A hot potato: Intel CEO Pat Gelsinger's decision to turn the Santa Clara corporation into a chip manufacturing foundry and open it to orders from third-party companies hasn't impressed AMD. Team Red explains that it's the wrong choice which will ultimately bring Intel to its downfall.

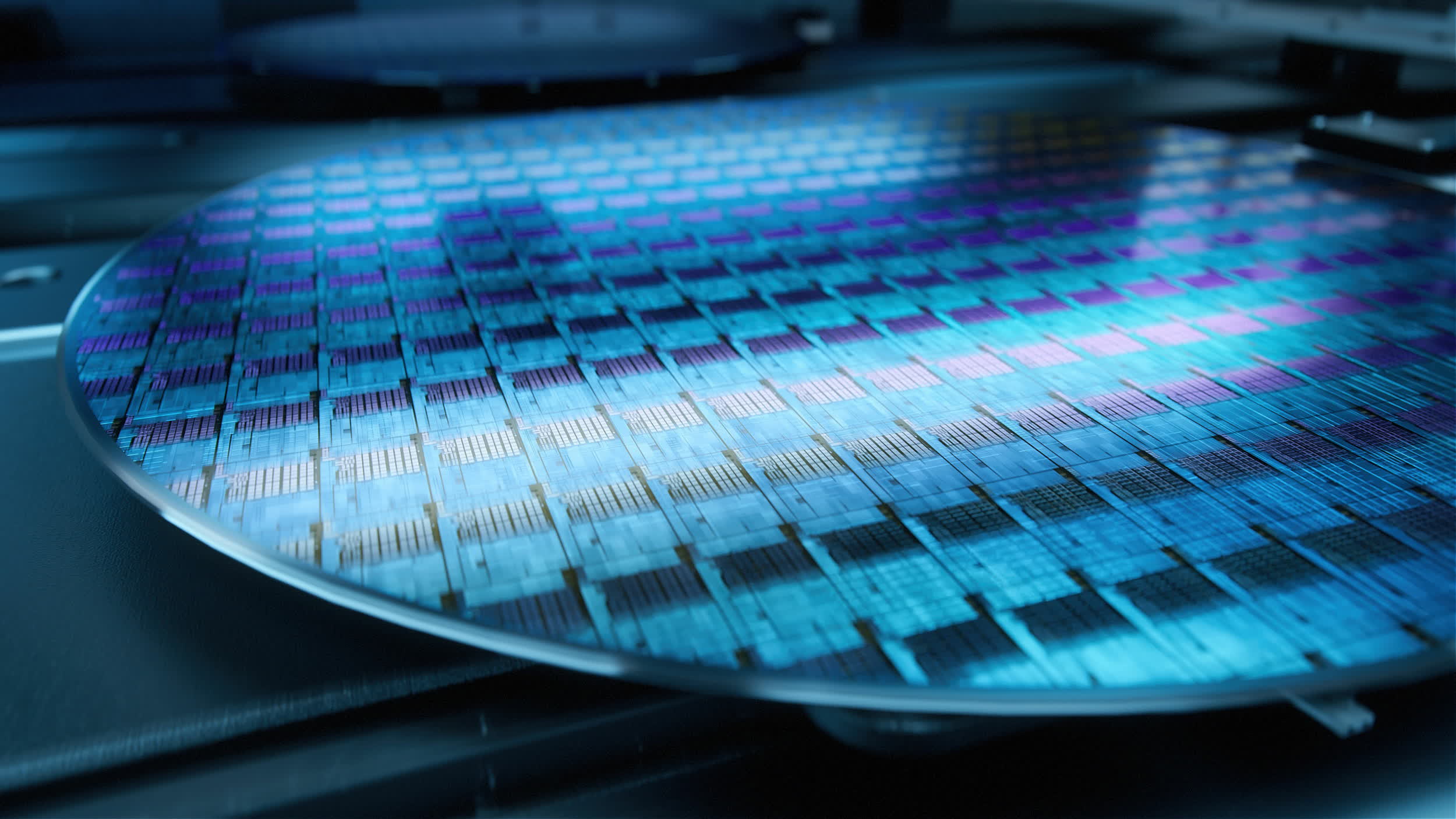

Intel's Foundry Services (IFS) offers "world-class wafer foundry" services to chip companies that don't have a manufacturing arm. Chipzilla is opening its advanced manufacturing sites, advanced packaging technology and development services even to competing companies, as its CEO Pat Gelsinger is trying to open new revenue sources in an increasingly competitive and shrinking PC market.

Will Intel succeed in this seismic shift in its traditional business structure? "Of course not," said Darren Grasby. An AMD VP for strategic partnerships and president of AMD EMEA, Grasby slammed Intel's decision during the Canalys EMEA Forum 2023, stating that the company's new path to revenue growth is the wrong one.

AMD made the opposite journey years ago, Grasby said, abandoning its own chip manufacturing fabs and choosing a totally "fabless" route. The x86 company was thus able to invest a lot more money into the roadmap of its processor designs, which is ultimately bringing AMD's "leading edge technology" and successful Ryzen products to the market today.

Intel has always been a chip manufacturing company, at least when it comes to its powerful x86 CPUs. Under Gelsinger's tenure, the corporation adopted a more open approach for newer product lines like Arc GPUs, which are made by Taiwanese foundry TSMC. Intel is also making significant investments in new production facilities for the IFS initiative, with new manufacturing plants being built in the US (Arizona, Ohio, New Mexico) and Europe (Germany).

Speaking about IFS, Gelsinger recently said that he and the company would receive a "passing grade" two and a half years into the journey. If the foundry initiative is successful, Gelsinger stated, Intel will have to "accept business" opportunities from its competitors as well, which means that "made by Intel" chips would bring in revenue from the likes of Nvidia, Arm and even AMD.

Market analysts recently speculated that Intel could soon split in two, with a R&D arm becoming customer of a newly created (and essentially independent) chip foundry business. According to IDC senior analyst Andy Buss, having more choices among chip foundries is "good" for the entire chip market. TSMC is running out of manufacturing space, and AMD must compete with the likes of Nvidia, Apple and other prominent technology corporations to make its chips.

https://www.techspot.com/news/100424-amd-executive-intel-foundry-services-destined-fail.html