In brief: Ten of the top 25 semiconductor vendors posted double-digit revenue declines last year. According to preliminary data from Gartner, worldwide semiconductor revenue totaled $533 billion in 2023. That's down 11.1 percent year over year, but it was even worse for memory segments.

Global DRAM revenue fell by 38.5 percent to $48.4 billion, and NAND flash wasn't far behind with a year-over-year decline of 37.5 percent to $36.2 billion. Joe Unsworth, VP analyst at Gartner, said weaker than expected demand and excess inventory for smartphones, PCs, and servers, especially in the first half of the year, largely contributed to the declines.

There were a few sunny spots in an otherwise overcast year.

Intel reclaimed the number one overall spot after two years in second place, besting rival Samsung with $48.67 billion in revenue. Still, it's down 16.7 percent from the $58.44 billion the company earned in 2022. Samsung finished in second place with $39.91 billion and a 7.5 percent market share, a drop of 37.5 percent compared to the $63.82 billion generated in 2022.

| 2023 Rank | 2022 Rank | Vendor | 2023 Revenue | 2023 Market Share % | 2022 Revenue | Growth % |

|---|---|---|---|---|---|---|

| 1 | 2 | Intel | 48.664 | 9.1 | 58.436 | -16.7 |

| 2 | 1 | Samsung | 39.905 | 7.5 | 63.823 | -37.5 |

| 3 | 3 | Qualcomm | 29.015 | 5.4 | 34.780 | -16.6 |

| 4 | 6 | Broadcom | 25.585 | 4.8 | 23.868 | 7.2 |

| 5 | 12 | Nvidia | 23.983 | 4.5 | 15.331 | 56.4 |

| 6 | 4 | SK Hynix | 22.756 | 4.3 | 33.505 | -32.1 |

| 7 | 7 | AMD | 22.305 | 4.2 | 23.620 | -5.6 |

| 8 | 11 | STMicroelectronics | 17.057 | 3.2 | 15.842 | 7.7 |

| 9 | 9 | Apple | 17.050 | 3.2 | 18.099 | -5.8 |

| 10 | 8 | Texas Instruments | 16.537 | 3.1 | 18.844 | -12.2 |

| Others | 268.853 | 50.7 | 294.729 | -8.8 | ||

| Total Market | 533.025 | 100.0 | 599.562 | -11.1 |

The biggest winner in the top five was without a doubt Nvidia. The GPU maker climbed seven spots from 2022 to finish last year with $23.98 billion in revenue, up 56.4 percent. It's the highest position Nvidia has ever held, and is largely due to recent success in the artificial intelligence market.

STMicroelectronics also had an impressive showing in 2023, improving from just outside the top 10 at number 11 to finish in eighth place. The Swiss-based tech company accounted for 3.2 percent of the market on $17.06 billion in revenue, an increase of 7.7 percent over 2022.

Broadcom, which placed fourth with $25.89 billion in revenue, also saw positive growth of 7.2 percent year on year. Others in the top 10 including Qualcomm, AMD, and Apple held the same position they did a year earlier.

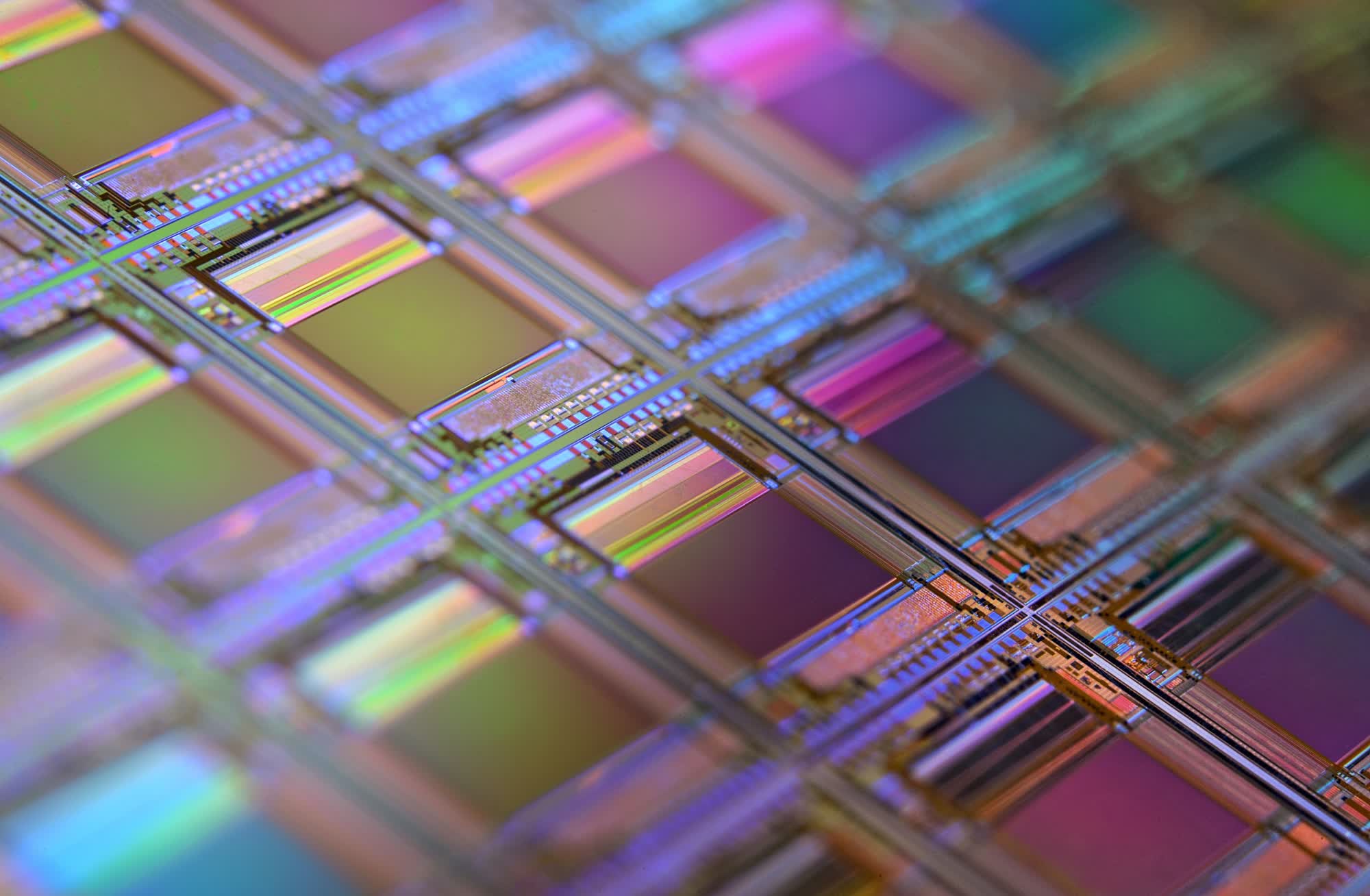

Image credit: Laura Ockel

https://www.techspot.com/news/101552-nvidia-surges-while-samsung-slides-gartner-highlights-2023.html