Forward-looking: Kioxia hopes to raise significant capital with an IPO set for this October, and stakeholders, Toshiba and Bain Capital, look to cash out. As the world's second-largest NAND flash producer, Kioxia's projected market capitalization of more than $18.9 billion would make it the largest IPO for Japan this year.

Kioxia, formerly known as Toshiba Memory Holdings, is setting its sights for an IPO as soon as October on the Tokyo Stock Exchange, according to Nikkei Asian Review.

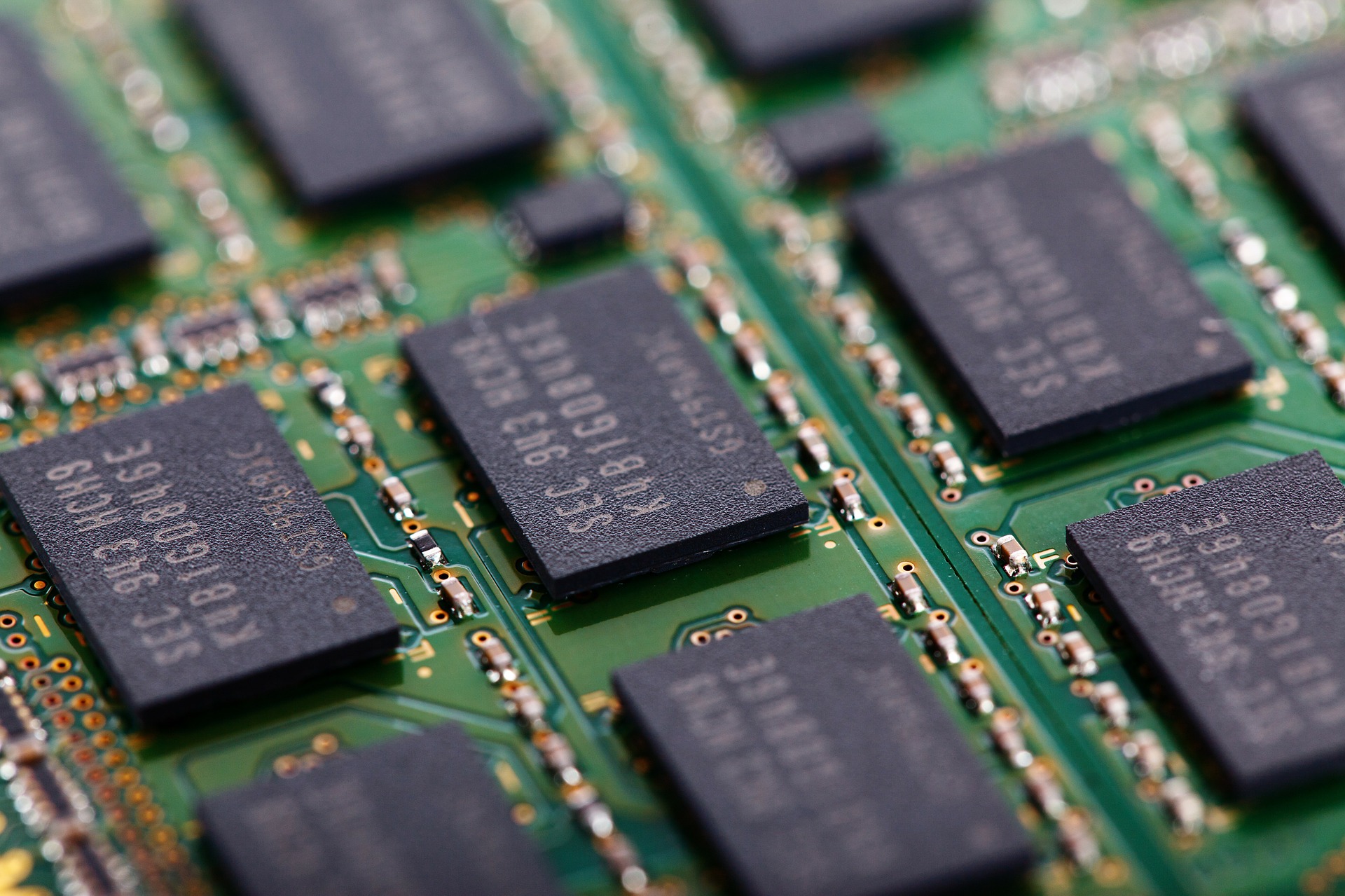

Four decades ago in 1980, Toshiba invented flash memory and stayed the industry leader in the NAND flash memory market for the years to come. Toshiba Memory Holdings was a highlight of the struggling Japanese conglomerate in recent years, yet shareholders pushed Toshiba to sell a majority (60%) stake of the memory chip division in an effort to stabilize the company.

Toshiba's financial problems have been well publicized.

Starting with an accounting scandal in 2015, Toshiba then suffered huge losses in its nuclear power arm, Westinghouse Electric, that led to its bankruptcy and sale to Brookfield Business Partners. Other subsidiaries sold by Toshiba include its Television business to Hisense, and most recently included the sale of its laptop business to Sharp, leaving Toshiba without a presence in the PC market.

As a result of the IPO, both Toshiba and Bain Capital will sell portions of their respective Kioxia holdings. Toshiba plans to use half the proceeds to reward investors, and the other half as growth investments for the company.

The IPO announcement comes at an interesting time for the market. Flash prices seem to have downward pressure due to oversupply and weak demand pointing to revenue losses in the near term, but investors have recently been pushing more money into the technology sector in hopes of future growth due to the current economic volatility. Whether or not the recent technology sector gains are justified is yet to be seen, but we're sure Kioxia is hoping the current bullish sentiment on tech companies is still around when they launch their IPO.