In context: Once the undisputed leader in semiconductor manufacturing, Intel now finds itself at a critical juncture as its foundry operations face significant financial challenges. It remains uncertain whether a deal with TSMC can rescue Intel's foundry business, but without it the company – better known in its heyday as "Chipzilla" – must find a way to address its manufacturing challenges and financial losses.

Intel's foundry division reported a staggering loss of over $13 billion on $17.5 billion in revenue last year. In Q2 2024 alone, the foundry posted an operating loss of $2.83 billion, a sharp increase from $1.87 billion the previous year. This stands in stark contrast to TSMC, the industry leader, which generated $41.1 billion in operating profit on $90 billion in revenue during the same period. These figures highlight the severity of Intel's predicament.

As Intel grapples with its foundry woes, speculation has emerged about a potential partnership with TSMC. This idea gained traction following a report from Robert W. Baird analysts, citing "discussions from the Asia supply chain," which suggested that TSMC could become a joint owner of Intel's manufacturing business after a potential spinoff. While unconfirmed, the possibility of such a collaboration has drawn significant interest from industry observers.

Chris Caso, an analyst at Wolfe Research, spells out the rationale behind this potential partnership: Intel's core server and PC businesses will no longer generate enough growth to absorb the significant costs for leading-edge fabs, he said in a research note. Caso further emphasizes that only TSMC can drive the foundry volume needed to absorb Intel's fixed costs in an expeditious manner.

At the same time, Intel's financial struggles have taken a toll on its market value. The company's stock price plummeted 60% last year, recently trading near a 10-year low. Even with a recent 22% surge in share price, Intel's market capitalization remains roughly one-eighth that of TSMC's – a stark reversal from just five years ago when both companies were valued at parity.

Adding to Intel's woes is its substantial cash burn. Over the past three years, the company has spent nearly $40 billion in an effort to catch up with TSMC's manufacturing processes. According to FactSet estimates, analysts expect negative free cash flow to persist through at least the end of next year.

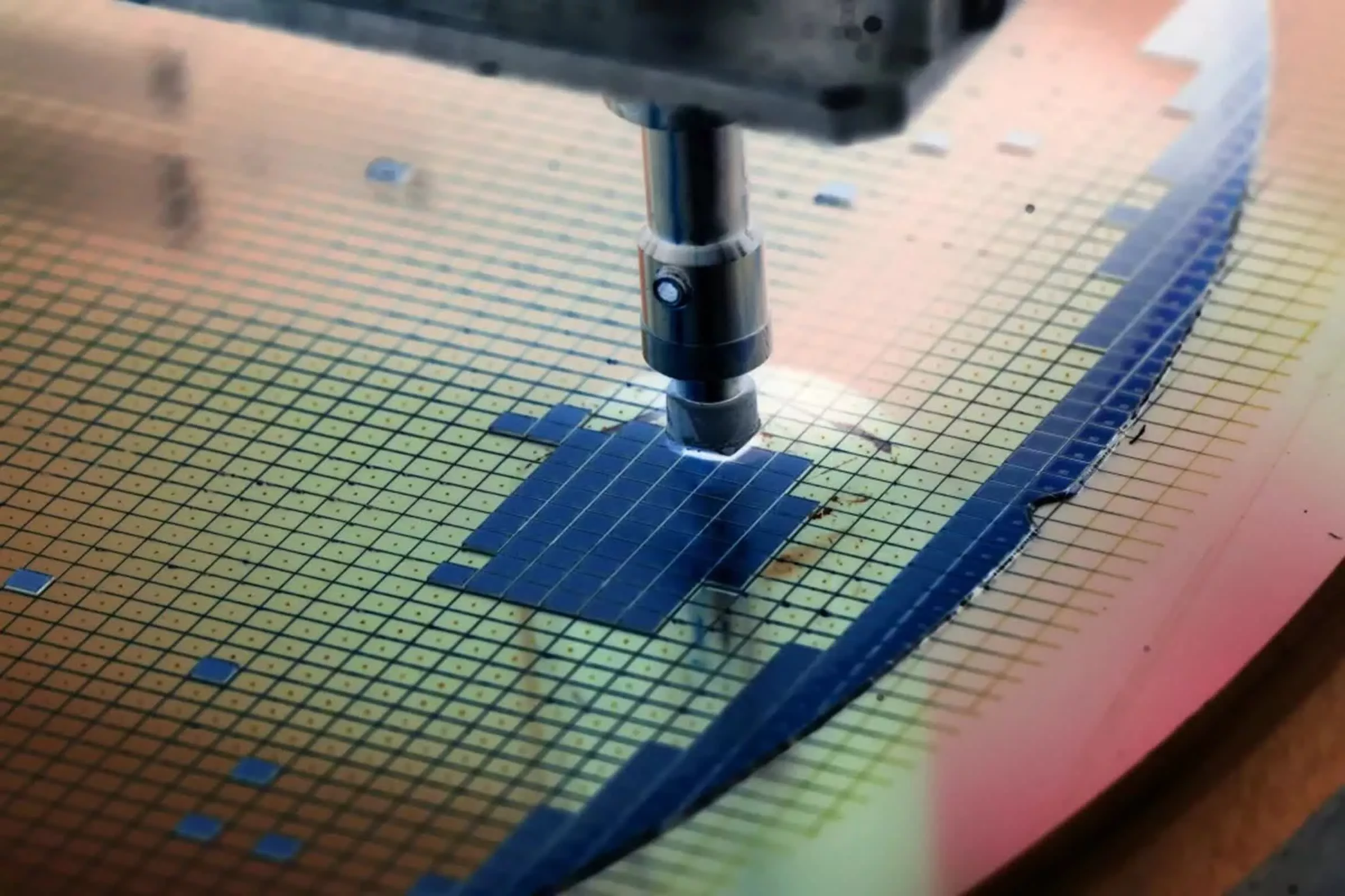

Beyond financial concerns, Intel's foundry operations also suffer from a technological lag. The company trails TSMC by approximately a year in achieving competitive yields for each new process node. Additionally, Intel's manufacturing costs are estimated to be 30% to 35% higher than TSMC's due to lower wafer volumes.

A lot hinges on Intel's latest 18A manufacturing process, which is expected to be a pivotal moment for the company's foundry ambitions. Intel has positioned 18A as a game-changer, boasting advancements such as RibbonFET transistors and PowerVia technology to enhance power efficiency and performance.

Intel's $13B foundry loss raises stakes for potential TSMC partnership