A hot potato: How much of an impact did cryptominers have on the graphics card market during the first quarter? Quite a lot, according to a new report. It’s estimated that 700,000 high-end and midrange gaming cards that shipped in Q1 went to miners—about $500 million worth of product.

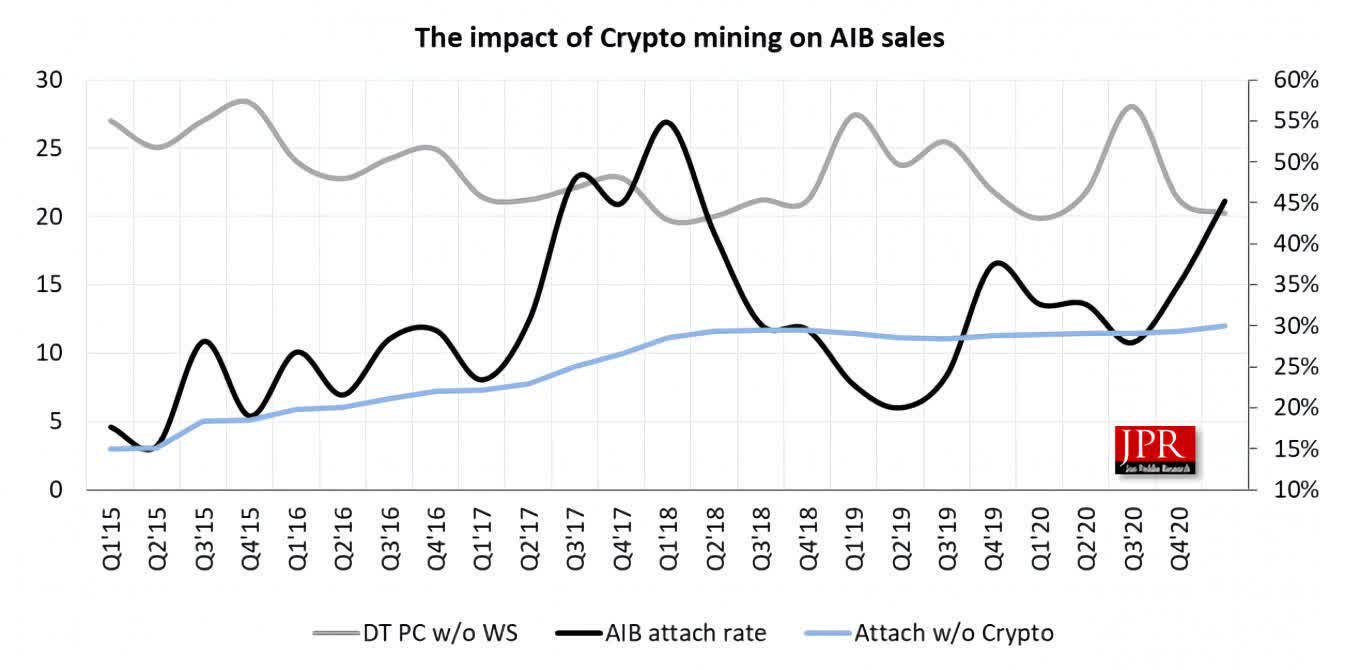

Analyst Jon Peddie Research writes that those figures mean 25% of all graphics cards shipped between January and March ended up being used to mine crypto. The company looks at the attach rate of AIBs (add-in boards) to PCs, which had fallen as low as 25% before recently jumping to 50%, and uses the difference between the trending normal attach rate and the current rate to calculate the mining use of AIBs.

JPR makes the assumption that most miners already own dedicated rigs and buy cards for them, though some amateurs do buy entire systems for mining. The company admits its formula isn’t as precise today as a few years ago due to the global component shortage that has seen scalpers and miners using bots to buy cards in bulk before selling them on eBay.

While cryptomining has been a major factor behind the increasing price of graphics cards, by up to 70% in some cases, it’s not the only reason. The massive surge in demand, most of which stems from the pandemic, has resulted in component shortages that have pumped up the cost of GDDR6 memory, capacitors, etc. A recent report forecast that GDDR6 prices would rise by 13% this year, inflating cards’ retail selling price even further.

JPR does note that Nvidia is trying to push miners away from its mainstream gaming cards by releasing its Cryptocurrency Mining Processor (CMP) line while adding a hashrate limiter to the RTX 3060, RTX 3070 Ti, and RTX 3080 Ti. The company is also replacing the RTX 3060 Ti, RTX 3070, and RTX 3080 with LHR (Lite Hash Rate) models. Hopefully, we'll start seeing the results of this strategy soon enough. AMD, however, has publicly stated it has no problem with its RDNA 2-powered cards being used for mining and does not plan to limit their performance in the same way as Nvidia.

Image credit Yevhen Vitte