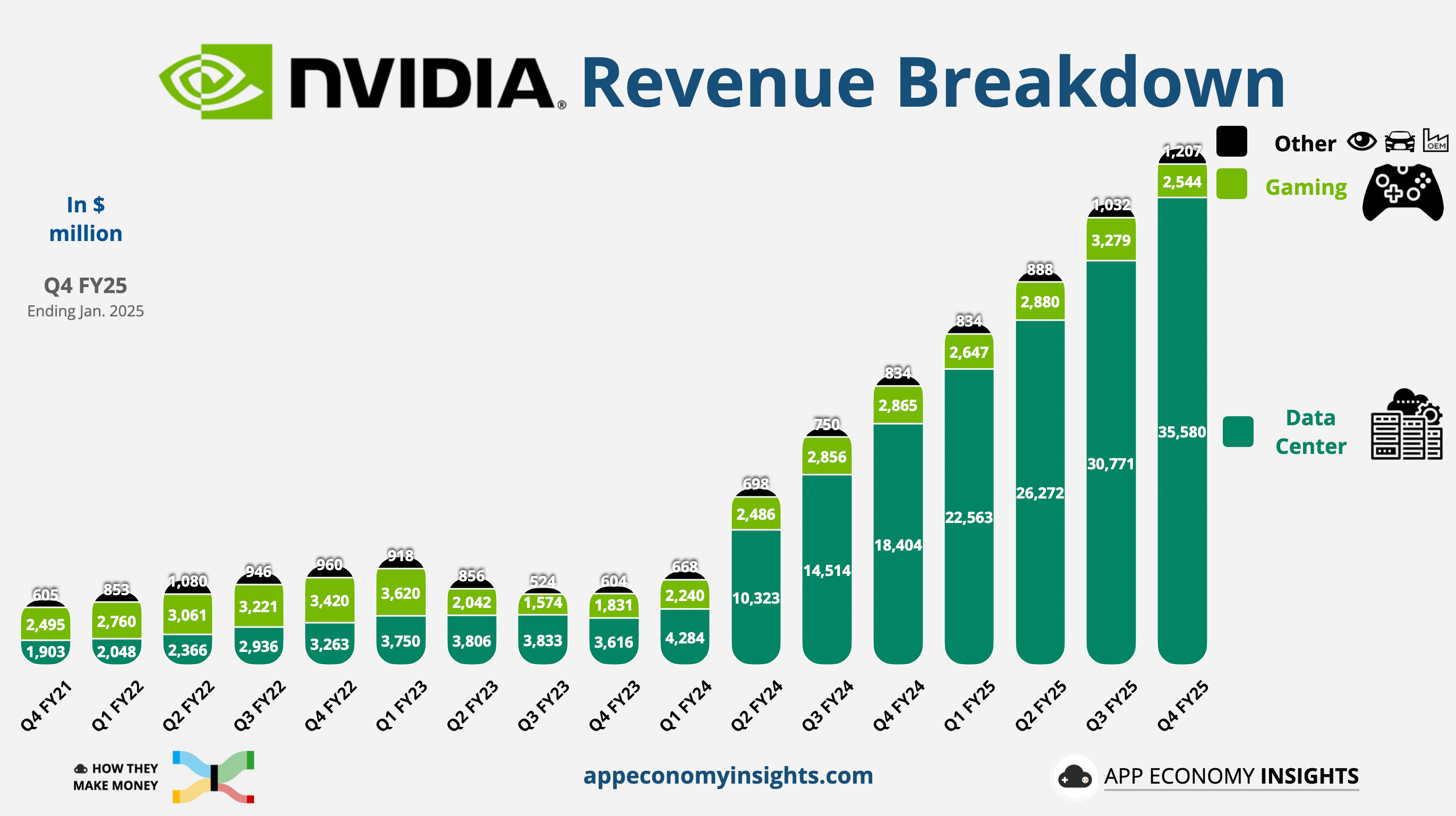

The big picture: Nvidia has reported record fourth quarter earnings of $39.3 billion for the three-month period ending January 26, 2025. That's an increase of 12% compared to the third quarter and up 78% versus the same period a year earlier. Nvidia's data center business was by far the company's revenue driver accounting for over 90% of the quarter's income.

GAAP earnings per diluted share reached $0.89, up 14 percent quarter over quarter, 82 percent year over year, and above the $0.84 that Wall Street was prepared for. Full-year earnings totaled $130.5 billion, an impressive 114 percent increase compared to last year.

Nvidia's data center business was by far the company's best performing division, accounting for $35.6 billion in Q4, representing a healthy 16 percent increase quarter over quarter and up 93 percent from the same period last year.

Graph by App Economy Insights

Gaming, which was Nvidia's bread and butter not all that long ago, brought in $2.5 billion in the fourth quarter, down 11 percent year over year. In total, the data center segment accounted for 91 percent of Nvidia's quarterly revenue.

CEO Jensen Huang said demand for its Blackwell architecture has been "amazing," adding that it achieved billions of dollars in sales in its first quarter. Chief financial officer Colette Kress noted that Blackwell sales were led by large cloud service providers, which accounted for roughly half of their data center revenue.

During a meeting with investors in October, the company said Blackwell GPU products had a 12-month backlog – not exactly a bad problem to have.

Looking ahead to the first quarter of 2025, Nvidia expects to generate roughly $43.0 billion, plus or minus two percent. Again, that's better than the $41.78 billion forecast from analysts, but we'll have to wait to see if Nvidia's figure materializes.

Despite the impressive performance and solid outlook, shares in Nvidia are down 3.99 percent in morning-after trading to $126.04. Year to date, the stock is down around 8.6 percent but is up more than 60 percent over the last year and an incredible 1,772 percent over the last five years.

Nvidia posts record-breaking Q4 as Blackwell GPUs drive massive growth