Editor's take: Despite US export bans following the invasion of Ukraine, chips continue flowing into Russia through a complex web of unofficial channels. The key takeaway is that sanctions often look strong on paper but remain porous in practice. For now, efforts to cut off Russia's access to high-end chips appear largely symbolic.

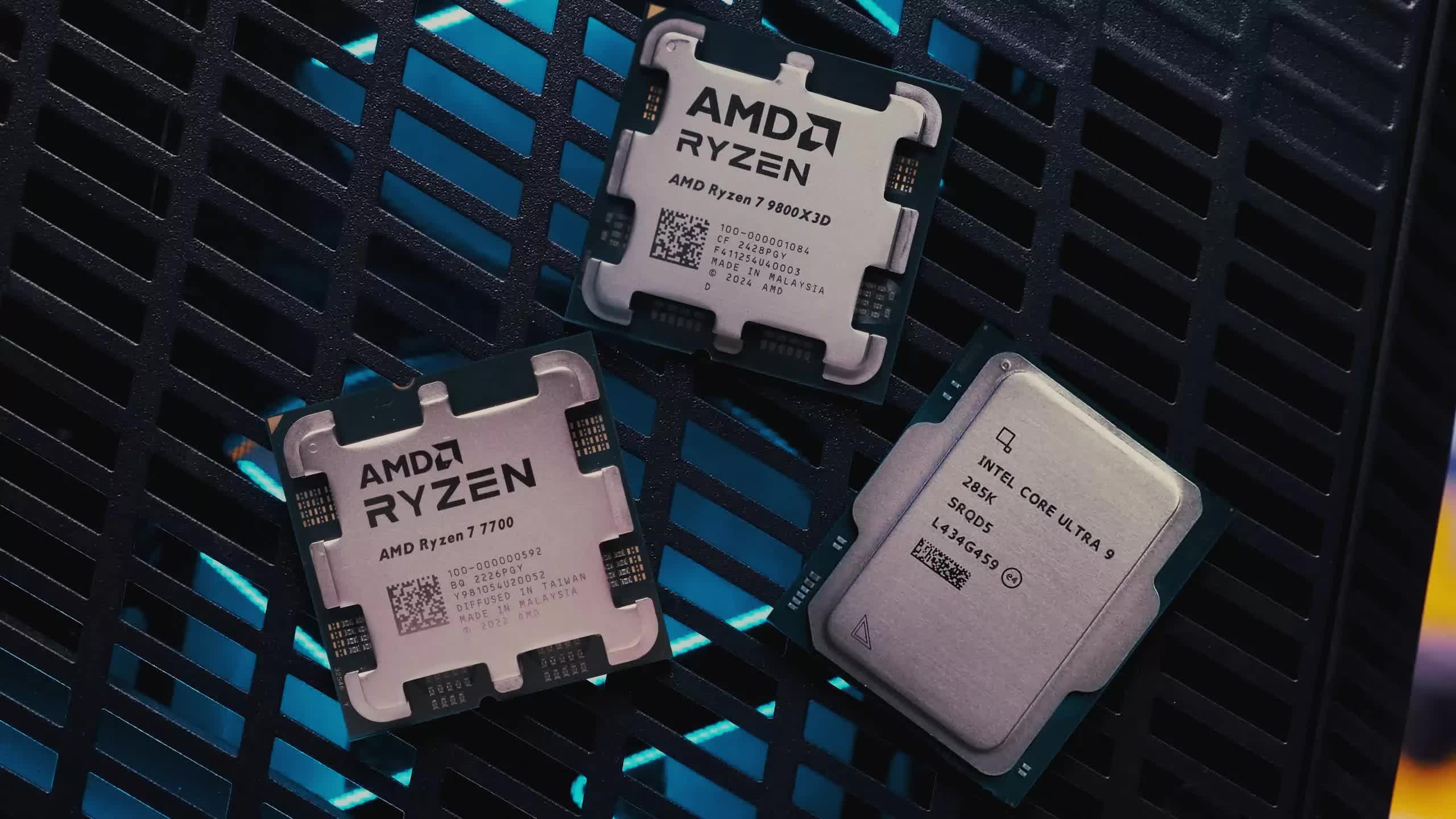

Russia's official customs data suggests the country's once-thriving market for US-made processors has nearly disappeared. Figures from the Federal Customs Service (FCS), reported by Russian publication Kommersant, show Intel CPU imports fell by 95 percent last year compared to the previous year. By comparison, AMD shipments dropped by 81 percent. That amounts to just 37,000 CPUs total – a steep decline from 537,000 units in 2023.

Executives in Russia's tech manufacturing sector paint a different picture. Leaders at major domestic assemblers like Lotos Group and Rikor told Kommersant that processor deliveries are not only continuing but increasing. Rikor reports purchasing over 120,000 processors last year – about 30 percent more than the year before. Many Russian tech firms also say chip supplies have improved for the third consecutive year.

Sanctions enforcement is struggling to keep up with a growing number of workarounds. Hong Kong remains a key hub in this network, with one address reportedly managing billions of dollars in smuggled semiconductors. Meanwhile, other chips enter Russia through countries like Malaysia and India, often relabeled or bundled within broader product categories that conceal their true nature from customs officials.

Industry insiders say many processors arrive without being labeled as such. A Russian tech executive told Kommersant that the word "processor" often doesn't appear on delivery sheets. This practice helps explain why the Federal Customs Service's import numbers look so anemic, even though factory shelves remain well-stocked.

It's not all smooth sailing, however. Suppliers warn Russian buyers to expect a 10 to 12 percent price increase in 2025, citing inflation and ongoing tensions in US-China trade relations as key factors. Still, prices for mainstream processors have remained relatively stable for the time being.