Amongst the many car tech-related developments, few are receiving more attention than ridesharing services such as Uber and Lyft. To their credit, these companies have managed to build up enormous valuations and continue to receive major investments from traditional auto industry players.

The primary reason for all the excitement isn’t their current business model—providing convenient means to transport people from place to place—but the bigger vision they have of turning cars into a service. The idea is that instead of buying and owning cars, people will turn to this type of automotive service for all their transportation needs, thereby dramatically reshaping the automotive industry and our transportation infrastructure.

In many ways, the concept is certainly an intriguing and vaguely appealing one. In fact, many in the tech and urban-focused Silicon Valley area seem to accept it as a foregone conclusion. According to a recent TECHnalysis Research survey of 1,000 US consumers about automotive related technologies, including autonomous driving and ridesharing, however, reality is different. In fact, dramatically so.

To participate in the survey, consumers had to both own a car and expect to purchase one over the next two years. While this precludes representation from people who may have already given up on owning a car (likely a tiny percentage anyway), their impact has already been factored into current car sales. The purpose of this portion of the study was to better understand any potential future impact of ridesharing on car purchases.

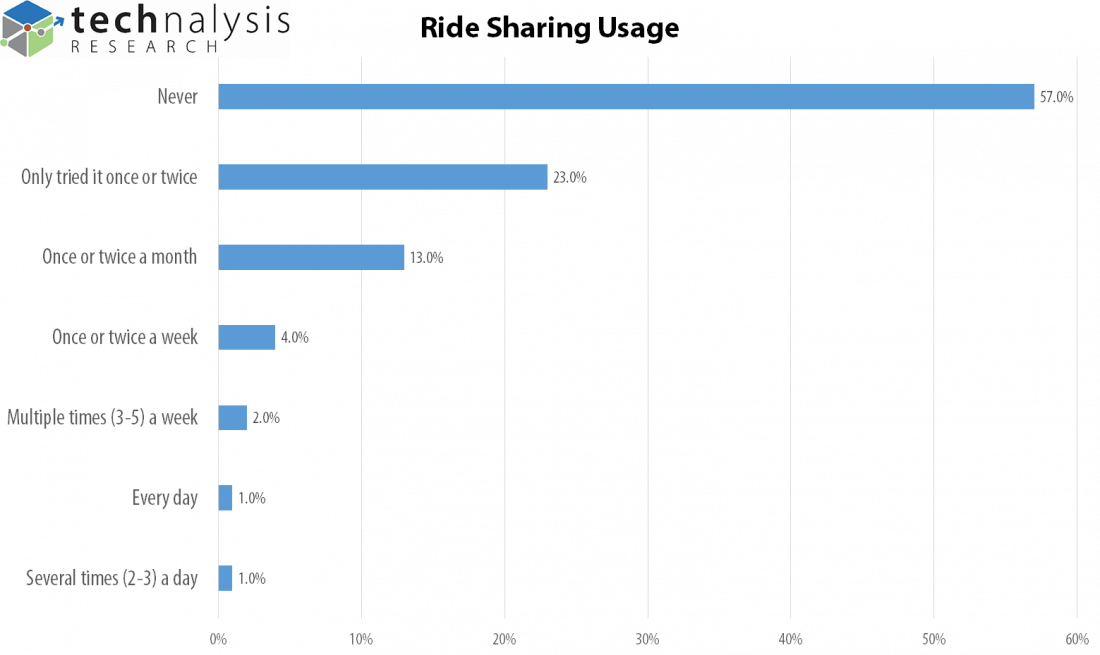

The first key point that the study uncovered is that a huge percentage of the US population still has little to no experience with any ridesharing service. In fact, about 57% have never used a ride-sharing service and another 23% have only used one once or twice. This puts rideshare users in the minority. In fact, only about 20% are regular or semi-regular users of ridesharing. The top-level results are shown in Figure 1. (Note that the numbers don’t add up to 100% due to rounding.)

Not surprisingly, the numbers vary by home location, with 31% of city dwellers, 17% of suburbanites and 9% of rural dwellers saying they use ridesharing at least once or twice a month. (FYI, city residents make up roughly 1/3 of respondents, suburban residents approximately ½, and rural residents about 1/5—a very similar mix to overall US census data.) The numbers also vary by age, with 32% of those under 35 using it at least once or twice a month.

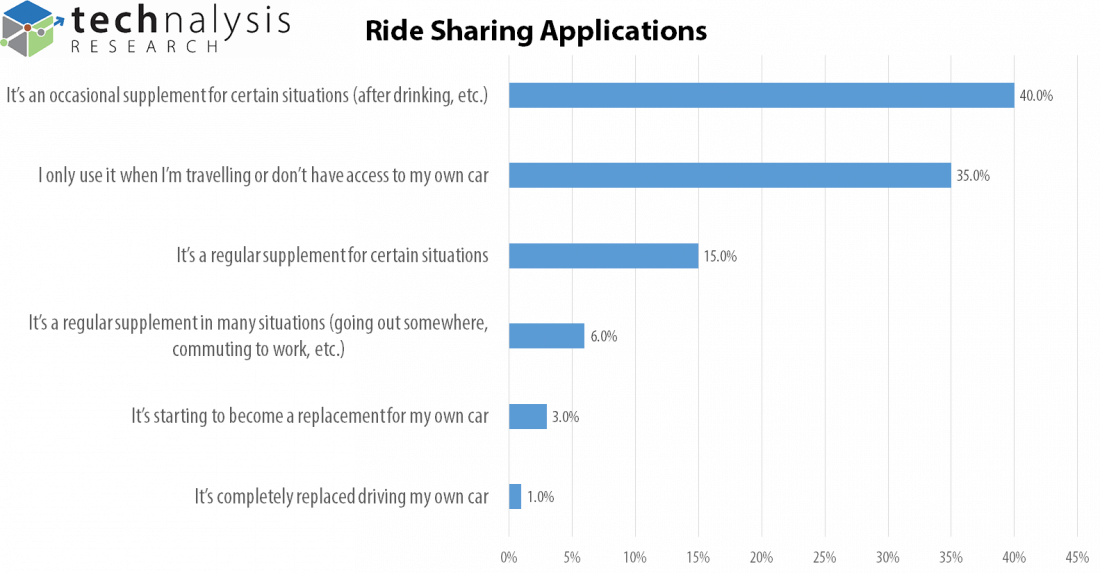

More importantly, even among those who use ridesharing services, the reasons or situations in which they do use them strongly suggest occasional, supplemental usage to their regular driving. In fact, nearly 75% of ridesharing users view it as a supplemental service for situations such as after drinking, while travelling, or other circumstances where they don’t have access to a car. That leaves just 5% of the total population (or one quarter of all rideshare users) who actually use ride sharing more than just occasionally.

As Figure 2 illustrates, just 4% of all ridesharing users (6% of city-dwelling users) see their cars as either potentially or definitely being replaced by ridesharing users—less than 1% of the total survey respondent base.

Survey respondents were also asked to rate the amount of influence that ridesharing services would have on their next car purchase (from 0% influence or no impact, to 100% influence or will definitely not buy a car because of them). The results showed that just 8% of the overall total said it would have a strong or greater impact (defined as at least a 50% impact), with 14% of city dwellers, 4% of suburbanites and 10% of rural dwellers selecting those same options. One interesting point to note is that not a single suburbanite said they would definitely not purchase a car because of ridesharing services.

Ridesharing services have had an impact on the way that people think about cars, car ownership, and transportation in general. But their influence on new car purchases is likely to be extremely small for some time to come.

One last point the survey also explored was the potential impact that autonomous vehicles would have on ridesharing services. The largest group of respondents, 40%, said if ridesharing services started using autonomous vehicles, it would not impact their usage of the services. (FYI, only those who had used ridesharing services were asked the question). However, a combined 43% said they would either use ridesharing a little less, a lot less or completely stop using them if autonomous vehicles were put into service. Interestingly, the results were relatively consistent across the different location-based groups, but city dwellers actually had the highest percentage of respondents (15%) who said they would stop using the services completely if autonomous cars were deployed.

There’s no question that ridesharing services have had an impact on the way that people think about cars, car ownership, and transportation in general. But as the survey results dramatically illustrate, their influence on how, why, or if people actually purchase new cars is likely to be extremely small for some time to come. It’s certainly possible that we’ll see some dramatic changes in opinion over the course of the next several years, but for now, the obsession over “cars as a service” is definitely misplaced.

Bob O’Donnell is the founder and chief analyst of TECHnalysis Research, LLC a technology consulting and market research firm. You can follow him on Twitter @bobodtech. This article was originally published on Tech.pinions.

https://www.techspot.com/news/66148-ride-sharing-impact-dramatically-overstated.html