Why it matters: Tesla's high-profile investment in Bitcoin and planned support of the cryptocurrency to purchase products in the future has already helped to push the popular cryptocurrency to an all-time record value, and it's barely even lunch time.

Tesla in a filing with the US Securities and Exchange Commission on Monday revealed that it has invested $1.5 billion in Bitcoin.

The purchase, which falls under a revised company policy on investing initiated last month, provides the company with "more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity."

Tesla additionally said it sees its Bitcoin holdings as highly liquid, and that it may acquire and hold digital assets "from time to time or long-term."

What's more, Tesla said it expects to start accepting Bitcoin as a form of payment for its products in the near future. The company hasn't yet decided if it will liquidate those funds upon receipt.

Tesla in the filing said it had $19.38 billion in cash and cash equivalents as of December 31, 2020, meaning the $1.5 billion Bitcoin investment accounts for around 7.7 percent of the company's total capital resources.

Musk earlier this month on the Clubhouse chat app said he was a supporter of Bitcoin and that it was on the verge of "getting broad acceptance by conventional finance people."

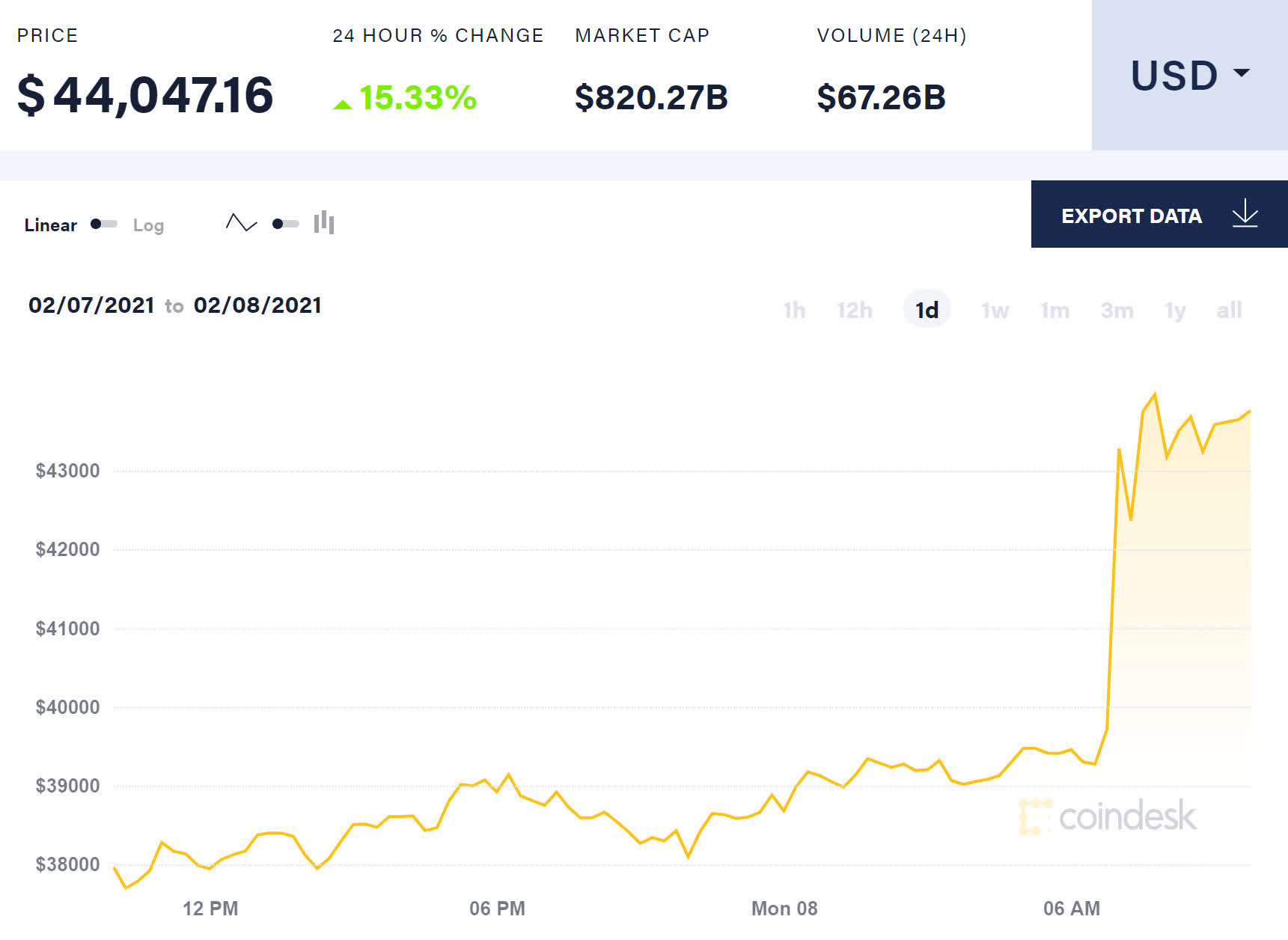

The price of a single Bitcoin started the day around $39,000 and spiked just north of $44,000 after the SEC filing was published, a few thousand dollars higher than its previous all-time high of nearly $42,000.

Masthead credit john smith williams