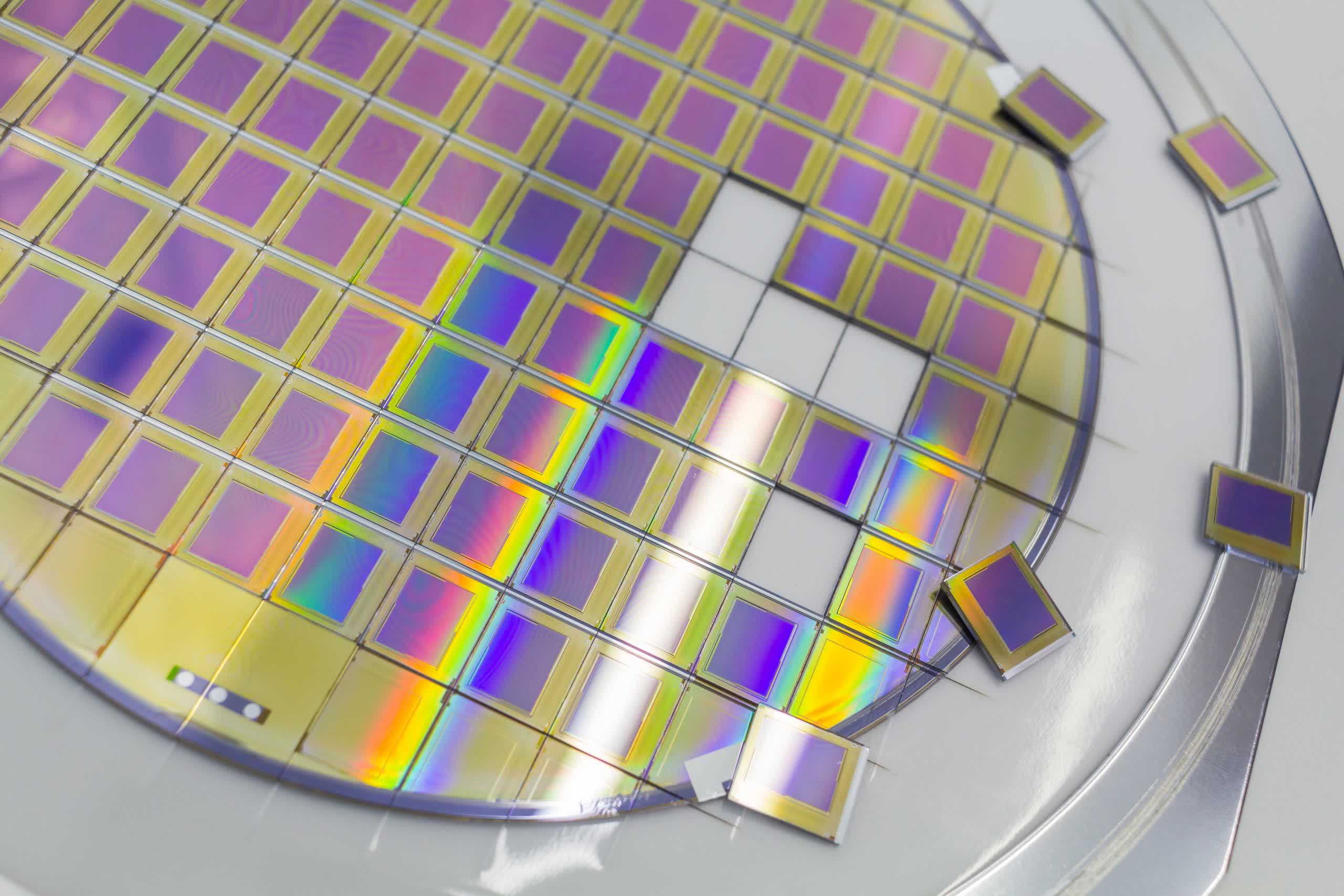

Rumor mill: Intel has been outsourcing its Arc GPU manufacturing to TSMC since 2022. According to recent speculations from a prominent investment bank, Intel might significantly increase its reliance on the Taiwanese foundry over the next few years.

Goldman Sachs analysts, quoted by the Taiwanese media outlet Commercial Times, suggest that Intel is likely to expand product outsourcing to TSMC in 2024 and 2025. The "total addressable market" for Intel's outsourcing orders is projected to be $18.6 billion in 2024 and $19.4 billion in 2025, the analysts stated. It's probable that TSMC will receive manufacturing orders from Intel amounting to $5.6 billion in the next year and $9.7 billion in 2025.

Goldman Sachs' assumptions seem to be based on the challenges Intel has faced with smaller and more advanced manufacturing processes since the 10-nanometer node. Moreover, the US chipmaker recently chose to establish a "foundry-like" relationship between its manufacturing groups and its internal product business units, as noted by the analysts.

Opinion: Is Intel turning a corner?

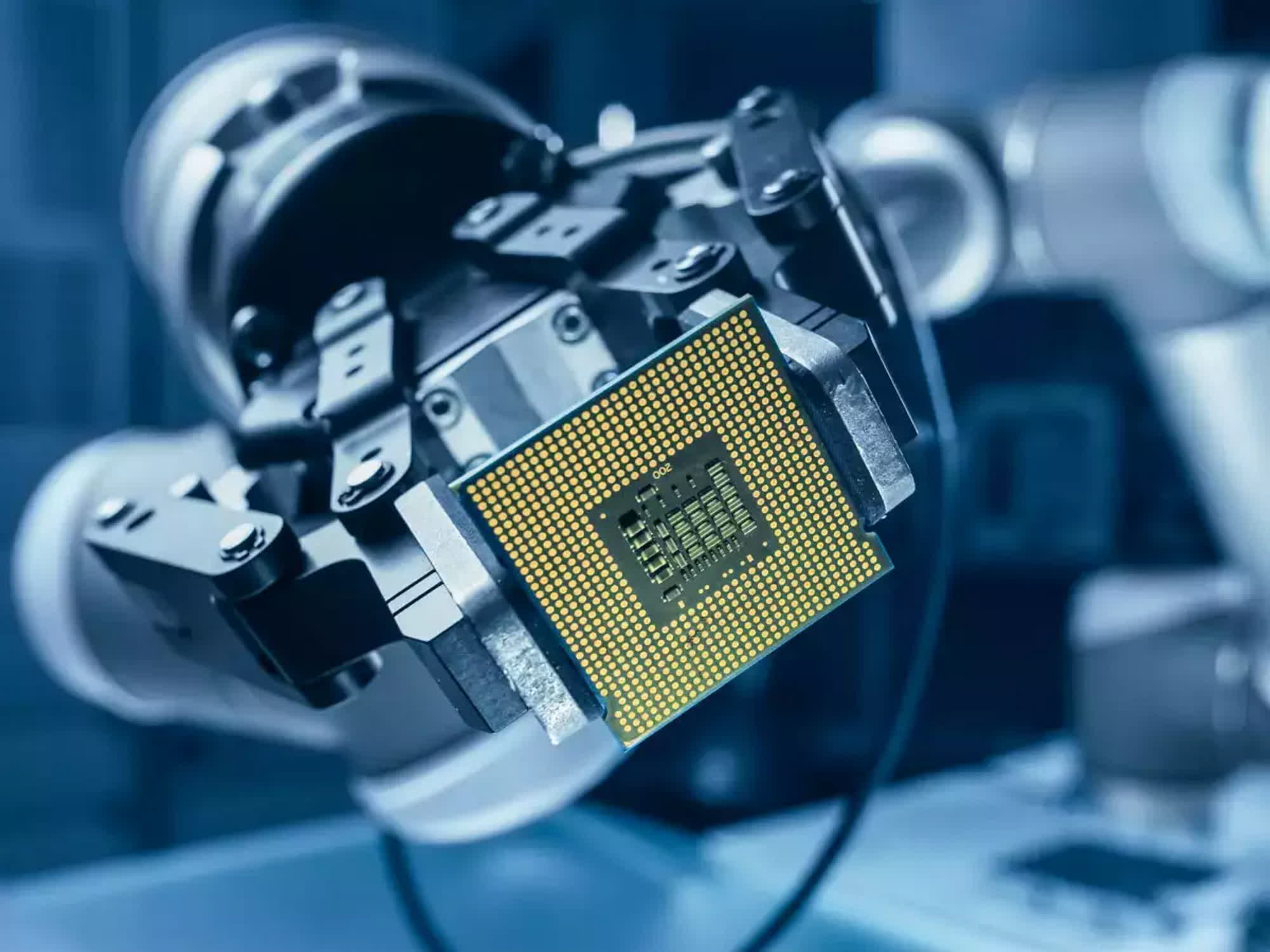

Semiconductor industry analyst Andrew Lu believes this relationship will evolve further. Intel's chip manufacturing arm directly competes with TSMC, while its design division is working hard to maintain its footing in the increasingly competitive semiconductor sector. Intel chip designers appear eager to cultivate a closer collaboration with the Taiwanese foundry.

Lu even speculates about a potential separation within Intel's competing business arms, predicting that the Santa Clara-based chip maker might split into two distinct companies in the coming years. Intel is increasingly adopting a chiplet design for its upcoming CPUs, with some chiplet components expected to be outsourced to external foundries by the end of 2023.

Setting speculations aside, it's likely that all of TSMC's manufacturing capacities for 2024 and 2025 are already reserved. If Intel plans to outsource a significant portion of its semiconductor products to the Taiwanese firm, contracts would have been finalized by now.

Assuming the figures provided by Goldman Sachs analysts – $5.6 billion and $9.7 billion – are accurate, Intel's orders could represent approximately 6.4% and 9.4% of TSMC's overall revenues for 2024 and 2025, respectively. Yet, despite the significant sums involved, neither Intel nor TSMC have publicly confirmed or refuted these claims.