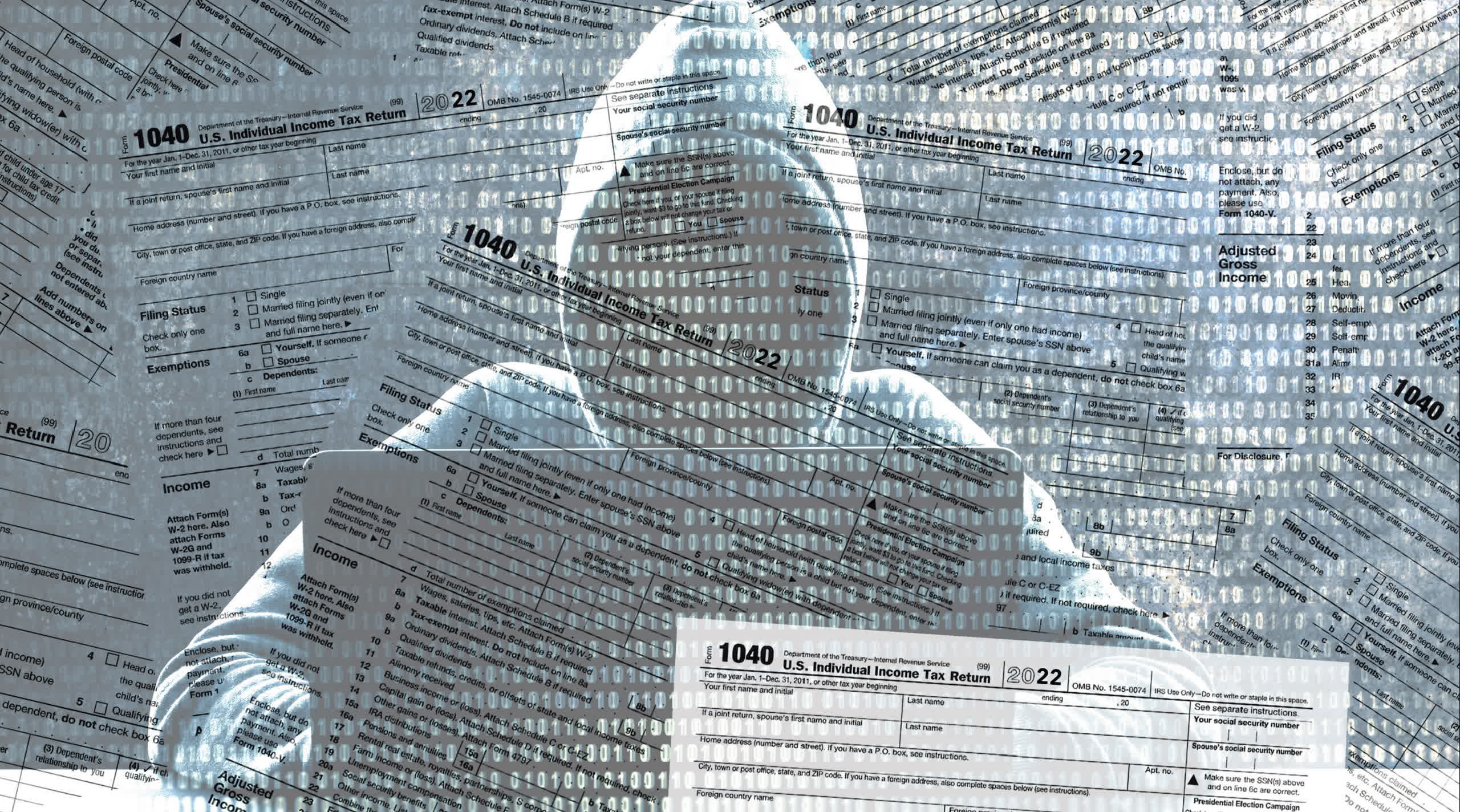

Facepalm: US lawmakers are accusing tax companies, Google, and Meta of abusing taxpayers' data through the use of invisible tracking technology. The companies have shared highly sensitive information for years, an act that appears to necessitate direct intervention by federal agencies and the US government itself.

Seven US Democratic lawmakers led by Elizabeth Warren recently unveiled the results of a seven-month-long investigation into the data sharing practices of tax preparation companies. The six Senators (plus Representative Katie Porter) released a 54-page report, which highlights what the politicians perceive as an "outrageous, extensive, and potentially illegal sharing" of taxpayers' sensitive personal and financial information with Big Tech corporations.

The report describes how tax preparation companies TaxAct, TaxSlayer, and H&R Block confirmed that they used tracking pixel technology, now known as a "Web beacon," provided by Meta (Meta pixel) for "at least" a few years. These companies have also used Google Analytics (GA) tracking technology for an even longer period.

According to the report, these tax preparation companies have shared the data of millions of US taxpayers with Facebook and Google, providing two of the world's leading advertising corporations with "extraordinarily sensitive" personal and financial information. Meta, Google and the tax companies claimed that data sharing was an anonymous process, yet experts have revealed that such data could be used to "easily" identify individuals or to create "dossiers" useful for targeted advertising and other purposes.

The lawmakers suggest that these companies were indeed "reckless" with their data sharing practices, likely installing tracking tools on their websites without fully understanding their implications. Those corporations may have "violated taxpayer privacy laws by sharing taxpayer data with Big Tech firms," the report states, and they need to be fully investigated by "relevant enforcement entities" including the IRS, the Treasury Inspector General for Tax Administration (TIGTA), the Federal Trade Commission (FTC), and even the Department of Justice (DOJ).

"Spy pixels" – or web beacons – are an advertising-focused technology which has been used since the late 1990s, when privacy experts first discovered the stealthy profiling programs employed by websites and internet companies. The technology is still popular today, even though users have now more tools designed to counteract invisible tracking and invasive advertising.

As for the charges brought by the newly published report, a Meta spokesman stated that the company's policies on advertising are very clear and transmitting sensitive information about people is against the rules. Meta further remarked that its system is designed to filter out any "potentially sensitive data" that it can detect. Google also said that Google Analytics includes "strict policies and technical features" prohibiting customers from collecting profiling data.