In brief: Fear, uncertainty, and tariffs are threatening to negatively affect the PC market in the next few months. A recent report highlights the trials and tribulations of the PC business, portraying a never-ending adjustment effort in response to quickly shifting business conditions and Donald Trump's actions.

Counterpoint Research's preliminary data show that PC shipments grew 8.4 percent year-over-year during the second quarter of 2025. The market experienced the highest yearly increase since 2022, when the pandemic had a significant effect on consumer demand for new hardware and PC systems. However, things are much more complex and chaotic today.

Major factors behind the latest growth in PC shipments include the quickly approaching end of official Windows 10 support, early adopters of AI PC systems, and commercial demand caused by Trump's tariffs. Many OEMs are now deeply in their "wait-and-see" approach to business, CR said, because the new US administration keeps using import tariffs as a looming threat against the entire world.

The increase in shipments was especially driven by the commercial segment of the market, with large enterprises and public organizations upgrading their PC fleets based on Windows 10. Windows 11's popularity is finally surging four years after the OS debuted, just as Microsoft stops supporting the old system in October 2025. Meanwhile, the consumer segment showed mixed signals with more moderate growth.

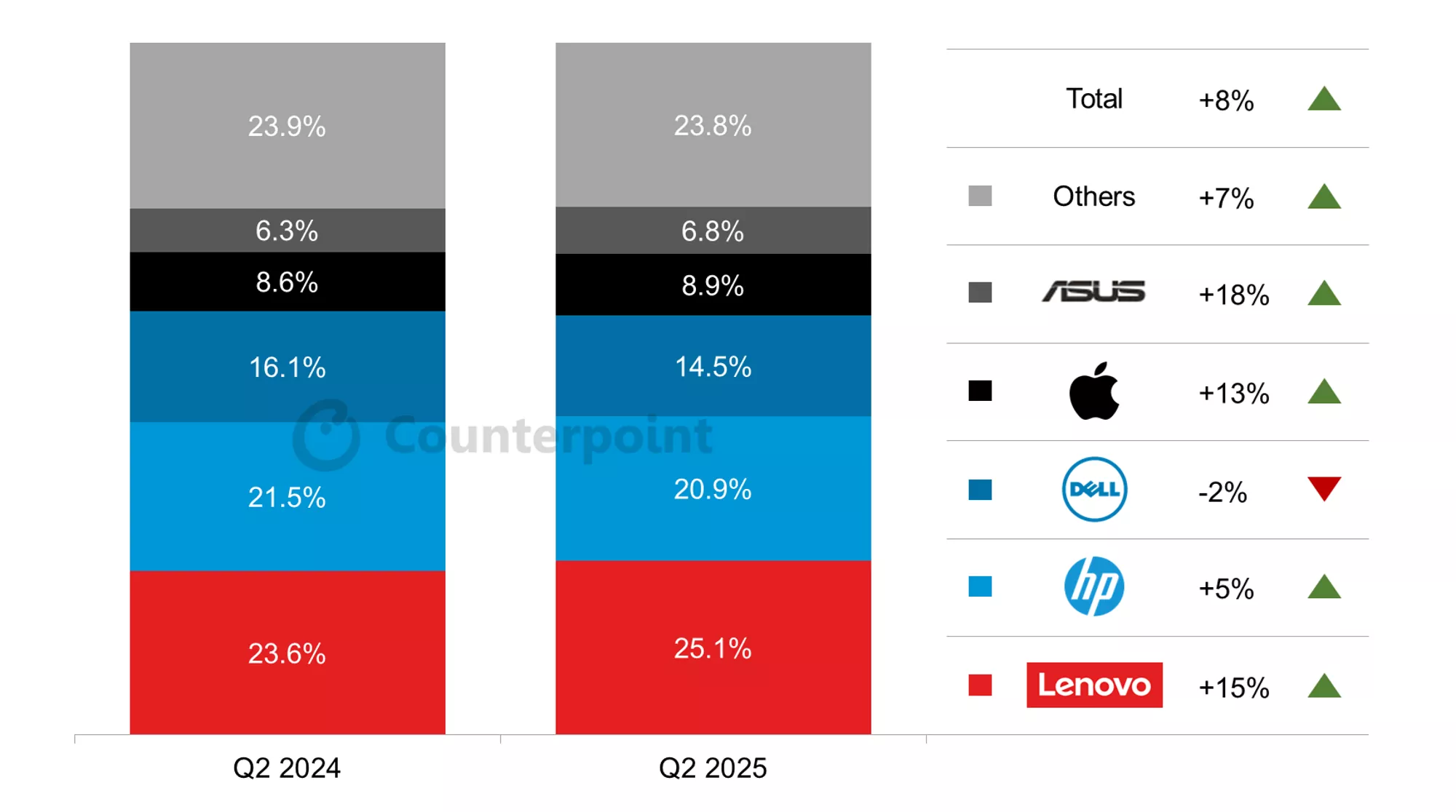

Counterpoint's data shows Lenovo as the current leader in the PC business, with 25 percent of total quarterly shipments and a 15 percent growth compared to the previous year. US manufacturers HP and Dell are in second and third places with 20.9 percent and 14.5 percent of the market, respectively, though only the former experienced growth (5 percent) while the latter lost a couple of percentage points.

Apple is in fourth place with 8.9 percent of the market and a 13 percent YoY growth, which CR attributes to "solid" MacBook sales thanks to the latest M4 series. Asus, which shipped 6.8 percent of the systems during the quarter, experienced the largest growth (18 percent) among the major global PC manufacturers.

According to Counterpoint Senior Analyst Minsoo Kang, uncertainty related to Trump's tariffs will likely cause weaker PC shipment results during the second half of 2025. Thanks to the increasing demand for AI PCs and other factors, the market should provide much better results in 2026. Half of the laptops shipped next year and onward will be AI-enabled systems, which is widely expected.

Another significant shift in the PC market will likely be related to geopolitics and logistics. The manufacturing business is still heavily focused on China, but PC vendors, original design manufacturers, and providers of electronics manufacturing services are making a major effort to bring their production capabilities to other countries. Vietnam, India, and Mexico are the most likely alternatives to China, though Trump's unpredictable approach could negatively affect these markets in the future.

PC market grows in Q2, but tariffs and trade fears signal turbulence ahead