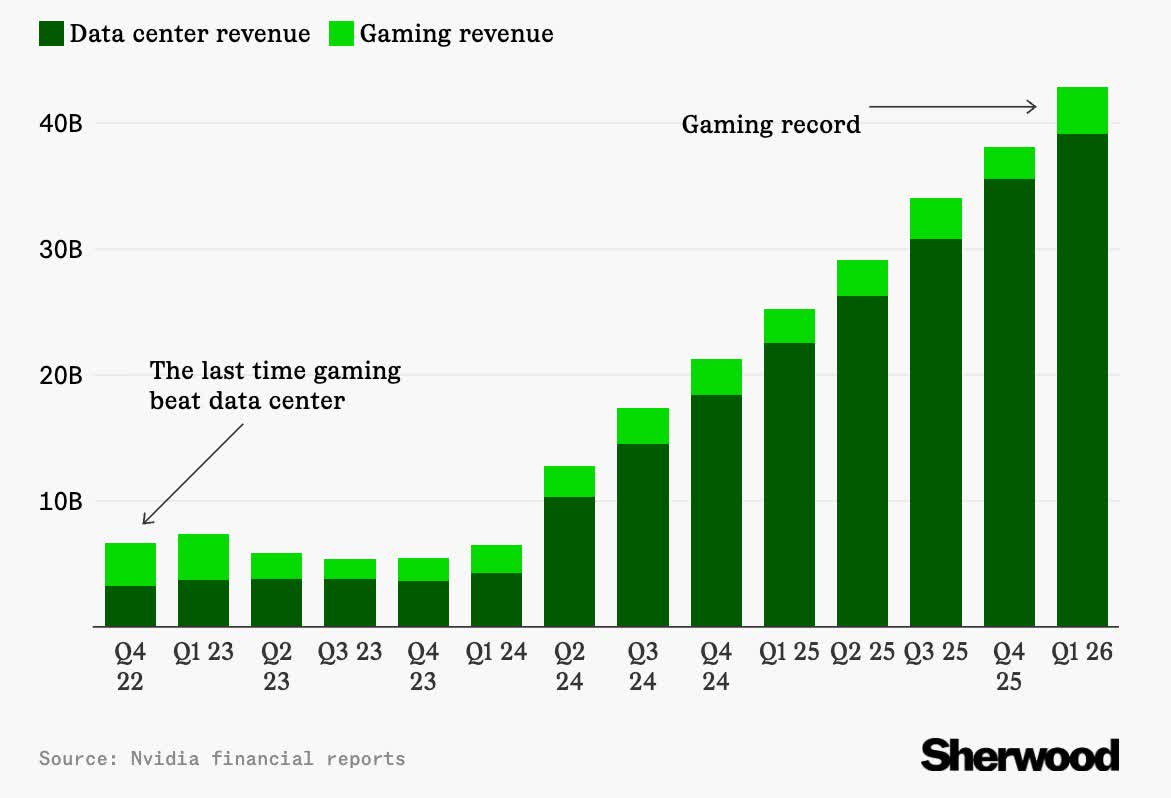

Big quote: Nvidia has been raking in record-breaking revenue from its AI data center business. But this time it was the gaming division that unexpectedly stole some of the spotlight. For Q1 FY26, Nvidia's gaming revenue surged to a record $3.8 billion, up 42% year-over-year and 48% quarter-over-quarter. That's the fastest growth rate the gaming GPU segment has seen in years, and even exceeding Wall Street's expectations by over 30%.

As for what's behind the surge, analysts says it's all got to do with Nvidia's "Blackwell ramp." The new GPUs may be rolling out faster than any generation before, which the company claims offers massive performance gains, especially when combined with DLSS and Multi-Frame Generation (MFG). However, our benchmark data paints a more tempered picture. Real-world performance improvements are far less dramatic than Nvidia's marketing suggests.

Another overlooked factor behind gaming revenue growth may be the increasing diversion of high-end consumer GPUs into small-scale AI operations. As demand for AI compute spreads beyond large data centers to startups and independent developers, some gaming-class GPUs – especially higher-end RTX cards – are being repurposed for machine learning workloads.

This trend inflates sales figures but reduces the actual number of GPUs reaching traditional gamers, contributing to higher prices and scarcity for consumers despite what appears to be strong market performance.

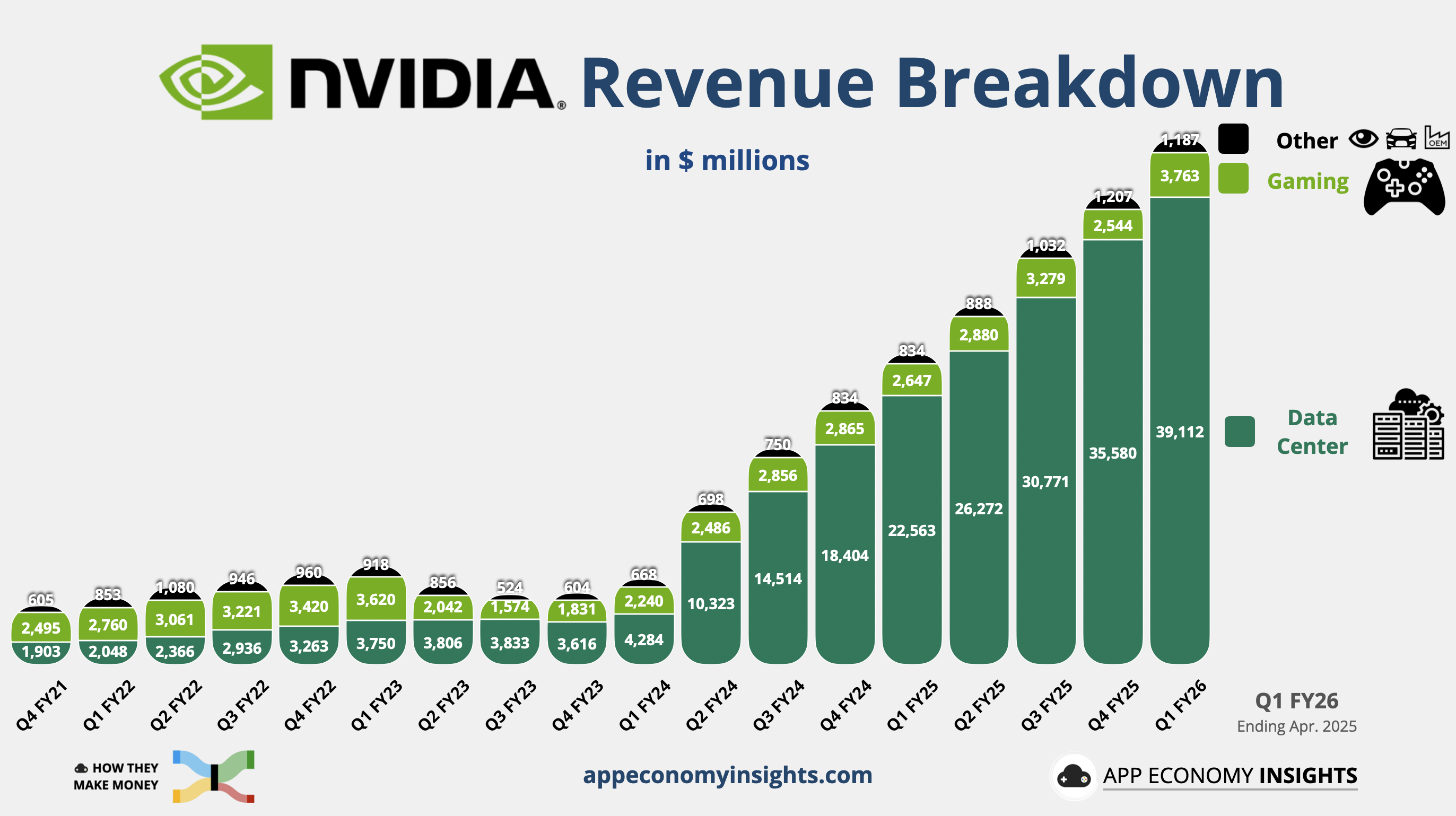

It's worth noting that even with this banner quarter, gaming accounts for just 8.5% of Nvidia's total revenue. That's a stark drop from early 2022, when gaming made up 45%. The decline isn't due to weakness in gaming – it's because AI has far outgrown it.

In the same quarter, Nvidia's total revenue hit $44.1 billion, with $39.1 billion of that coming from the data center segment.

That's nearly a 10x growth rate over gaming compared to the same quarter from two years ago and up 73% year-over-year. So it's no surprise that CEO Jensen Huang in March said that Nvidia is now an AI infrastructure provider. That said, $3.8 billion in gaming revenue is in no way a small figure and is still larger than many entire companies.

Not everything is smooth, though. The quarter came with a $4.5 billion write-down due to US export restrictions on high-end chips to China. Nvidia also warned of an $8 billion revenue hit in Q2 because of the same issue.

In the earnings call, Huang didn't mince words when he said that US chipmakers have effectively lost access to China's AI market. While that's directionally accurate, it's not entirely the case – numerous reports suggest GPUs routed through other regions ultimately end up in China.

Huang also warned that Chinese competitors are stepping up to fill the gap. "Export restrictions have spurred China's innovation and scale. The AI race is not just about chips. It's about which stack the world runs on," he stated. A Chinese startup founded in 2021 is reportedly preparing to mass-produce a GPU based on its own architecture, with performance rumored to rival Nvidia's RTX 4060.

Image credit: App Economy Insights, Sherwood Media