What just happened? Nvidia’s $40 billion acquisition of Arm has collapsed. The US tech giant has announced that the intense regulatory scrutiny the deal faced prevented the transaction from completing. As previously speculated, Arm will now start preparations for an initial public offering (IPO).

There were reports that Nvidia was considering walking away from the acquisition last month. Now, the company has confirmed that "the parties agreed to terminate the Agreement" due to the "significant regulatory challenges" it faced.

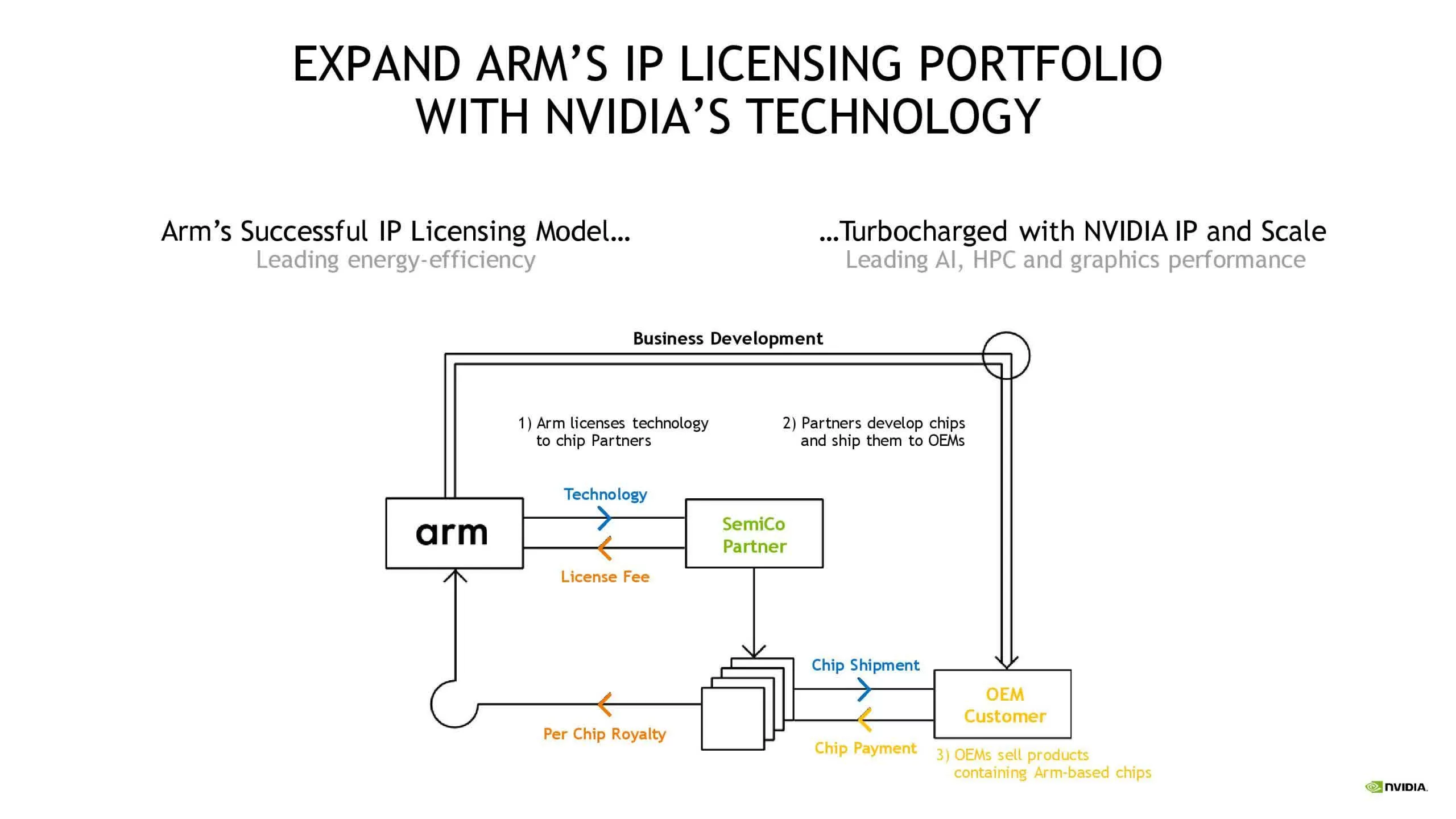

"Arm has a bright future, and we’ll continue to support them as a proud licensee for decades to come," said Nvidia CEO Jensen Huang. "Arm is at the center of the important dynamics in computing. Though we won’t be one company, we will partner closely with Arm. The significant investments that Masa has made have positioned Arm to expand the reach of the Arm CPU beyond client computing to supercomputing, cloud, AI and robotics. I expect Arm to be the most important CPU architecture of the next decade."

News that Nvidia had begun the first steps in acquiring UK-based Arm from SoftBank arrived back in September 2020. Team green said it would take around 18 months to complete a deal of this size, but it has been beset by problems, mostly due to the regulatory approval required from the UK, China, the European Union, and the United States.

In addition to an investigation by the UK’s Competition and Markets Authority’s (CMA) and intervention from the country’s government, the FTC sued to block the acquisition over fears it would stifle innovation, there was an extended EU antitrust investigation, and China threatened to block the purchase even if others didn’t.

There was also significant pushback from those within the tech industry. Qualcomm, Google, and Microsoft all voiced concerns, even Arm’s co-founder, Hermann Hauser, said the deal would be a disaster.

Arm will now start preparations for an IPO within the fiscal year (ending March 31, 2023), a move many believed would happen if the deal fell through. SoftBank will receive a $1.25 billion breakup fee that Nvidia previously agreed to pay if the purchase failed to complete.

The Financial Times writes that the deal’s failure will result in Arm’s chief executive, Simon Segars, being replaced by Rene Haas, head of the company’s intellectual property unit. The publication also notes that the cash-and-shares acquisition would have been worth $66 billion as Nvidia’s share price has increased since the initial announcement.

The tech industry will doubtlessly breathe a sigh of relief following confirmation of the deal’s demise. Many Arm licensees feared the consequences of a competitor such as Nvidia owning the company they rely on for their chip designs.

https://www.techspot.com/news/93309-nvidia-confirms-40-billion-acquisition-arm-has-terminated.html