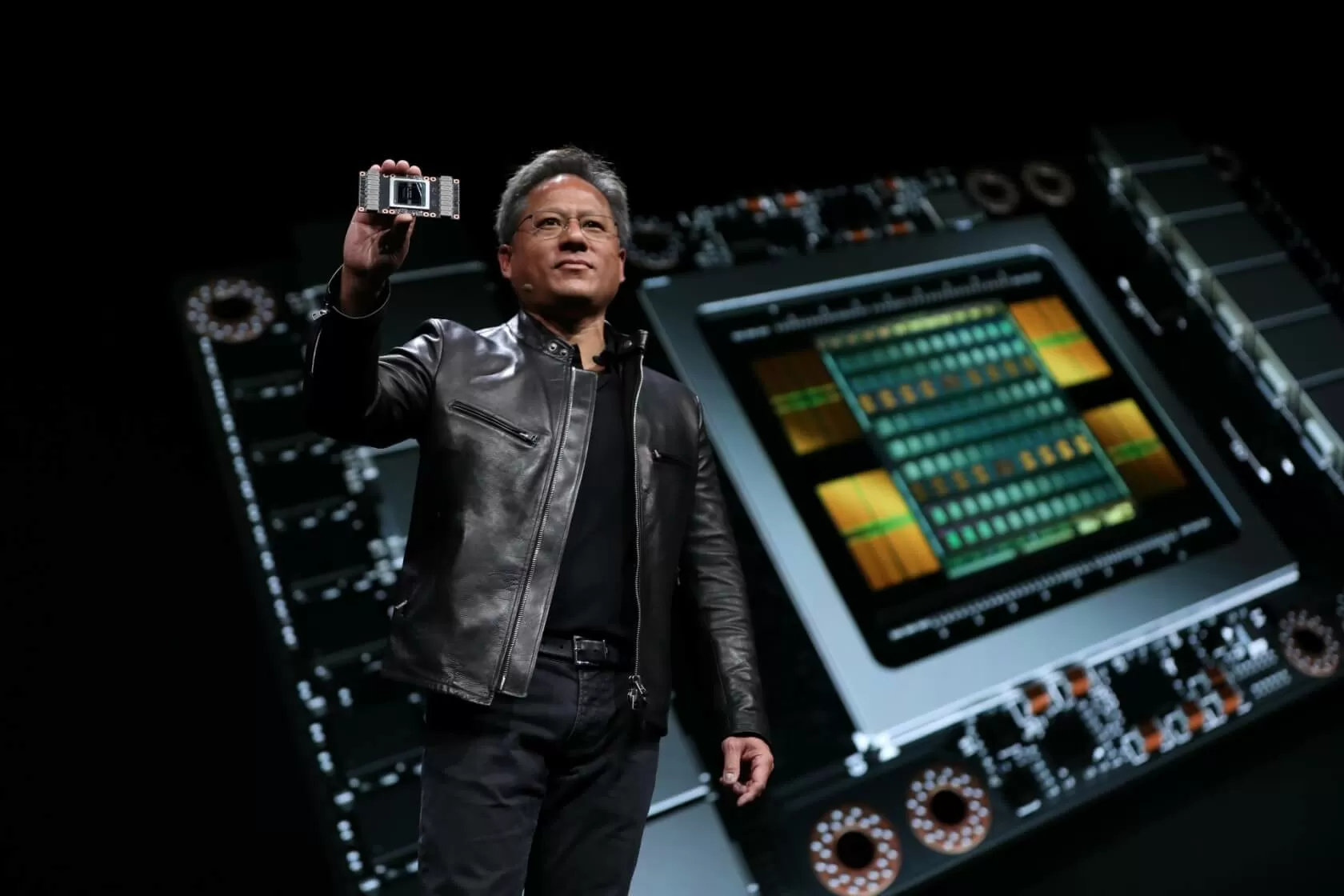

In context: Nvidia's roaring success isn't just good news for investors in the company; it's also made CEO Jensen Huang the 21st richest person in the world. Nvidia reported another excellent quarter recently, exceeding Wall Street's expectations and adding $277 billion to its stock market value. Huang's 3.5% share in Team Green has pushed his net worth to almost $70 billion, moving him just outside the top twenty on Bloomberg's Billionaires Index.

The AI boom continues to line Nvidia's pockets. The company reported record sales and a huge revenue jump for the final quarter of 2023, with total earnings hitting $22.1 billion, up 265% compared to the same period a year earlier.

The impressive performance, which exceeded analysts' high expectations, pushed Nvidia's stock price up more than 16%, from $667 to $785, bringing its market cap to $1.94 trillion. Reuters notes that the $277 billion added to the company's value was the largest one-day gain in history, beating the previous $196 billion record held by Meta, which it only attained on February 2.

Nvidia's stock price has surged over the last 12 months

Nvidia is now the third most valuable company in the US behind leader Apple and second-place Microsoft. It's also the fourth most valuable globally, sitting behind Saudi Aramco.

It's all good news for Huang, of course. Nvidia's success has boosted its CEO's wealth by $9.6 billion to $69.2 billion. Bloomberg writes that the gain has pushed Huang above Charles Koch and Chinese bottled-water tycoon Zhong Shanshan to 21st place on the publication's Billionaires Index.

Huang has shot up the list over the last 12 months; he was in 128th place with a net worth of $13.5 billion early last year.

Nvidia owes its success to the AI revolution. The company's Data Center business grew 409% YoY in Q4, generating $18.4 billion in revenue. Nvidia now controls around 80% of the high-end AI hardware market.

Nvidia's rally has also increased the fortunes of 30 other billionaires on Bloomberg's list whose wealth can be at least partly linked to AI. Charles Liang, CEO of Super Micro Computer Inc., saw the biggest increase, jumping 33%.

https://www.techspot.com/news/101999-nvidia-stellar-performance-propels-ceo-jensen-huang-21st.html