What just happened? A new financial marketplace aims to offer crucial risk management tools to a resource at the center of the tech industry's explosive growth. If successful, the initiative could make access to high-performance compute more predictable and affordable.

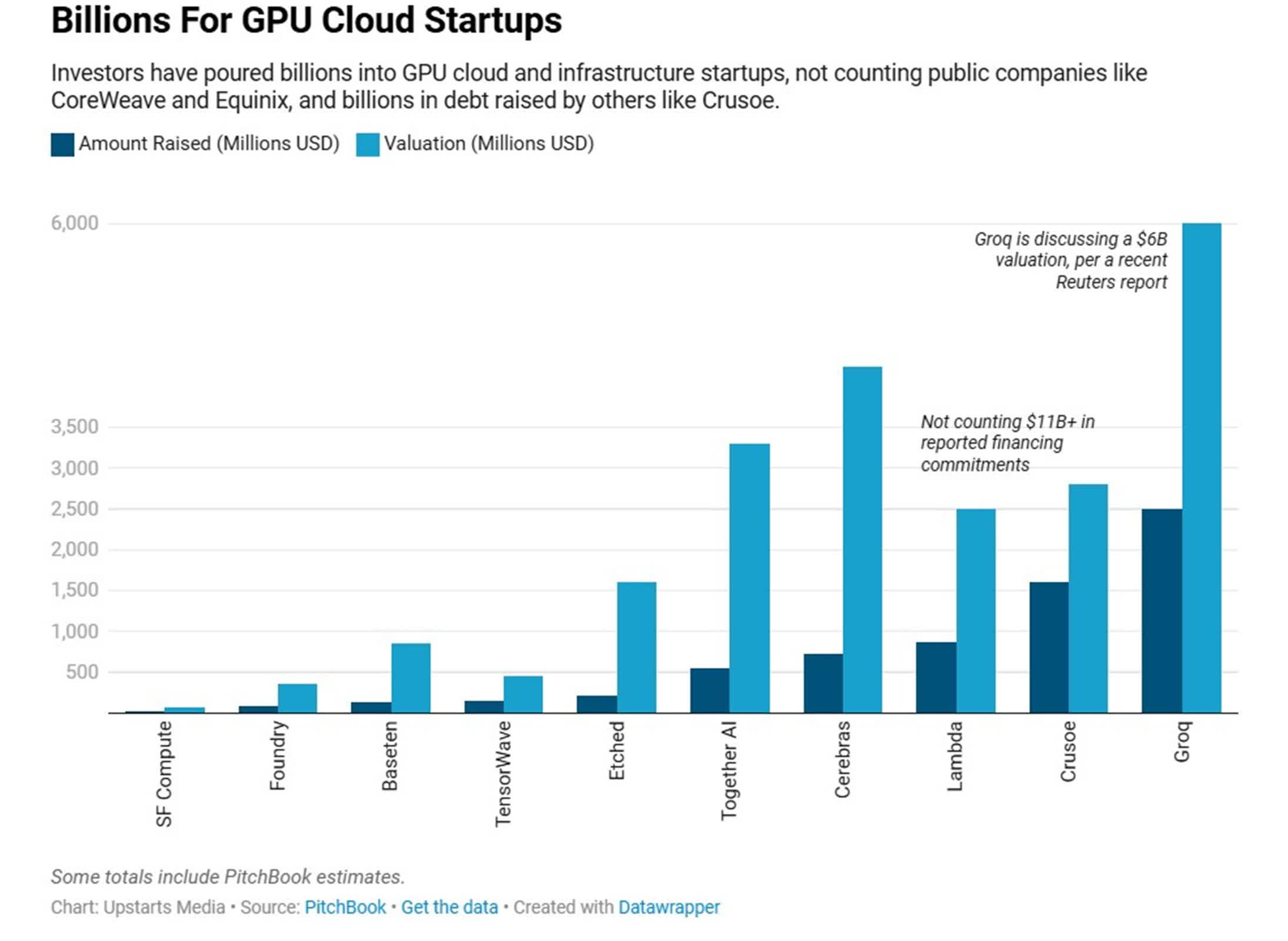

The world of artificial intelligence is built on computing power, and at the heart of that engine are graphics processing units. These chips are in such high demand that they have often been compared to oil during the gold rush, driving the value of companies like Nvidia well into the trillions and pushing tech giants to announce investments worth hundreds of billions in AI infrastructure. Yet, for all their importance, GPUs have remained stubbornly outside the reach of one of finance's core mechanisms: the ability to hedge, lock in prices, and trade futures on the very resource on which so many companies depend.

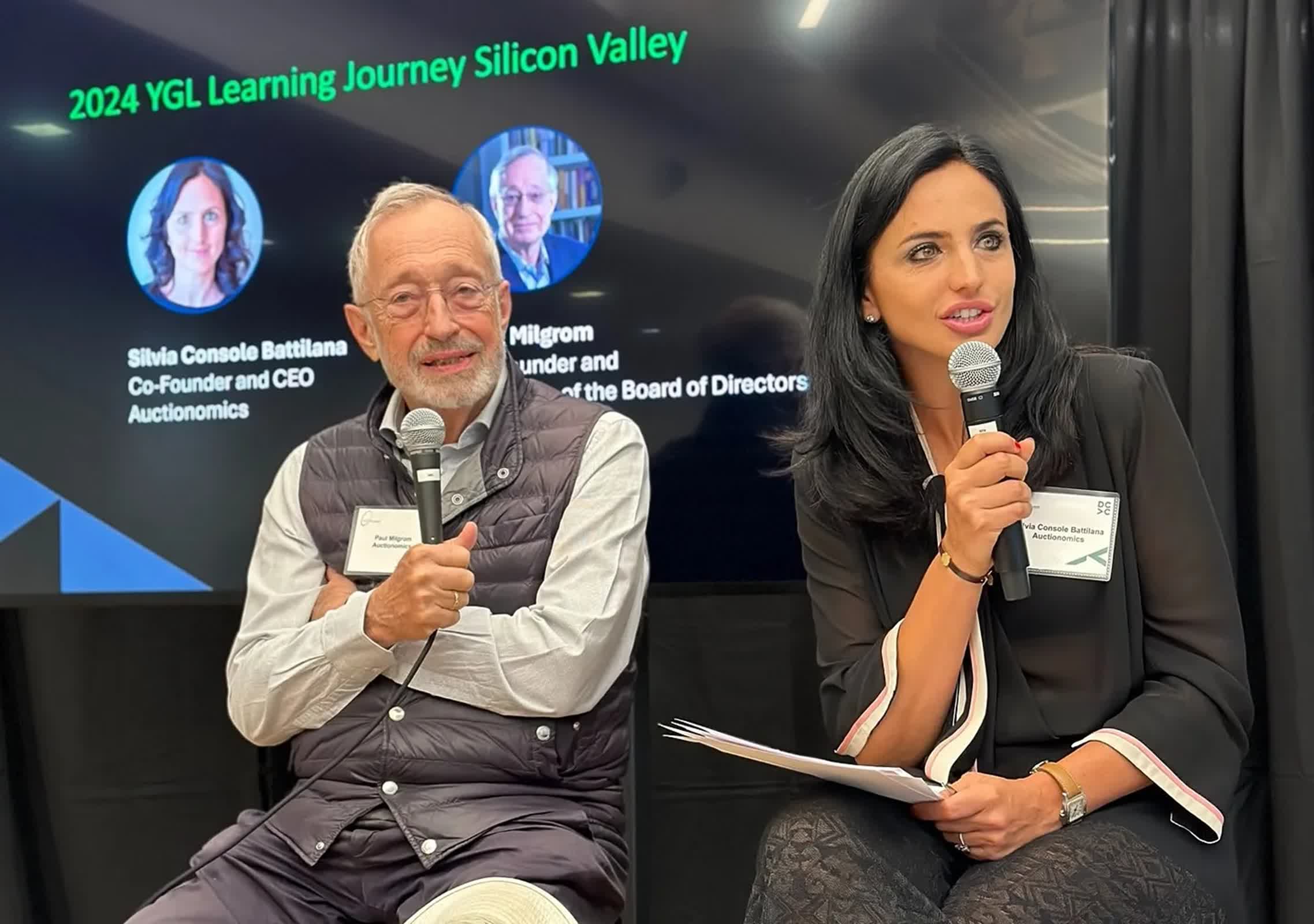

That may soon change. Startup OneChronos has partnered with Auctionomics, a market design firm co-founded by Nobel Prize-winning economist Paul Milgrom, to launch the first organized financial exchange for GPU compute. This new marketplace is designed to let participants buy and sell access to GPU resources in a manner similar to commodity futures, addressing chronic shortages and price spikes that have long frustrated AI developers.

Auctionomics founders Paul Milgrom and Silvia Console Battilana

While markets for commodities like electricity and cocoa have existed for years – enabling producers and consumers to speculate, hedge, and manage risk – the same has not been true for GPU compute, despite its centrality to AI's explosive growth. "GPUs are about to be the largest unhedged corporate asset class on the planet," Kelly Littlepage, CEO of OneChronos, told Upstarts Media. He argued that while oil and power are routinely hedged "down to the penny," GPUs have so far lacked a similar financial toolset.

OneChronos initially made its mark with so-called smart markets – advanced auctions that handle large, complex transactions. Its existing trading system for US equities handles $6.5 billion in daily volume. But Littlepage described this as merely a starting point for what he calls "the bazaar for the AI agents of the future" – a vision that has now drawn the expertise of Auctionomics, whose market designs have delivered billions in savings and helped reshape industries from telecommunications to television streaming.

"We're not completely reinventing the wheel," Milgrom said. "It's helping people monetize their inventory, finance their investments, and manage their risk." The new platform aims to do just that for the GPU market, which has seen demand outpace supply as AI workloads skyrocket, resulting in soaring rental prices and persistent bottlenecks for both startups and research institutions.

The system is set to operate through regular auctions, where companies can bid on GPU time slots or capacity. It holds the potential for a new degree of price discovery, risk management, and liquidity in computing resources. According to Silvia Console Battilana, co-founder and CEO of Auctionomics, much of the behind-the-scenes work has involved standardizing exactly what is being bought and sold. "We spent a lot of our time defining what is exactly for sale," Console Battilana said. Milgrom described their solution as a closely guarded "magic sauce."

If the project succeeds, it could bring numerous benefits: startups might gain more affordable and reliable compute for AI training or research, while infrastructure operators could finance new capacity or sell off excess resources more efficiently. The goal is to allow a broader range of participants – data center operators, chip manufacturers, institutional buyers – to lock in pricing, manage exposure, and better plan for the future.

However, the road ahead is steep. For GPU compute to become a truly tradable commodity, the marketplace will need broad participation, from dominant chip makers like Nvidia to cloud giants and emerging data center providers. OneChronos and Auctionomics are currently in discussion with multiple stakeholders across the industry. "We think there's some interest in this from the broad ecosystem, and the more diversity of participants we have, the better and healthier the market will be," OneChronos co-founder Stephen Johnson said.

Milgrom, reflecting on the significance of the initiative, likened the moment to early developments in agricultural markets: "Markets evolve and develop new capacities to support new economic activities." The comparison is apt, as the new exchange aims to do for AI compute what railroads and futures contracts once did for wheat – unlocking growth by making critical resources truly tradable.

Image credit: Upstarts Media

Startup and Nobel laureate collaborate to create GPU financial exchange