Something to look forward to: Intel's push into contract manufacturing comes at a critical time. The success of its foundry business was central to former CEO Pat Gelsinger's revival plan. However, Gelsinger was fired in December, and the company has since mothballed its forthcoming artificial intelligence chip, pushing back hopes for that product until at least 2027.

Intel is making strides in its bid to become a true player in the contract chip manufacturing business. Sources familiar with the matter told Reuters that Nvidia and Broadcom are conducting manufacturing tests with Intel, signaling early confidence in the company's advanced production techniques.

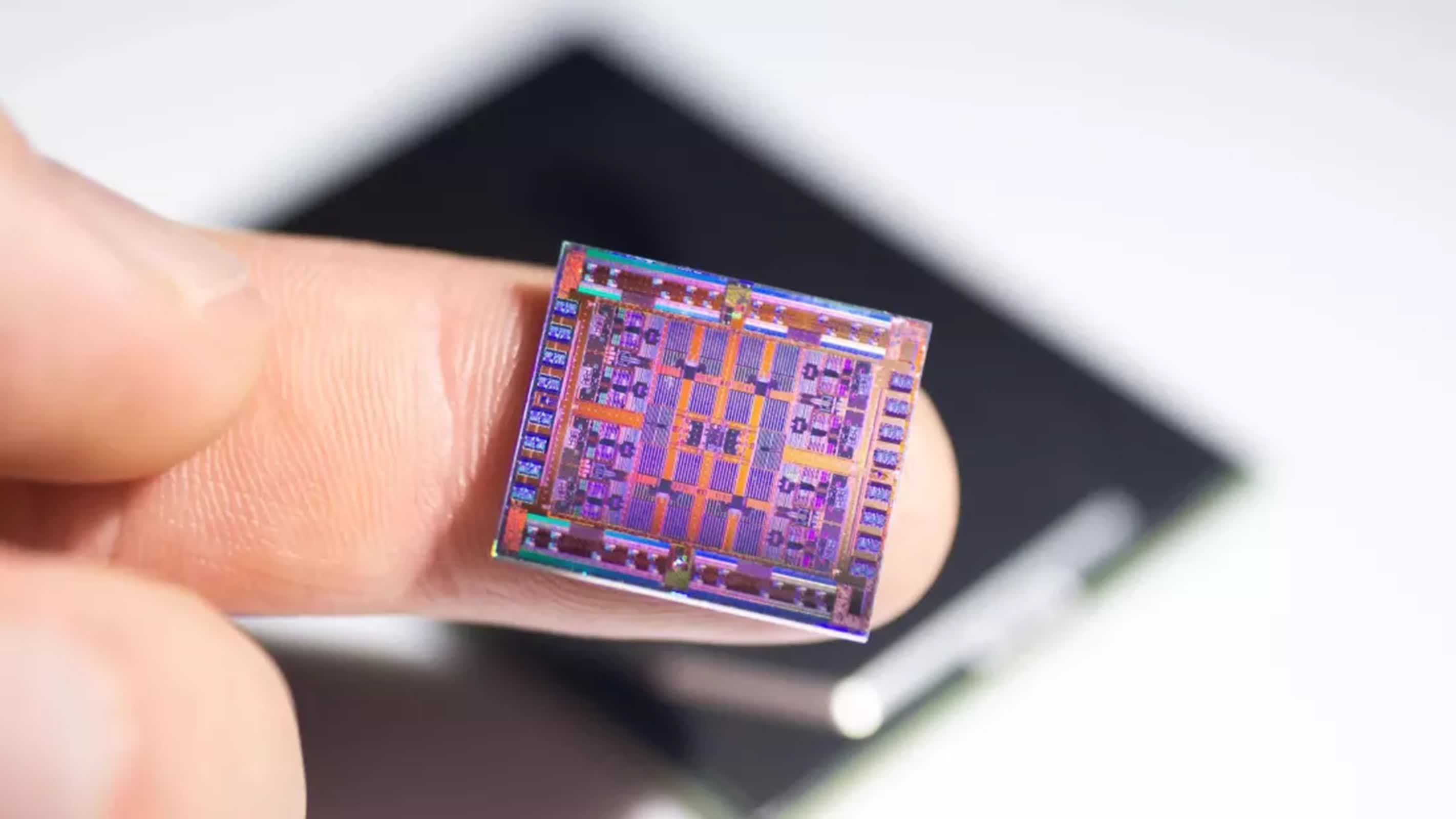

These previously unreported tests focus on Intel's 18A process. The tests, which could last for months, are not being conducted on complete chip designs. Instead, they aim to evaluate the behavior and capabilities of the process. Chip designers often purchase wafers to test specific components before committing to high-volume production of a full design.

However, these tests do not guarantee future business for Intel. Last year, a batch of Broadcom tests reportedly disappointed its executives and engineers, although the company stated it was continuing to review Intel's foundry.

The struggling chipmaker has attracted attention from the U.S. government, which sees Intel as crucial to restoring American manufacturing prowess and competing with China.

Earlier this year, administration officials reportedly met with TSMC CEO in New York to discuss the possibility of TSMC taking a majority stake in a joint venture with Intel's factory unit. However, this week, TSMC announced a new $100 billion investment in U.S. chip production, adding to its existing $65 billion commitment in Arizona. The move aligns with the U.S. national security push to boost domestic chip manufacturing – it's a clear sign that the Taiwanese chipmaker is ready to spend money in the U.S., but not necessarily for Intel's assets.

The funding will support three TSMC fabrication plants, two advanced packaging facilities, and a research and development center in the United States.

Synopsys CEO Sassine Ghazi says Intel's 18A process currently performs at a level between TSMC's most advanced process and its predecessor. "Right now, there are a lot of customers waiting – I'm talking foundry customers – to see the state of Intel. Will I commit? Will I not?" Ghazi told Reuters.

Intel confirmed last week that the 18A process node is "ready" for third-party clients, with tape-out design finalizations set to begin in the first half of 2025. The node is expected to introduce advanced semiconductor features ahead of products featuring TSMC's N2 process, which is set to debut in 2026.

18A promises a 30 percent increase in chip density and a 15 percent improvement in performance per watt compared to Intel 3. The company plans to use the process for its upcoming Panther Lake laptop processors and Clearwater Forest server CPUs, both of which are expected to launch before the end of the year.

Intel has also announced deals with Microsoft and Amazon to produce chips on the 18A process, but details remain scarce. The company is expected to generate $16.4 billion in revenue from its foundry business this year, but almost all of that revenue is expected to come from Intel itself. Last year, revenue for the foundry segment declined by 60 percent, and the company has stated it will not break even until at least 2027.

Nvidia and Broadcom are testing Intel's 18A capabilities, but future deals remain uncertain