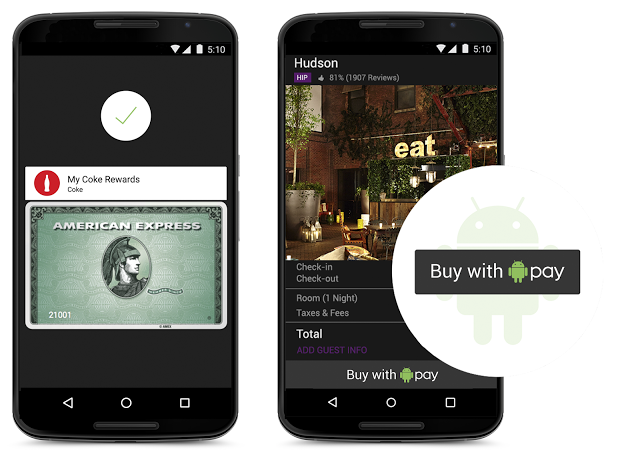

Google is taking another shot at mobile payments with the introduction of Android Pay today at its I/O developer conference. The service relies on NFC technology, much like its Wallet predecessor and its competitors, but apparently the process is more streamlined this time around with fingerprint recognition (if your phone supports it) and the use of "tokens" so your real card number is never shared with establishments – similar to Apple Pay.

The move to this new token system first championed by Apple means users must link their debit and credit cards directly to Android Pay and will no longer be able to keep a balance in an Android Pay account, like they did with Wallet. On the upside this method is generally viewed as more secure.

No new hardware is required to support Android Pay, so as long as your phone is running Android 4.4 "KitKat" or later with NFC built in you should be good.

Google says around 700,000 stores will support Android Pay at launch, including some big names like Best Buy, Gamestop, Macy's, Bloomingdale's, and McDonald's. The app will come pre-installed on Verizon, AT&T and T-Mobile phones and supports Visa, MasterCard, AmEx and Discover cards.

Android Pay is an open-platform API which means developers can integrate the service into their existing apps so you don't need to fill in payment information each time you make an online purchase. Some early partners that will support Android Pay via their apps include Lyft, Grubhub, Chipotle, and Uber.

Although Android Pay is meant to replace Google Wallet, the latter will stick around as a peer-to-peer app for sending cash around between friends, competing with services like Venom and Facebook's Messenger.