What just happened? AMD has spent most of this year taking advantage of Intel's struggles, but Team Red was dealt a blow yesterday when Bank of America downgraded its stock from Buy to Neutral. BofA Securities cited risks including competition in an AI chip industry dominated by Nvidia, as well as weakening PC sales. The company's share price is now down almost 10% compared to one week ago.

Bank of America analysts wrote that in addition to the competitive risks against Nvidia in the AI market, cloud customers are showing a growing preference for custom chips from Marvell Technology and Broadcom, which is limiting AMD's potential to gain market share.

It was also noted that AMD's largest cloud customer, Amazon, has indicated its preference for alternative custom products, which again could restrict AMD's market share in the AI accelerator industry.

"AMD's pipeline remains 1 year-plus behind Nvidia's (which is accelerating) and lacks a competitive networking (switching, optics) portfolio," said BofA analyst Vivek Arya. "Longer term, we continue to see Nvidia at 80%-plus accelerator share, custom chips at 10-15%, with the remaining shared by AMD and a range of startups."

AMD's share price over the past six months

Arya also warned that there could be a PC market correction in the first half of 2025, which might impact AMD. According to Gartner, worldwide PC shipments in the third quarter of 2024 totaled 62.9 million units, a 1.3% decline from the same period in 2023. But Gartner believes PC demand will see more robust growth in 2025, when the PC refresh will be at its peak.

Arya lowered his rating on AMD stock and cut his price target to $155 from $180. Sales and earnings estimates for the company were also reduced. The 2025 GPU revenue estimates were cut significantly, to $8 billion from $8.9 billion, far below the consensus estimate of $9.6 billion.

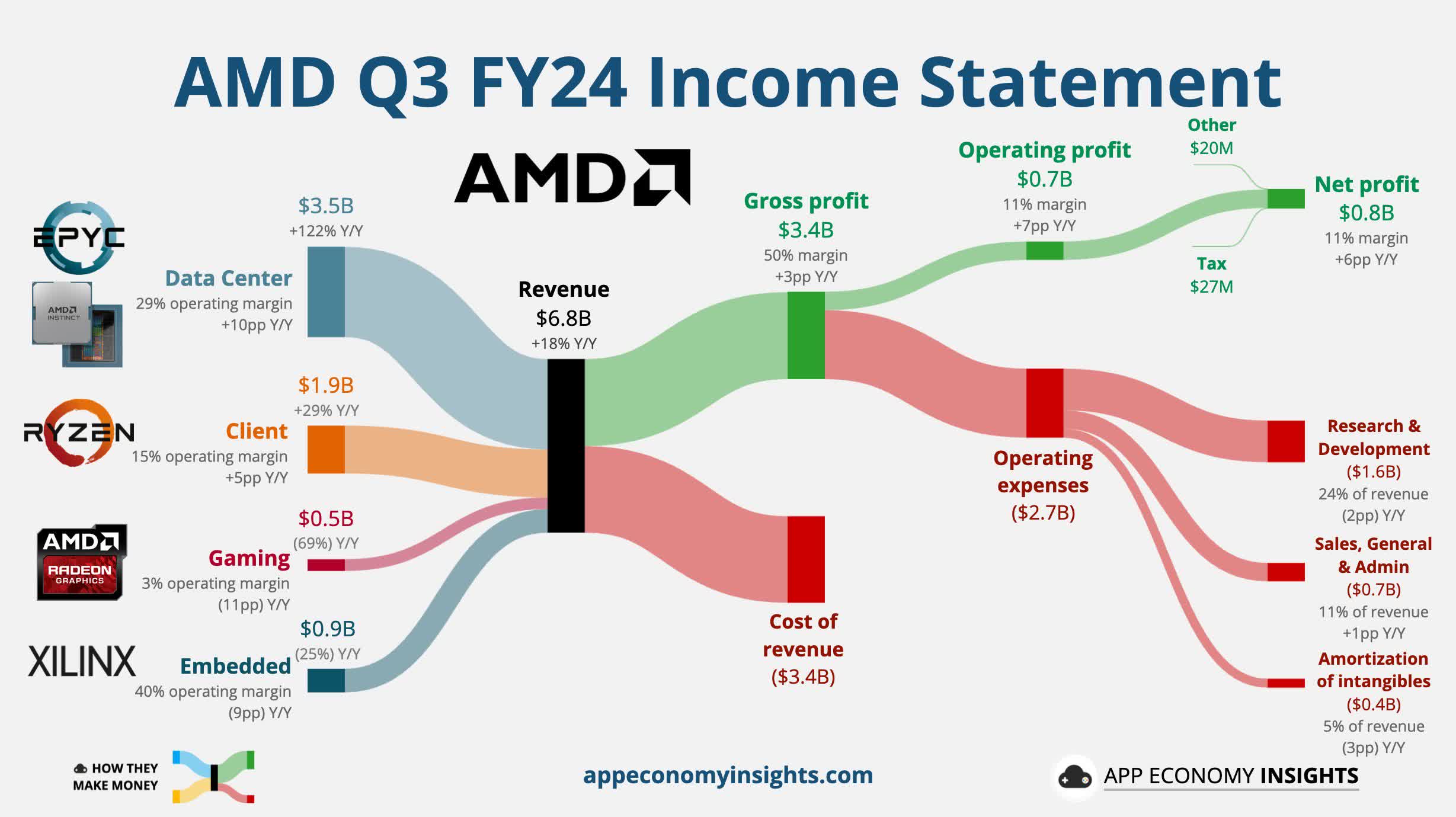

Source: App Economy Insights

The analyst did have some good news for AMD. He noted that Lisa Su's firm could take advantage of the struggles at Intel, which recently ousted Pat Gelsinger. It's something we're already seeing. During the recent Black Friday event, almost 90% of the motherboards sold by German retailer Mindfactory came from AMD, which is also dominating the US Amazon sales charts for both CPUs and mobos. Moreover, the most recent Steam survey shows AMD has climbed to its highest-ever user share in the CPU category, reaching almost 36%.

Bank of America lowers AMD stock rating, citing Nvidia AI dominance and declining PC demand