What just happened? Apple made a huge number of announcements during its WWDC 2022 conference yesterday, many of them related to the latest version of its mobile operating system. One of iOS 16's new features is gaining a lot of attention: a Buy Now, Pay Later (BNPL) option for Apple Pay called Apple Pay Later.

BNPL plans have been gaining popularity recently, especially with inflation hitting a 40-year high and the increased cost of living—Elon Musk recently said he has a "super bad feeling" about the economy. PayPal, Block, Affirm, Klarna, and Mastercard are just some of the firms offering BNPL, and Apple is joining in with Apple Pay Later.

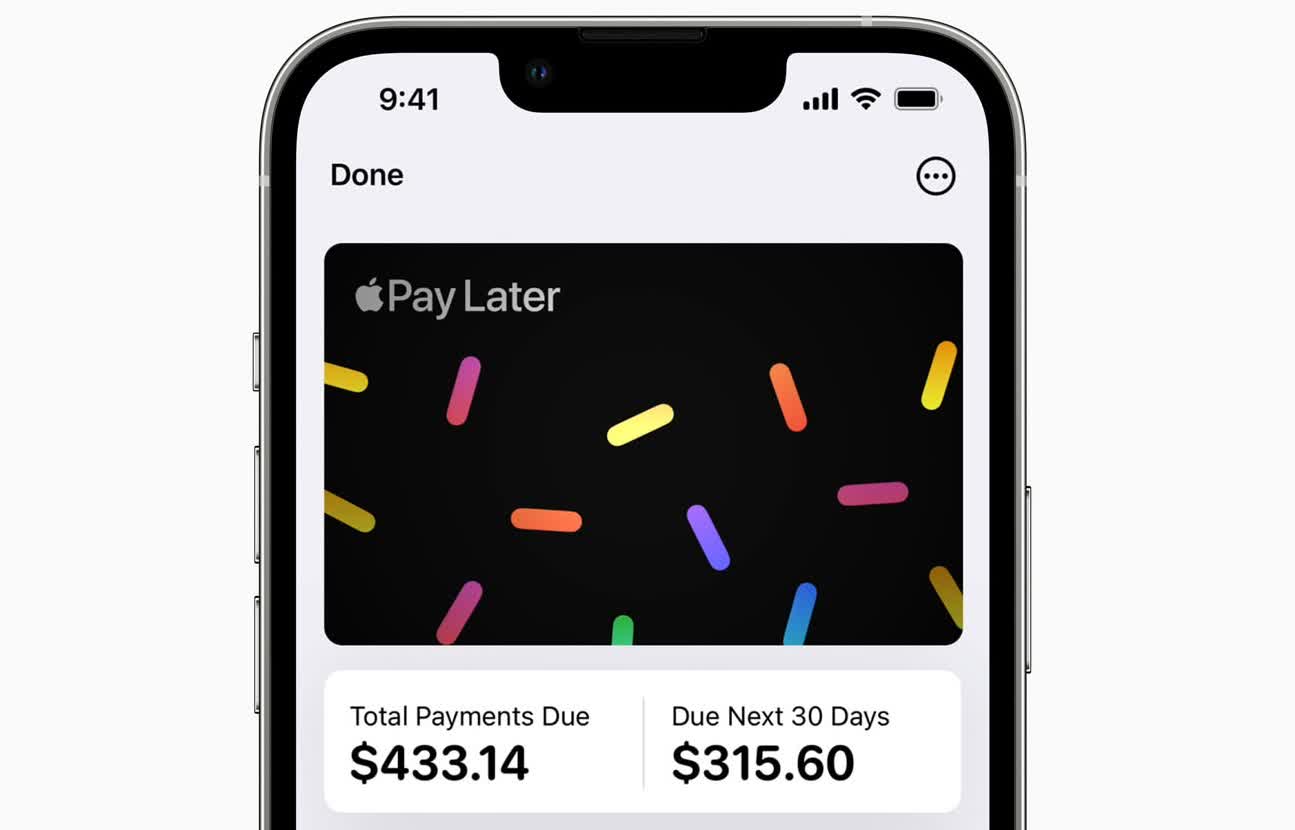

The iOS 16 version is more rigid than some of its competitors. Buying something with Apple Pay will bring up the option of paying for the item in four equal purchases across six weeks. The first payment is made upfront, with the remaining payments occurring every two weeks. There's no added interest or hidden fees when using Apple Pay Later.

Additionally, users will be able to view, track, and repay Apple Pay Later payments within the Apple Wallet. The feature is available everywhere Apple Pay is accepted online or in-app, using the Mastercard network.

Apple will do a soft credit check on those who apply for Apple Pay Later. Your credit score won't be affected by this but, as with other loan repayments, it will be negatively impacted if you miss any payments.

For all the benefits of interest-free, zero-fee BNPL plans, there's always the risk of people borrowing more than they can afford, missing payments, and landing themselves even further in debt. There was a lot of outrage at Microsoft last December after it integrated a Buy Now, Pay Later app called Zip in the Edge browser.

Another new Apple Wallet feature in iOS 16 is order tracking, which gives users detailed receipts and order tracking information for Apple Pay purchases with participating merchants.

The iOS 16 public beta begins in July, with general availability coming later this year.

https://www.techspot.com/news/94851-apple-joining-buy-now-pay-later-crowd-apple.html