Recap: DoorDash has partnered with Swedish-based financial services company Klarna to offer customers more ways to pay for deliveries. At checkout, you'll have the choice to break a bill up into four equal, interest-free installments, defer a payment until a later date, or pay in full as you normally would.

DoorDash said the option, which will launch in the coming months in the US, can be used on food deliveries as well as groceries, retail purchases, and to pay for a DashPass annual plan.

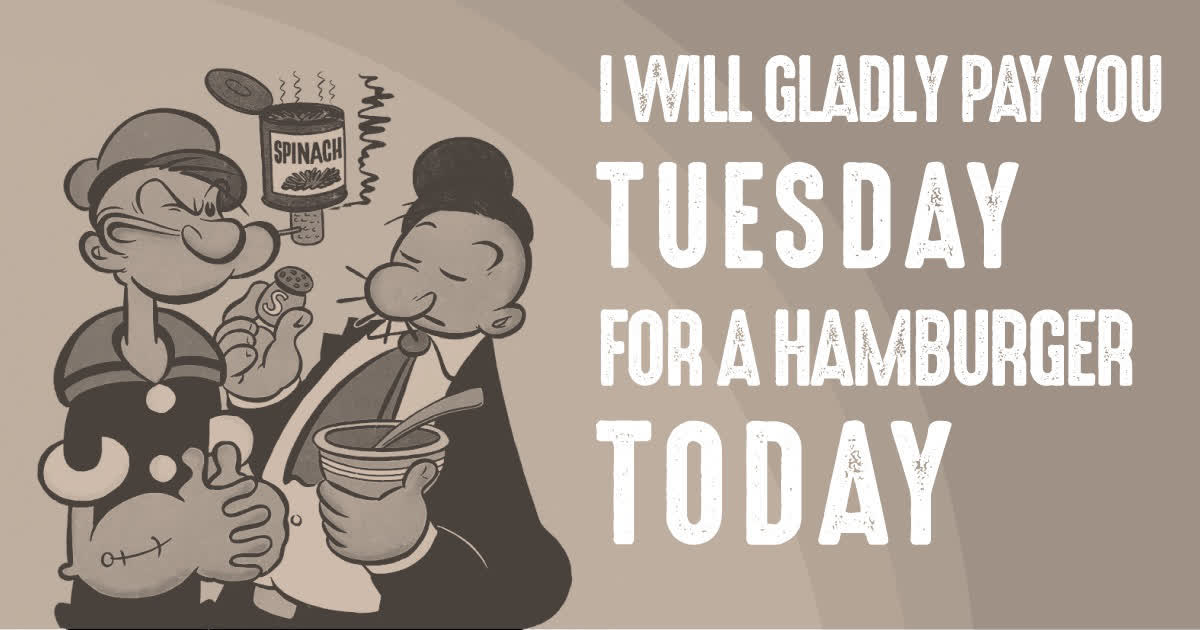

As NBC News highlights, the announcement has drawn criticism on social media. Folks are not terribly upset with DoorDash or Klarna so much as they are concerned about what the partnership says about our ever-increasing, debt-minded economy.

what do you mean you have $11k in "doordash debt" pic.twitter.com/pu1h8GqdZg

– adam 🇺🇸 (@personofswag) March 20, 2025

A Klarna spokesperson told the publication that the feature will only be available for DoorDash purchases totaling at least $35. "Wherever high-cost credit cards are accepted, consumers should be able to choose a zero-interest credit product, instead," the rep added.

Adam Rust, the director of financial services at the Consumer Federation of America, told NBC News, "I wouldn't characterize this as a solution. It is a fintech innovation that creates problems."

Douglas Boneparth, president of Bone Fide Wealth, shared a similar sentiment. "Eat now, pay later is an awful trap. If you need to borrow to have a burrito delivered to you, you are the product. Nothing more."

Klarna is one of several buy now, pay later (BNPL) operations that have emerged over the past decade or so. Such services allow users to make interest-free installment payments on purchases, and make money by charging fees when customers are late or miss a scheduled payment. Some services also earn revenue through partnerships with retailers.

BNPL is more popular than ever. According to Adobe, the option hit an all-time high during the 2024 holiday season and was responsible for $18.2 billion in online spend.

Consumer debt continues to be a problem for millions of Americans. According to the Federal Reserve Bank of New York, total household debt surpassed $18 trillion at the end of 2024. Unfortunately, society has normalized debt to the point where few see an issue with it… until they can't make their next payment.

A DoorDash spokesperson did not comment on the online criticism the partnership has sparked, but told NBC News that customers can already pay with a variety of methods including CashApp, Venmo, and even with government aid like SNAP benefits.

No cash? No Problem! DoorDash-Klarna partnership lets you pay for takeout in installments