Why it matters: Anyone on the market for a new build, or for an upgrade, knows full well that DRAM prices are sky high due to "tight supply." The cycle that began two years ago is now coming to an end however, and if all predictions come true, 2019 will see a substantial break in DRAM pricing and a lot less burn in our pockets.

DRAM market analysts TrendForce and IC Insights have just released reports claiming it'll be a bumper year for DRAM makers as revenues will top $100 billion by the end of 2018, with a 39% market growth.

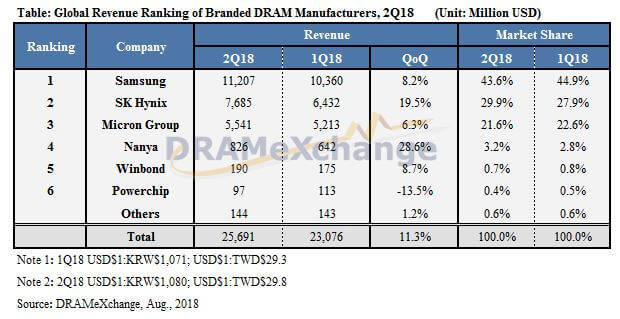

Worldwide, in the second quarter of 2018, DRAM revenues grew 11.3% quarter-on-quarter, with Samsung, SK Hynix and Micron taking a mind-boggling 95% of the share. While market share has come and gone, the top three manufacturers show increased revenues across the board. SK Hynix, in particular, has clawed back market share and is showing considerable revenue growth of nearly 20%.

Another noticeable trend is that DRAM is now generating twice as much revenue as CPUs, according to IC Insights. And that is huge. For many years, CPUs (and similar processing units) have driven IC revenues, but it seems that is no longer the case. If you're on the market for a new build right now, you'll see that 32GB of top-tier DDR4 will set you back as much as the CPU. This is due to a number of reasons. DRAM has seen pressure from a number of markets, including smartphones, with production being diverted to mobile, low-power ICs, graphics cards and NAND, due to diverted production capacity, as seen in the case of Samsung's V-NAND/DRAM fabs.

Right now, the top three memory makers are all in varying stages of increasing capacity at their fabs, say the reports. While Samsung is building more fabs, Micron is migrating to more modern process nodes at their Taiwan operations, and SK Hynix is very busy improving yields on current-gen DRAM.

Despite the doom and gloom predictions of ever-increasing DRAM prices until year's end, all is not lost, say the analysts.

In June, the Chinese government announced an investigation into alleged price-fixing by the world's top 3 memory manufacturers and a month later we witnessed a bevy of announcements from the top tier memory makers announcing sizable investments in fab capacity. As fab capacity comes online towards the end of the year, analysts are expecting prices to slowly begin a downward turn. TrendForce, in particular, is adamant that suppliers will no longer be able to sustain the current profitability of DRAM, as memory makers rev up the manufacturing and supply increases. The average gross margin for the top three memory makers hovers at 70%, which is a pretty healthy helping.

By the end of 2018, we hope DRAM will have broken the upturn and will become a lot more budget friendly.

We are hesitant to wave the all-clear flag, though. There are some trends on the horizon that we believe are significant for the memory market, and will require memory manufacturing to be more responsive than ever. The current trend towards AI and in-memory computing. This is a memory glutton that can possibly throw the market off-balance once more.