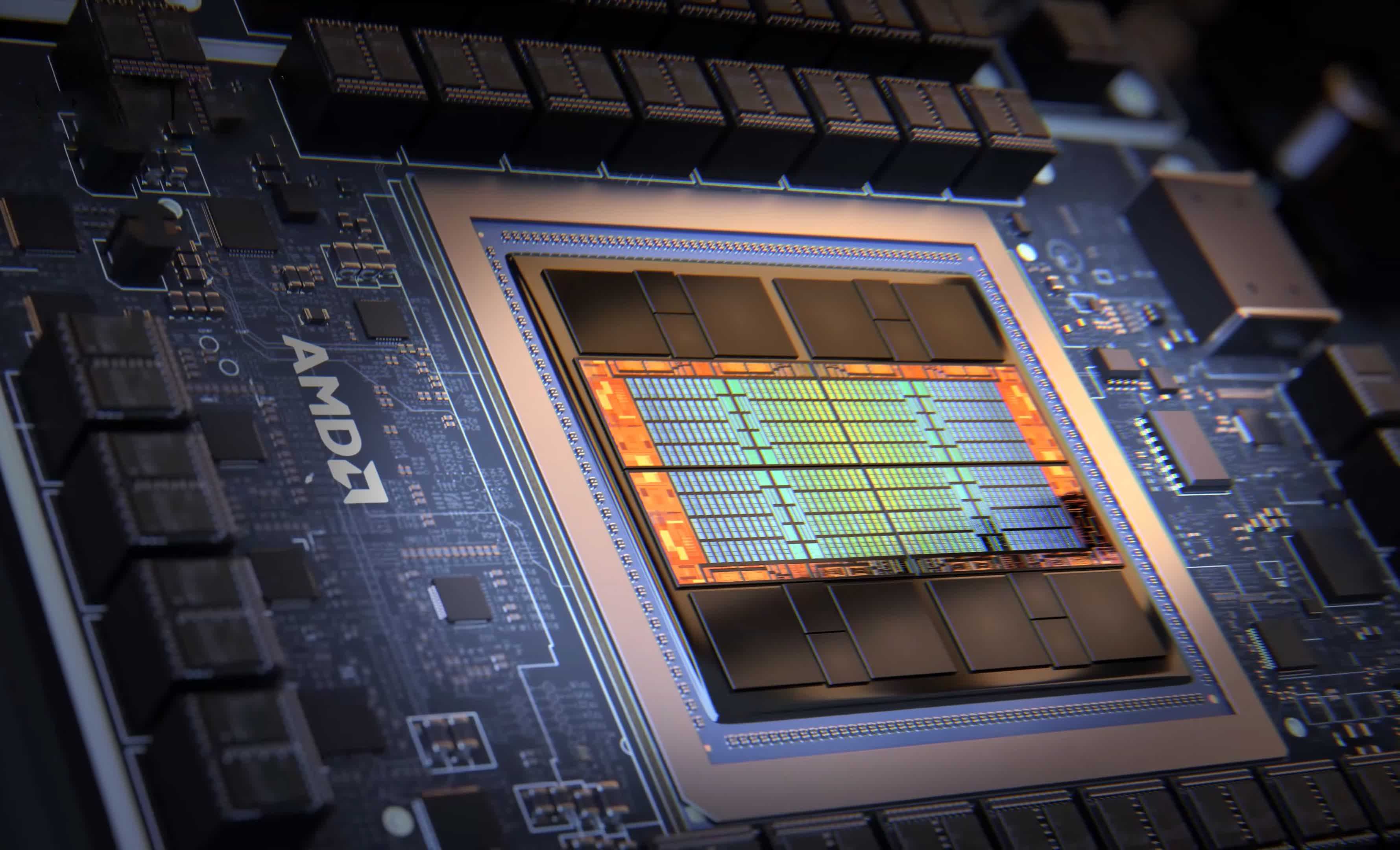

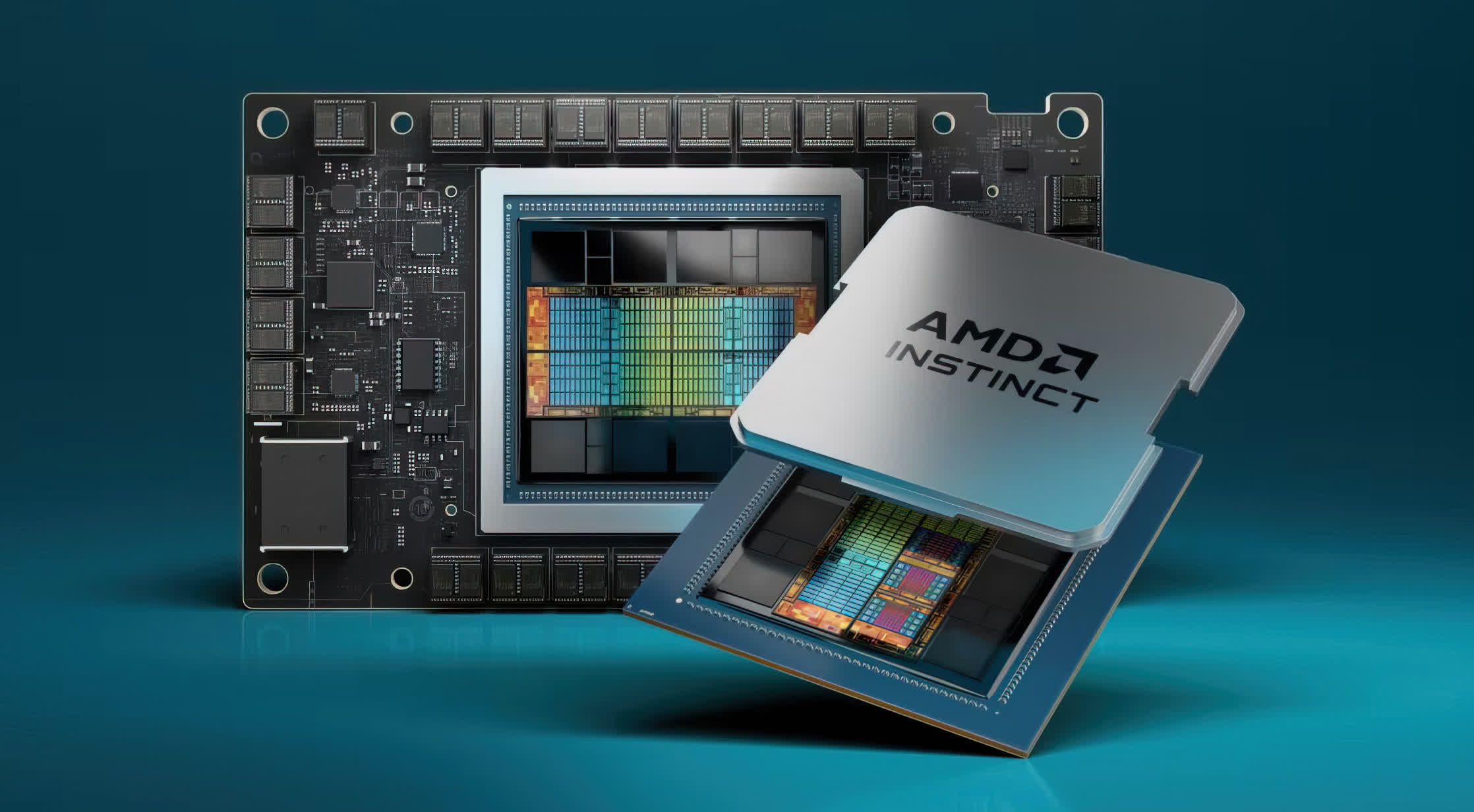

The data center segment was also positive for AMD. Growth in Epyc and Instinct chip sales increased last quarter's revenue by double digits, with 2023 revenue ticking upward slightly.

Analysts expect the PC sector to recover in 2024, which might boost AMD's 2024 financials. Demand for AI hardware helped the company's stock price this month. Significant product launches, expected later this year, could drive it further. AMD should see the launch of a line of Ryzen 9000 CPUs this year. Additionally, RDNA 4 graphics cards are on the potential horizon. Rumors of an upgraded PlayStation 5 console in 2024 also add to AMD's potential.

https://www.techspot.com/news/101717-amd-stays-vague-gaming-performance-amid-downward-2023.html