Cutting corners: Intel's next leap in semiconductor manufacturing, known as the 14A process, now hangs in the balance. The company warned that it could slow down or even halt development of the advanced 1.4nm-class technology unless it secures a significant external customer and meets critical project milestones.

This admission, made public in a regulatory filing, marks a notable shift for the chipmaker, which has traditionally set the pace for pushing leading-edge technologies but now risks ceding ground to rivals such as TSMC and Samsung Foundry.

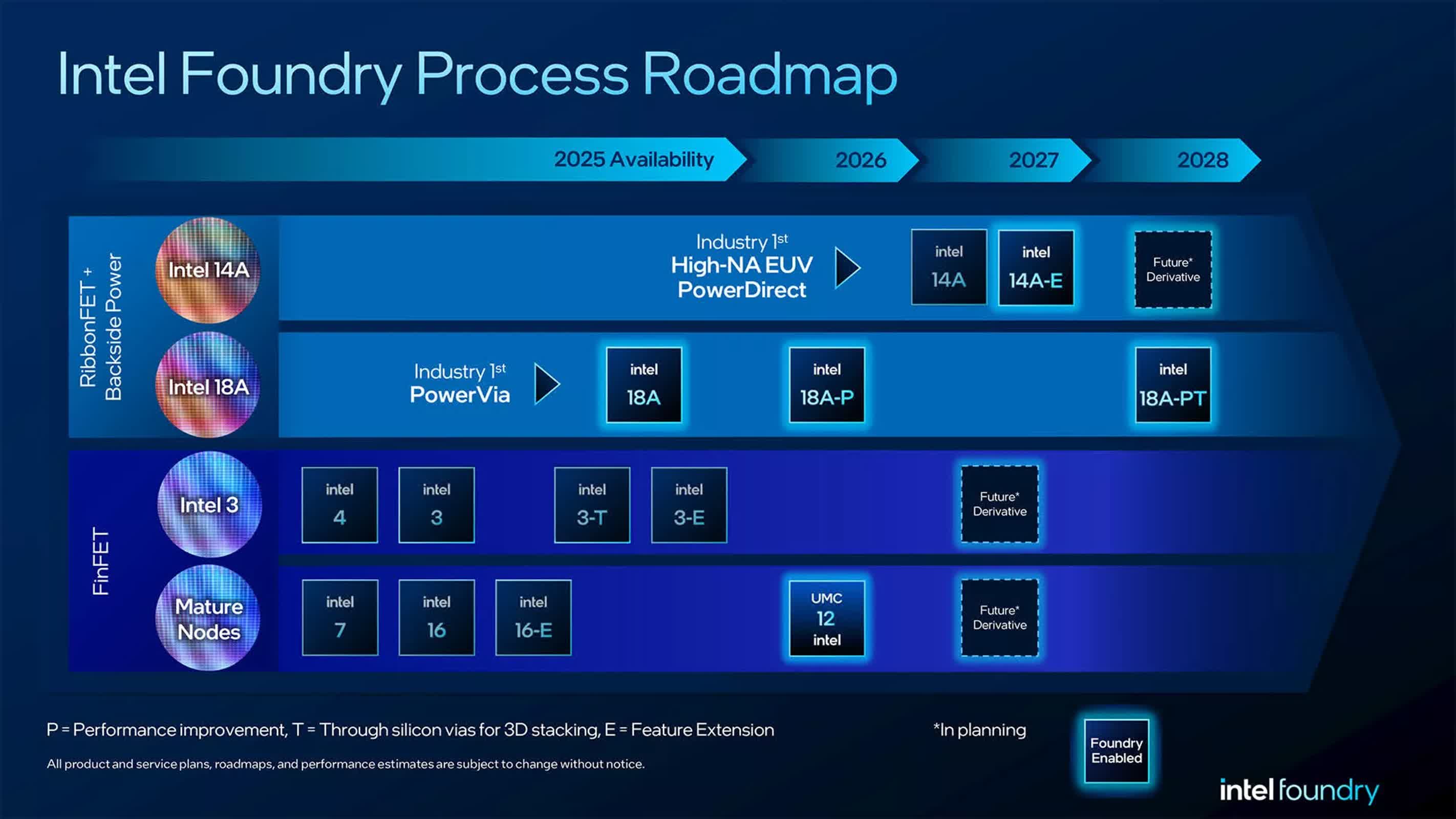

The future of the 14A node – a successor to Intel's 18A and 18A-P processes – was called into question as executives discussed the company's earnings and investment strategy. While Intel remains committed to its current technology roadmap, CEO Lip-Bu Tan emphasized a new approach of market-driven development.

"The 14A is the process node, but clearly I will make sure that I see the internal customer, external customer, and volume commitment before I put CapEx," Tan told analysts during the earnings call. "But that is something that has to meet my requirement in terms of performance and yield. It's a lot of responsibility to be serving our customers, make sure that we can deliver the result – consistent, reliable result – to them, so that their revenue can depend on us."

Developing technologies at the edge of what's possible isn't cheap. Intel spent over $16.5 billion on research and development in 2024, a sum that underscores the vast investment required to bring the 14A process to market. Its 14A node is expected to be its first to leverage high-numerical-aperture extreme ultraviolet (High-NA EUV) lithography for multiple critical layers, with each machine costing around $380 million. The cost of scaling 14A to high-volume manufacturing is so high that Intel insists these tools must serve both in-house and external customer needs.

The company's willingness to reconsider major technology projects reflects a hard pivot. If 14A does not achieve the commercial traction required, future high-performance Intel products could be outsourced to foundries like TSMC – a move that would have been unthinkable for Intel just a few years ago.

This tough assessment comes as Intel undertakes a dramatic restructuring of its global operations. According to Team Blue's latest earnings call and regulatory filings, the firm expects to end 2025 with roughly 75,000 "core employees" worldwide, down from nearly 100,000 at the end of the prior year. That reduction – amounting to approximately 24,000 jobs – reflects both layoffs and internal divestitures, shrinking the company by about one-quarter and marking the steepest workforce reduction in Intel's history.

Major international projects have now been shelved. Plans for large new chipmaking "mega-fabs" in Germany and Poland, once envisioned as bringing thousands of jobs to the region, are canceled. Assembly and test operations in Costa Rica will be consolidated or moved to larger facilities in Vietnam and Malaysia, though some engineering teams will remain in Costa Rica. In the United States, Intel is slowing construction on factory projects in Ohio and other sites to "align with market demand," according to its chief financial officer.

Addressing employees after the latest round of layoffs, Tan described the moment as a necessary inflection point. "We are making hard but necessary decisions to streamline the organization, drive greater efficiency and increase accountability at every level of the company," he said in a message to employees.

On the earnings call, he added, "I do not subscribe to the belief that if you build it, they will come. Under my leadership, we will build what customers need when they need it, and earn their trust."

Intel's 14A chip process in jeopardy, while cutting jobs and pulling back global expansion