Why it matters: Amazon CEO Jeff Bezos says that independent sellers are succeeding on the company's online platform, but has left out a few important points: they pay dearly for the privilege and their data can always end up helping Amazon push its own private label products.

When Amazon CEO Jeff Bezos testified before the House Judiciary Subcommittee on Wednesday, US Congress members brought into question the retail giant's apparent power over third-party sellers, which seems to extend beyond its own marketplace.

Bezos, who is currently the world's richest man, was calm and polite despite most of his answers being interrupted before he could even utter a few words. However, when he did get some time to respond he insisted that his company has fair policies that are "very, very focused on the customer" and that it strives to help small businesses thrive through the marketplace.

Republican David Cicilline, who is chairman of the subcommittee, started the five-hour long hearing with a remark on how the tech giants' "ability to dictate terms, call the shots, upend entire sectors, and inspire fear represent the powers of a private government."

Some of the documents brought forth during the hearing revealed that Amazon at times may have systematically weakened mid-size competitors that it deemed a threat in areas where it didn't hold a strong position.

Documents from the Hearing on “Online Platforms and Market Power: Examining the Dominance of Amazon, Apple, Facebook and Google" pic.twitter.com/Ypvxhm7asA

— House Judiciary Dems (@HouseJudiciary) July 29, 2020

For instance, Amazon wanted to make its way into the lucrative market of new parents. A congress member revealed an email where Amazon retail executive Doug Herrington wrote "we have already initiated a more aggressive ‘plan to win’ against diapers.com. [...] To the extent that this plan undercuts the core diapers business for diapers.com, it will slow the adoption of Soap.com."

Herrington referred to Quidsi -- the company behind diapers.com -- as the biggest short-term competitor. Then Amazon reportedly proceeded to sell the same products at a loss (losing as much as $200 million per month) for several months until Quidsi caved in and sold diapers.com to the retail giant for $545 million. Amazon eventually shut down that business after it supposedly failed to reach profitability.

Where it gets interesting is that one of the Congress members presented an anecdote involving a small business that had been striving to sell books on Amazon Marketplace. The business owner explained that their business grew over five times in size over a few years, and that one day Amazon just booted it from its platform with no explanation whatsoever -- not even after hundreds of messages, some of which were sent to Bezos himself.

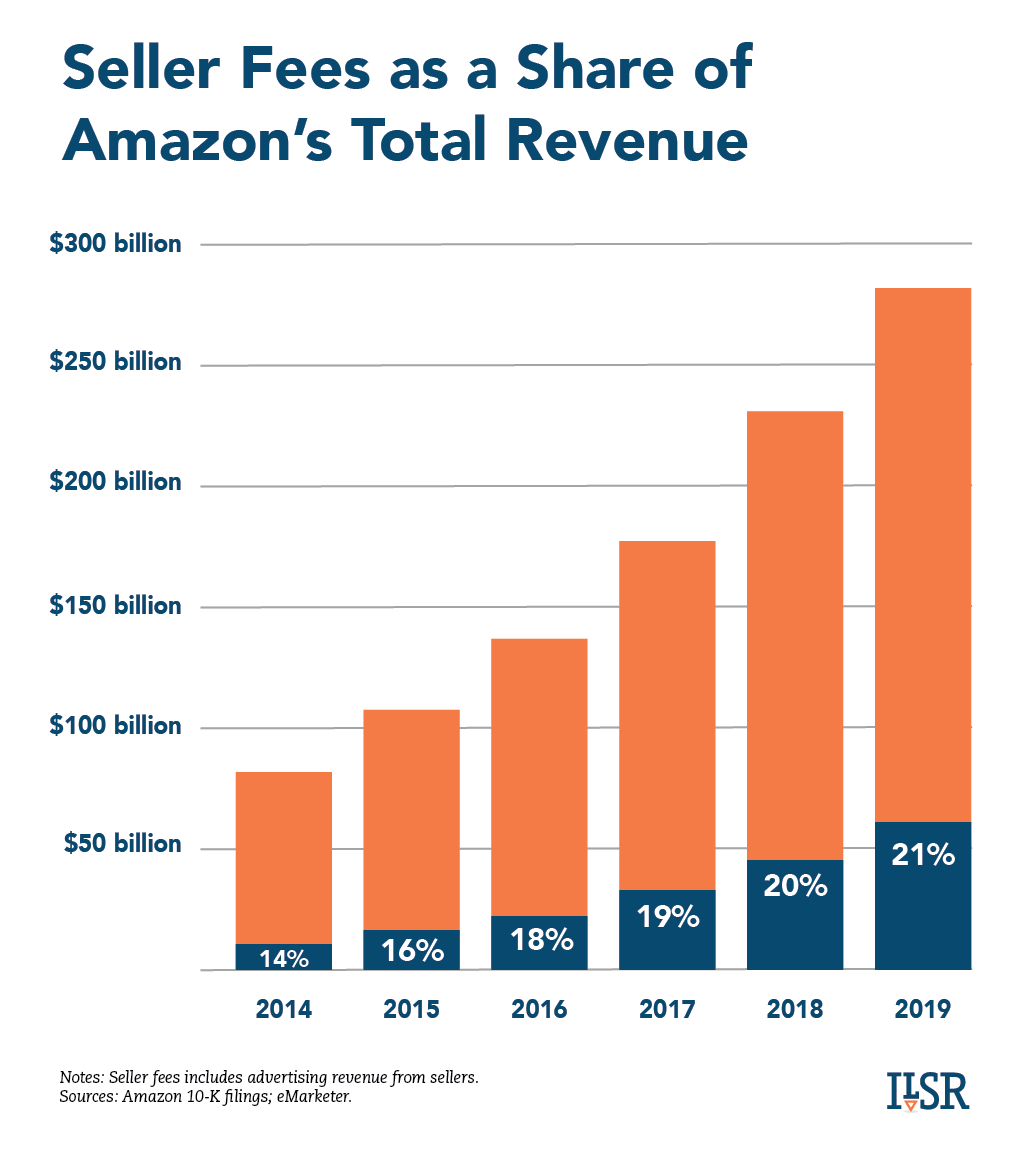

According to a report from the Institute for Local Self-Reliance, Amazon's true gatekeeper power is found in the seller fees.

On average, the retail giant takes a 30 percent cut on each sale made by independent sellers on Marketplace, a figure that was 19 percent only five years ago. In 2019 alone, seller fees brought in revenues of $60 billion, which is more than double the amount brought in by Amazon's cloud division.

Independent sellers have little choice but to bite the bullet and pay Amazon's steadily increasing fees until they can no longer manage to stay afloat. ILSR notes that "two thirds of the third-party revenue on Amazon goes to sellers who began selling on the site within the last three years. Sellers who’ve been operating for five or more years account for only 10 percent of sales".

When these small businesses fail, Amazon can steer potential customers towards its own products.

Something else that caught the regulators' attention was that the retail giant has been accused of spying on independent sellers in an effort to outcompete them, one by one. Bezos explained that "we have a policy against using seller-specific data to aid our private label business, but I can’t guarantee you that policy has never been violated."

The European Commission has been looking into this same issue and last year started a formal investigation into the practice, it's reportedly close to filing charges. However, Bezos told the antitrust committee that he believes this isn't a systemic issue, since this doesn't align with the company's core values and "third-party sellers in aggregate are doing extremely well on Amazon."

Even if Bezos is telling the truth and Amazon doesn't systematically abuse its power over independent sellers, there's no escaping the fact that it owns 40 percent of the US online retail market -- seven times more than its closest competitor, eBay. That means that Amazon is so big that it can crush small businesses without anyone at the company even realizing it.

https://www.techspot.com/news/86196-amazon-online-retail-dominance-may-partly-explained-high.html