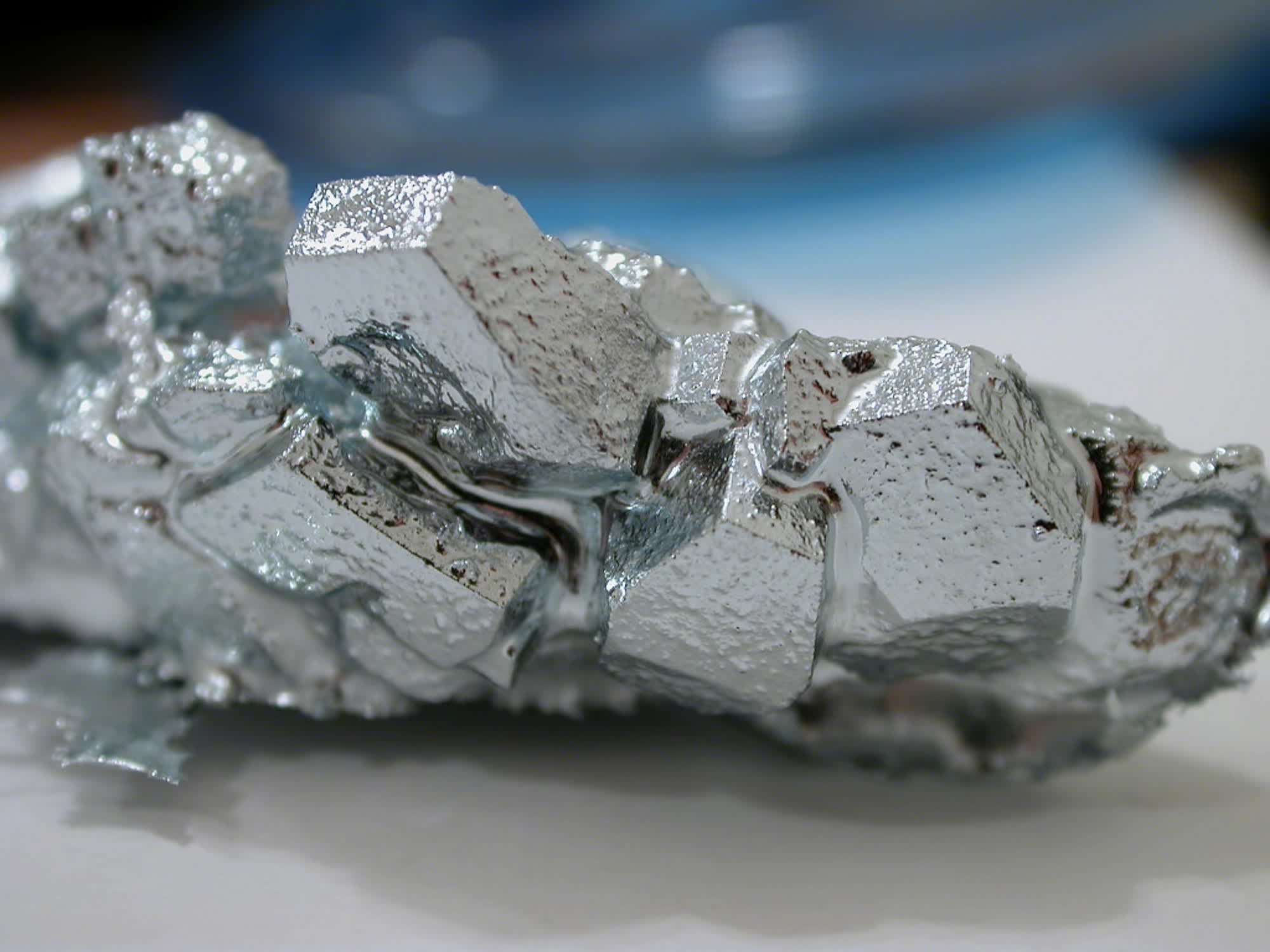

In context: Germanium and gallium are instrumental in manufacturing power chips, radio frequency amplifiers, LEDs, and many other silicon-based components. They aren't scarce metals, but China has been providing the world with cheap germanium and gallium for decades. However, new policy changes could affect global supplies.

China recently announced new export restrictions on germanium and gallium – two fundamental elements for chip manufacturing. As of Tuesday, Chinese companies interested in doing business abroad need to secure a proper export license from Beijing authorities. "Pure" germanium and gallium export, as well as export of any product which includes the two elements, are affected by the new restrictions. The Ministry of Commerce said that as long as exporting companies will comply with national security protocols and other local regulations, export operations will continue as usual.

The timing of the new restrictions suggests they are in retaliation against the US for tightening export restrictions on "AI chips" in July, and they could have remarkable consequences on chip manufacturers all over the world. China controls more than 90% and around 60% of the global production of gallium and germanium, respectively. The announcement of the proposed restrictions caused a 20 percent price hike for gallium in the US and Europe in July.

China's dominance in exporting these metals has heavily relied on their ability to refine them cheaply. The materials have become part of Beijing's effort to assert its economic position in the geopolitical clash with the US and other Western nations. The export restrictions should not seriously impact the production of silicon components like CPUs and GPUs. However, the compounds gallium nitride and gallium arsenide, used in manufacturing LEDs, radio amplifiers, and other essential technology components, might feel a more significant sting.

Japan could be the country most affected by the new export policy. According to stats from the Japan Organization for Metals and Energy Security, Japan imports 60 percent of its gallium supply. Of that portion, 70 percent is imported from China, making the country the world's largest consumer of commercial gallium.

Japanese compounding companies claim to have enough supply to avoid issues in the short term. Mitsubishi Chemical Group, a company making compound semiconductors and other products, is betting on its "ample" inventories. The same goes for gallium nitride substrate manufacturer Sumitomo Chemical and LED maker Nichia Corp. All said they are monitoring the situation closely.

The long-term prospects for Western countries, international corporations, and Japan could be to rework their investment in local production or material recovery from electronic waste, reducing their reliance on China's resources. So this geopolitical move could be a double-edged sword for the communist nation in the long run.