Twitter just got a much-needed boost, but there's bad news for the company's employees. The firm announced its third quarter results today, beating analysts' revenue and earnings per share expectations. Sadly, it also confirmed that rumors it would lay off 9 percent of its workforce are accurate.

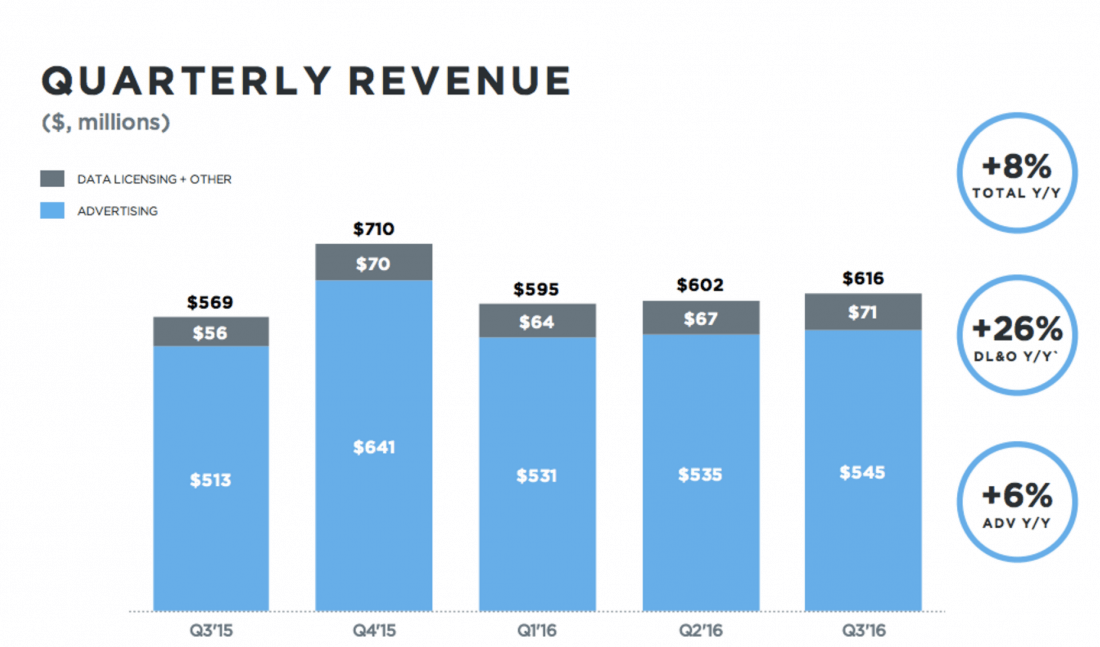

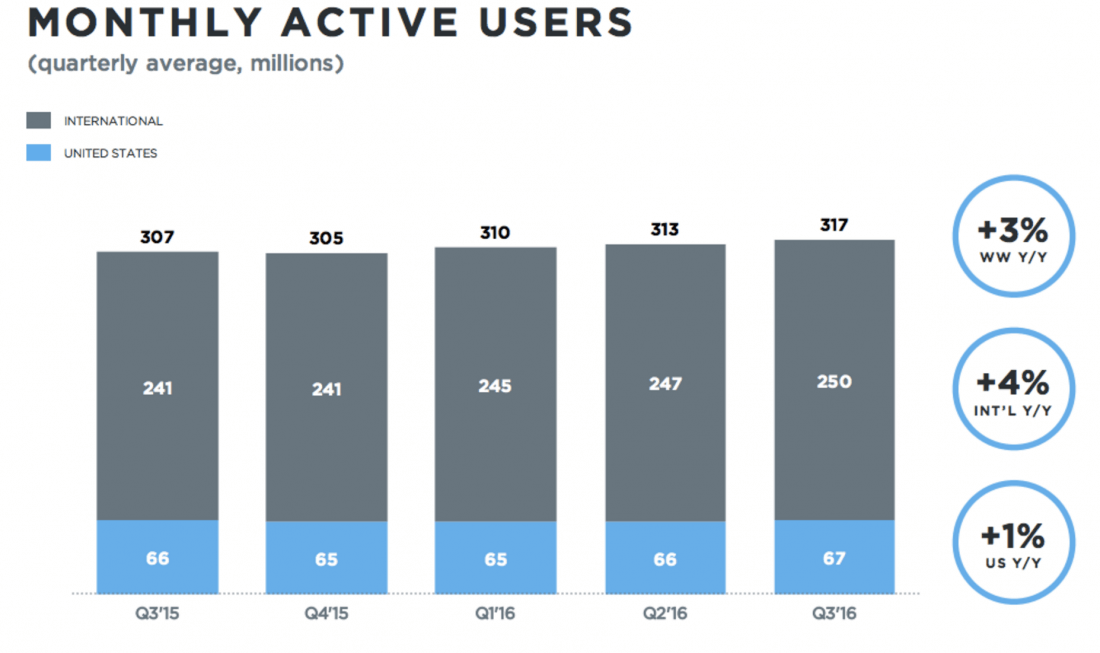

The microblogging site reported revenue of $616 million and an earnings per share of $0.13, beating Wall Steet expectations of $605.8 million in revenue and earnings per share of $0.09. Moreover, the all-important monthly active user (MAU) numbers hit 317 million, an increase of 4 million compared to the last quarter and 10 million more than Q3 2015. Analysts predicted MAUs would reach 315 million.

Despite the positive figures, Twitter continues to lose money. It posted a GAAP net loss of $103 million, or $0.15 per share, though this is an improvement over the $107 million it lost in the previous quarter and the $132 million from the same period last year.

The company confirmed reports from earlier this month that it would eliminate 9 percent of its workforce, which works out at over 300 people. Twitter's partnerships, marketing, and sales teams will be hit the hardest, the latter of which is being reorganized from three teams into two.

"Our strategy is directly driving growth in audience and engagement, with an acceleration in year-over-year growth for daily active usage, Tweet impressions, and time spent for the second consecutive quarter," said Twitter CEO Jack Dorsey. "We see a significant opportunity to increase growth as we continue to improve the core service. We have a clear plan, and we're making the necessary changes to ensure Twitter is positioned for long-term growth. The key drivers of future revenue growth are trending positive, and we remain confident in Twitter's future."

The news brought a rare boost to the company's share price, which rose as much as 5 percent before dropping slightly.

There was no mention of a possible acquisition in the report. Disney, Apple, Softbank, Alphabet, and Salesforce were all reportedly interested in purchasing Twitter, but have all since walked away from any possible deal. Also absent from the report was information regarding future revenues and the third quarter's daily active user numbers.