In brief: The PC industry got off to a strong start in 2025, but experts warn that a market slowdown in the second half of the year will result in minimal annual growth. An upgrade cycle triggered by the end of Windows 10 support likely won't hit until early next year.

According to the latest data from Canalys, shipments of desktops and notebooks reached 16.9 million units in the US in the first quarter – an increase of 15 percent compared to the same period a year earlier.

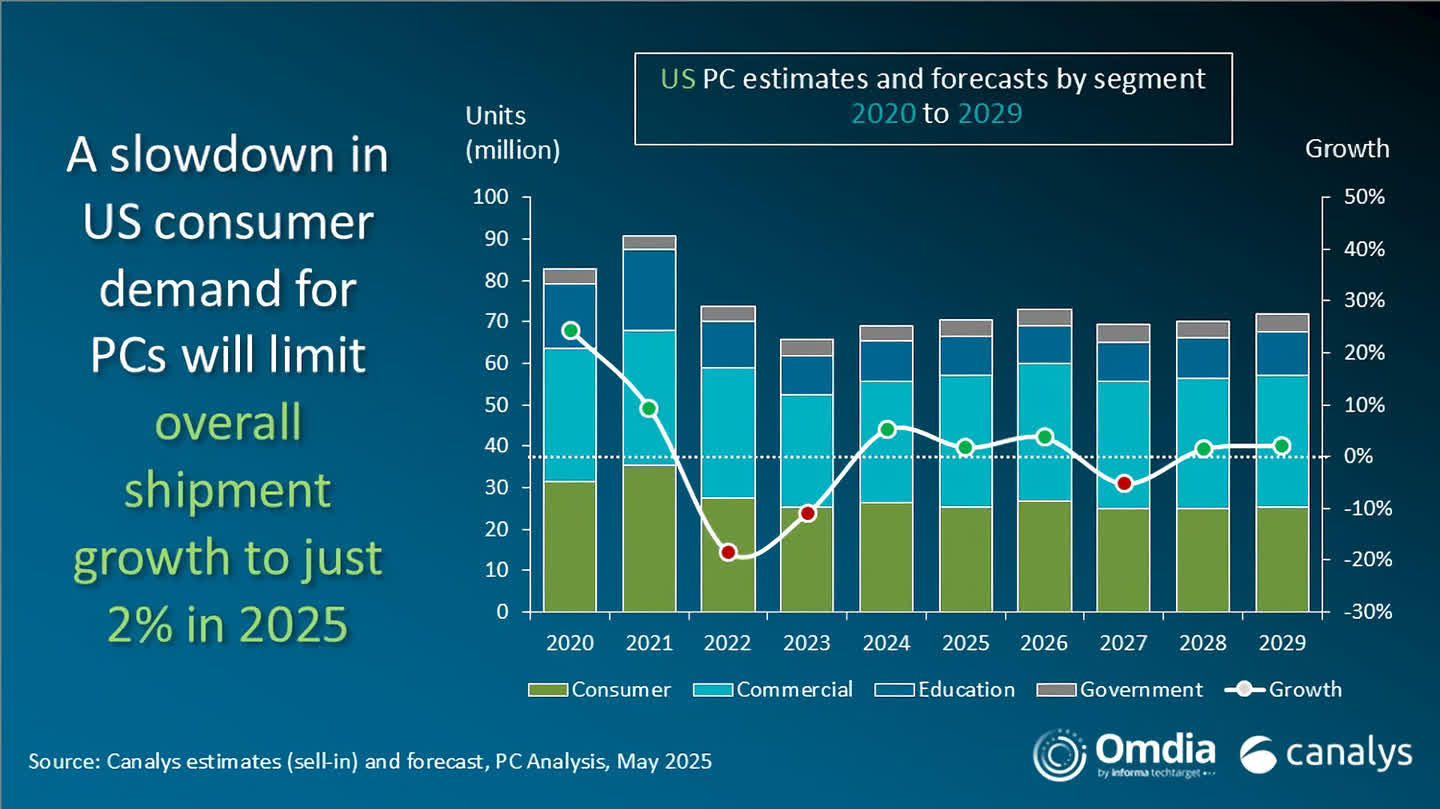

As we head into the back half of the year, however, vendors will be faced with clearing out excess inventory accumulated from tariff mitigation efforts. The situation, combined with what Canalys calls downward pressure on consumer spending, will result in a slowdown through the end of 2025. Once it is in the books, Canalys expects just a two percent annual increase in PC shipments.

Windows 10 is set to reach its end-of-life date in mid-October, which you'd think would trigger a large upgrade cycle among consumers. However, consumer PC shipments are expected to dip four percent year over year in 2025. The good news for vendors is that they will be offset by healthy growth in the business sector as commercial PC shipments are forecast to grow eight percent.

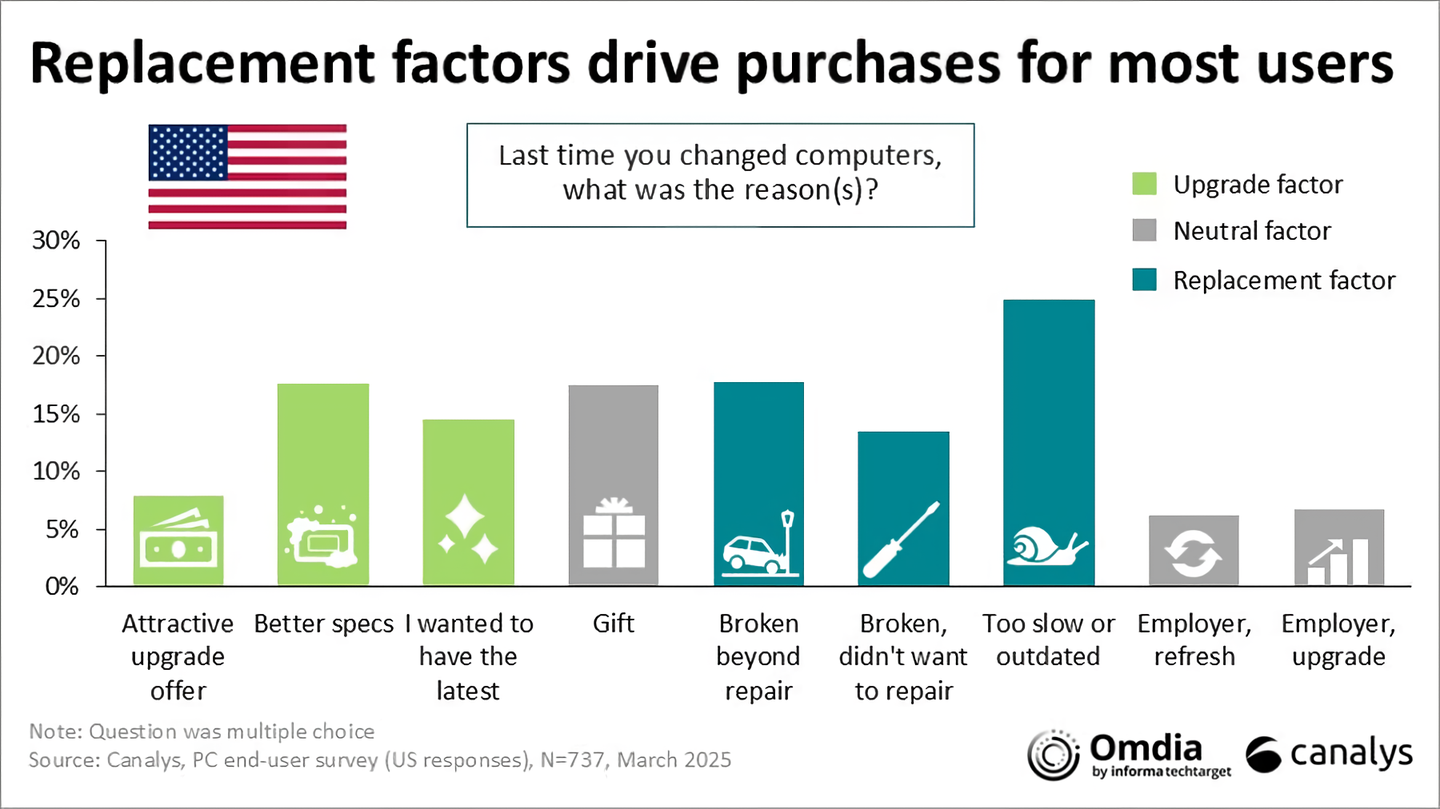

The reality of the matter is that many consumers likely aren't going to do anything about the Windows 10 end-of-life issue until it becomes a significant pain point, and that is not going to start becoming evident until at least a few months beyond the October 14 end date. As such, a boost in consumer PC shipments directly tied to Windows 10 won't occur until next year.

The prediction jives with established replacement factors. When asked about the reason for their last PC change, the majority of respondents said they replaced their system because it was too slow or outdated. Broken machines were also a common replacement factor.

Canalys also pointed to overwhelming specifications and unclear messaging as additional factors that complicate the PC buying process.

US PC market grew 15% in Q1, though Canalys warns of slowing growth