Apple sadly lost their iconic co-founder and former CEO Steve Jobs after his long battle with cancer late last year, raising questions about whether the Cupertino-based tech giant could continue its success in his absence. Though it may be early for a definitive judgement on that, investors can put their worries to rest after seeing Apple's record first quarter results, which surpassed the $40 billion predictions by Wall Street insiders.

The figures (PDF) for the quarter ending December 31 speak for themselves; Apple sold a record 37 million iPhones and 15.4 million iPads. Their profits more than doubled at $13.06 billion, up from $6 billion during the same period in 2010, with sales up 73% on last year's figures ($26.74 billion) to an incredible $46.33 billion.

"We would attribute it to just a breath-taking customer reception of the iPhone 4S," CEO Tim Cook said in a statement. The iPhone accounted for 53% of Apple's sales during the first quarter period. He continued, "Apple's momentum is incredibly strong, and we have some amazing new products in the pipeline."

There is no question that a lot of the American firm's success is due to its phone and tablet lines, but their computers sold well too. Apple sold 5.2 million Macs during the quarter, up 26% on last year's 4.1 million.

They look forward to a healthy second quarter as well, with a projected revenue of $32.5 billion. In response to the news the company's shares jumped eight percent to $453.16 in trading yesterday. Apple also reported total sales of $127.8 billion for the 2011 calendar year.

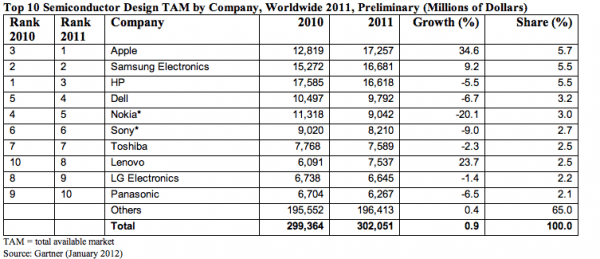

In related news, Gartner just published new figures for semiconductor components, with Apple now topping the list as the world's largest purchaser of semiconductors. Last year the firm was ranked third, behind Hewlett Packard and Samsung. The new figures mark a 34.6% growth in purchases during the last year.

"Those companies that gained share in the smartphone market, such as Apple, Samsung Electronics and HTC, increased their semiconductor demand, while those who lost market share in this segment, such as Nokia and LG Electronics, decreased their semiconductor demand," Yamaji said in a statement to Ars Technica. "Given the rapidly changing competitive structure of the IT and electronics industry, no semiconductor device vendor can afford just to monitor the requirements of the current market leaders."

Image credit: Forbes