In brief: It appears that the PC market is finally showing signs of recovery. According to new data from John Peddie Research (JPR), the total number of client CPU shipments in Q2 was up by 17% compared to the previous quarter. Intel dominated the three months with a massive 23% increase in its market share, while AMD's share was down 5.3%.

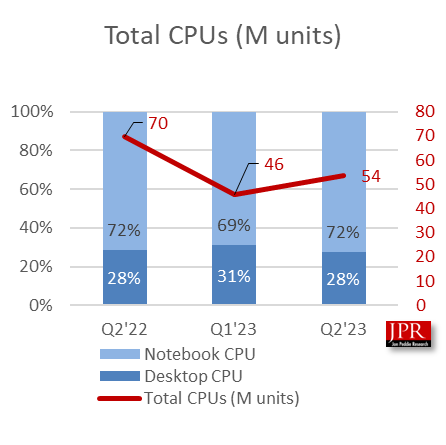

JPR's latest report shows that global client CPU shipments reached 53.6 million units in the second quarter of 2023. That's up from the 46 million units shipped in Q1. The figure is still down compared to the same period last year: desktop CPU shipments declined 23% YoY while notebooks were down 22%.

It shouldn't come as much of a surprise to see that Intel was the dominant CPU company during the quarter, thanks to its widely available 13th-gen entry-level notebooks and desktop processors. However, AMD has released cheaper options, its Phoenix and Dragon Range APUs could find their way into more laptops, and the upcoming Strix Point APUs sound promising. Intel, meanwhile, has its Raptor Lake Refresh and Meteor Lake chips on the way – we just saw leaks showing some good performance increases for the Intel i5-14600K and i7-14700

Elsewhere, notebooks CPUs were responsible for the vast majority of processors shipments, making up 72% of total units compared to 28% for desktop CPUs.

"Increase in client CPU shipments from last quarter is positive and welcomed news in what has been depressing results for that quarter as well as for the last two years," Jon Peddie said. "Integrated graphics also increased from last quarter, which is not too remarkable given most CPUs have built-in GPUs. The forecast for next quarter is a cautionary positive. AMD and Intel are guiding upward, albeit modestly."

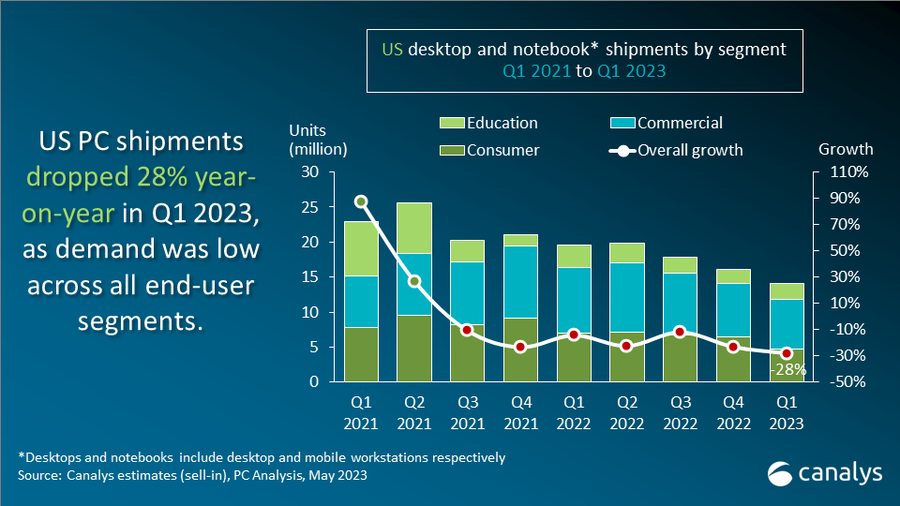

JPR's report aligns with analyst firm Canalys' recent prediction that the PC market will start to recover later in 2023. It noted that desktop and notebook shipments hit a nadir of 14 million units in Q1, down 28% YoY due to low demand across all end-user segments.

A different analyst company also noted a slight improvement in the second quarter. International Data Corporation (IDC) wrote that global shipments dipped 13.4% compared to the same period a year earlier - less of a decline than during Q1. A preliminary report from IDC pointed to weak demand from consumers and commercial clients, continued macroeconomic headwinds, and a shift in IT budgets as factors that have contributed to the 18-month slump.

https://www.techspot.com/news/99737-pc-market-shows-signs-recovery-intel-dominated-cpu.html