The big picture: The worldwide PC downturn continued in the second quarter as global shipments dipped 13.4 percent compared to the same period a year earlier. A preliminary report from International Data Corporation (IDC) pointed to weak demand from consumers and commercial clients, continued macroeconomic headwinds, and a shift in IT budgets as factors that have contributed to the 18-month slump the industry is currently in.

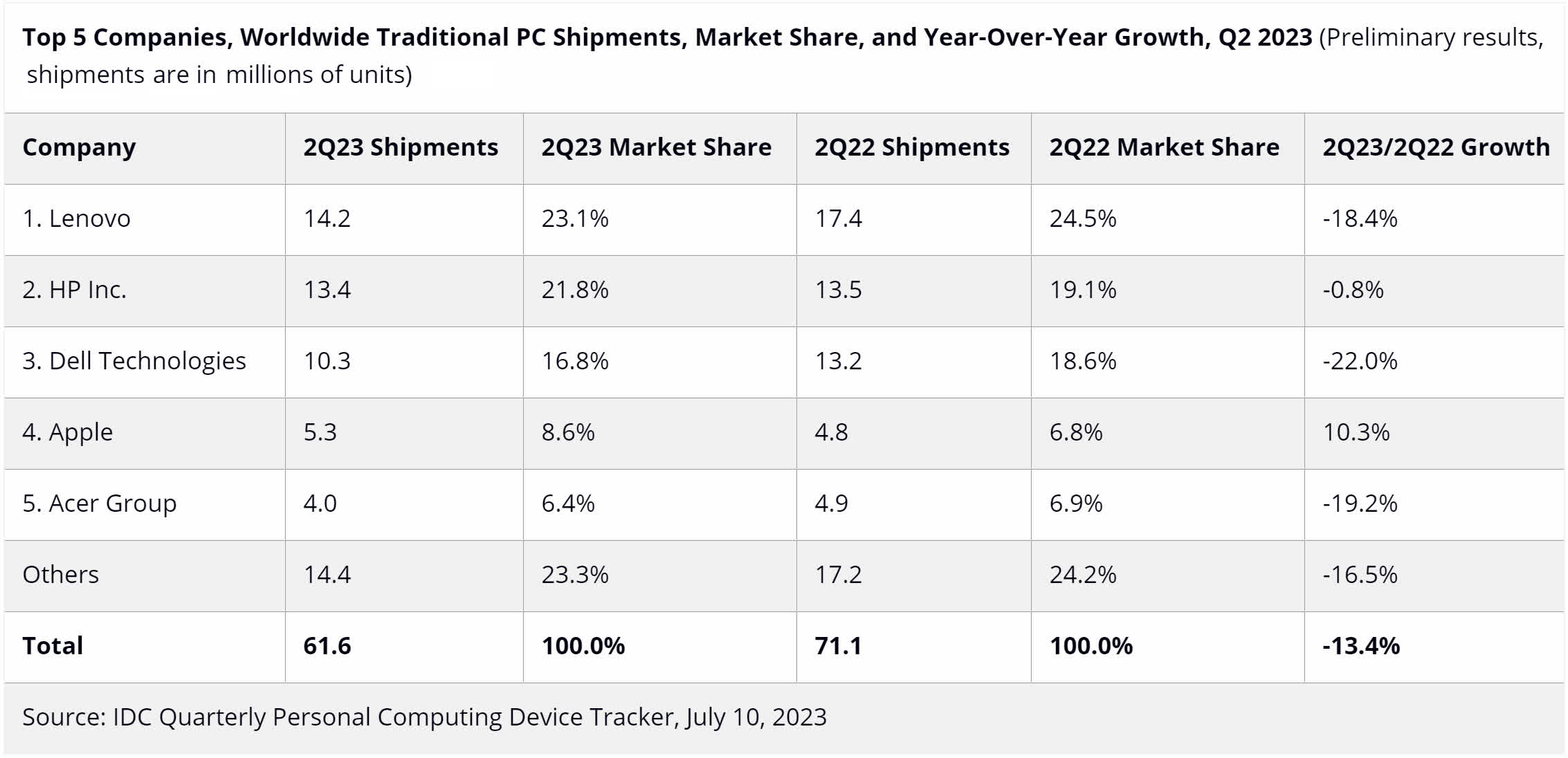

IDC said the downturn has caused elevated inventory levels for longer than anticipated, and that no PC maker has been immune. Among leading computer markers, Apple and HP were the only ones that didn't experience double-digit declines during the second quarter.

Mac shipments increased 10.3 percent year-over-year, due in part to supply issues Cupertino experienced in 2022. HP, meanwhile, saw shipment declines narrow to 0.8 percent compared to Q2 2022 as its inventory has finally started normalizing.

As for raw numbers, Lenovo led the way with 14.2 million PCs shipped in the quarter followed by HP at 13.4 million and Dell with 10.3 million units shipped. Apple finished fourth with 5.3 million Macs shipped and Acer rounded out the top five with four million shipments. All others combined for 14.4 million shipments. In total, 61.6 million PCs were shipped during the quarter compared to 71.1 million units shipped in the second quarter of last year.

Ryan Reith, group vice president for IDC's client device trackers, said the roller coaster of supply and demand the industry has faced over the past five years has been extremely challenging. On one hand, companies don't want to be caught with short supply like what happened in 2020. Conversely, many are hesitant to make a big bet on a market rebound at this stage.

Reith said IDC is seeing signs of a return to pre-pandemic consumer habits where computing needs are shared across multiple platforms. As such, the firm expects spending to favor smartphones over PCs. On the commercial side, continued workforce reduction and the growth of generative AI is only creating more confusion for CFOs working on budgets.