Video games pioneer Atari has filed for bankruptcy in the US and plans to sell all its assets in the next three to four months. But the iconic firm is likely to live on. According to a report by the Los Angeles Times, the move is intended to break the American business free from its debt-laden French parent Atari SA. The latter took over Atari in 2008 and has seen its share price drop 50% over the past year.

An unnamed "knowledgeable person" says that the plan is to develop Atari's US operations into a business based on digital and mobile platforms. The company has increased its focus on iOS and Android as gaming platforms since 2010, developing games based on well-known properties, among them a successful "greatest hits" compilation of arcade titles and an updated version of Pong.

Under the current company structure, Atari Inc. relies on London financial company BlueBay Asset Management for cash, but a $28-million credit facility with them expired as 2012 closed, leaving Atari without the resources to release games currently in the works, including a real-money gambling title titled "Atari Casino."

The company is said to have locked down a debtor-in-possession investment of $5.25 million from Tenor Capital Management in order to continue its operations during the bankruptcy.

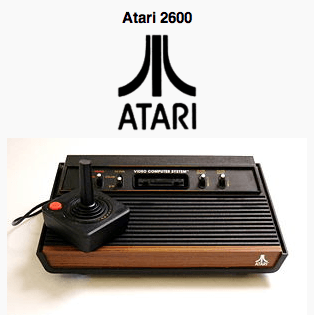

If Atari Inc.'s filing goes through, then the company will reportedly seek a private buyer, though with the company planning to sell defining franchises such as Pong and Asteroids and even its logo to raise cash, it's unclear who might step up to buy what's left of the 40 year-old video games legend.