Yes and No to your quote about Fiat currency's, the difference is that behind most country's currency's is something real, people, jobs, taxes etc.

It's no different for crypto, really. Do you think all these projects spawn by themselves? There are people and hardware behind every coin. The coins need computers to work, and teams actively work on the coins. They work on improving them, updating them, changing them etc. We even have democracy-like systems with crypto at their center called

DAO, to vote on how the project should proceed.

And one of the great things about it is that it can be controlled by a central bank to create price stability in economies,

That doesn't seem to be working that well, honestly. Remember 2008? We're gonna have another one like that, but worse. The current monetary system cannot be saved. It's only a matter of time. Physical metals are a way to help you guard yourself against that. Other assets are land etc. And, then there is crypto, which also falls in that category. Unless the internet is going away, Crypto is not going anywhere.

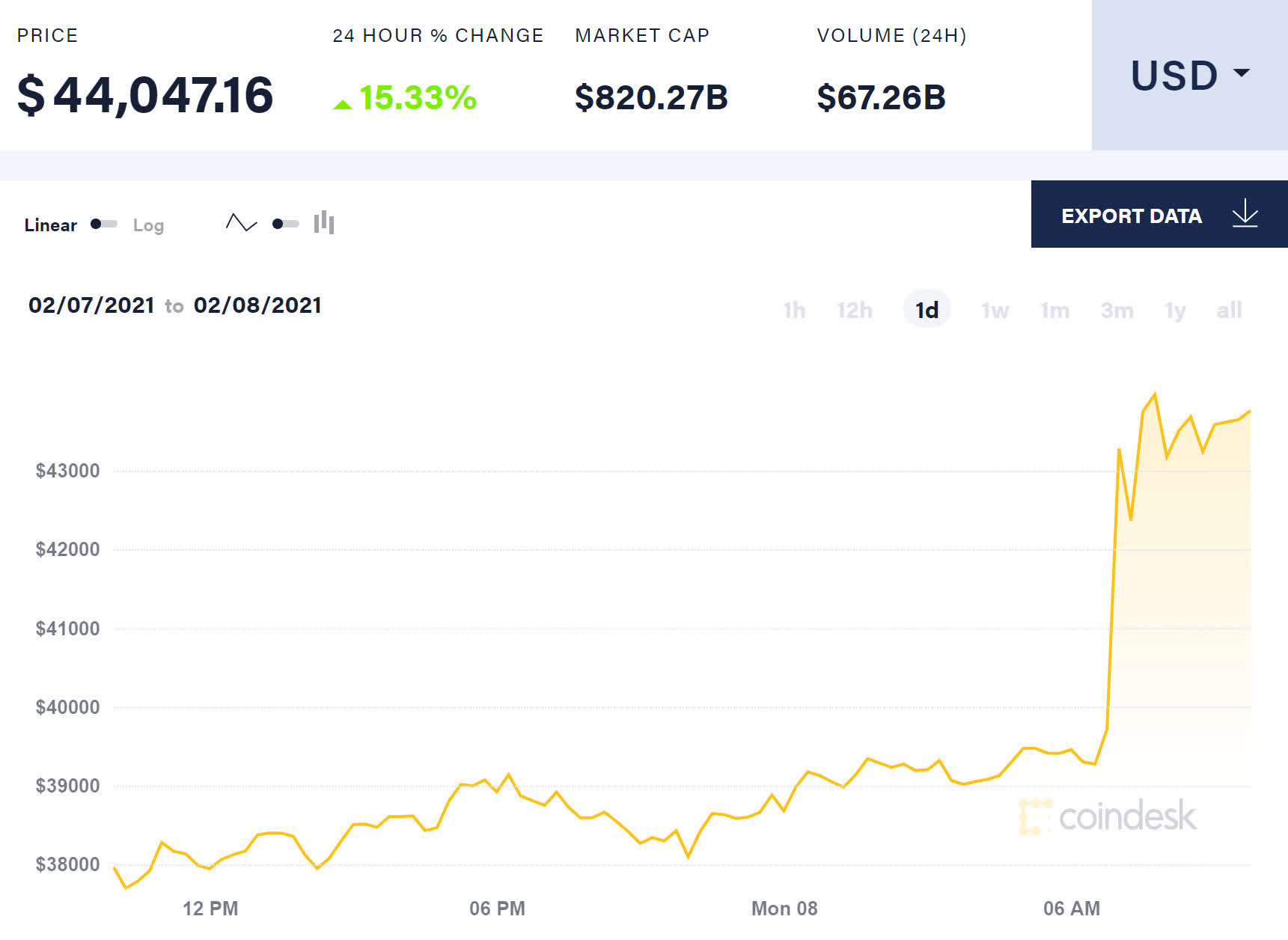

Bitcoin is uncontrollable and has become it's own market by right, people like Elon are just using it as a way of making a lot of money very quickly, he will sell out before it crashes while the average working Joe will probably lose half his savings.

It is true that crypto has become a market of its own. But that's how markets take over one another. Take the internet. More people read news on the internet or watch TV through the internet compared to previous means of doing the same thing. The internet became its own market, but ultimately made the old one obsolete. Crypto is doing the same thing, except, it's doing it in the financial sector as opposed to the news or entertainment sector.

If the average Joe is patient enough, it is likely that in a couple of years, that half of savings that he lost will at least double, if not go 10x.

GOLD (and any other precious metal) is rare and has tangible, intrinsic value. Crypto is "nothing".

The US Dollar is just paper but it's still tangible and backed by the military industrial complex and insured by the FDIC.

I understand your sentiment. If you think other assets are safer, it's perfectly fine to invest in those instead.

I think crypto is not only just as safe (if not safer), it's also a lot easier. And there are a few things that crypto has going for it.

Gold is indeed rare. But, we can always find a new mine, suddenly making it less rare than before. Bitcoin has its rarity programmed into it, and it will never change. This is an advantage for Bitcoin, because, its predictability on its rarity is one of the primary things that makes it valuable.

Gold is indeed tangible. But that is only true as far as you have your physical Gold stored in your house. You can have receipts or a certain amount of Gold in an account somewhere. But that would be no different than having a certain amount of Bitcoin in a wallet on an exchange. The difference is, Bitcoin doesn't need to work with accounts or receipts. You can own it directly, whereas you can still lose your Gold if the intermediary entity goes bankrupt, closes down or simply disappears. And in the case of physical Gold, someone can go in your house and take it from you. If you have it in a vault somewhere, the former point also applies.

Crypto is as much "nothing" as the internet is "nothing". The internet doesn't have any reality to it and is intangible. It does have a real effect on reality, and can be used to our advantage. Crypto is the same thing, but a bit more sophisticated.

The US Dollar is technically not paper. The sum of USD in every account does not have any paper equivalent available anywhere. The vast majority of USD is a number on a computer and nothing more. It used to be backed by Gold, which was later decoupled. Then they had to have 10% reserve, which was decreased to 5% reserve, and today banks require literally ZERO reserve for inventing new dollars on the spot. The USD is a measurement of debt that can be increased on the fly by only a certain group of people.

More importantly, every time an additional dollar is printed, your wealth which you worked for with your blood, sweat & tears by using time from your life, which is a non-recoverable asset, is literally being stolen from you.